M1CR, Credit for Income Tax Paid to Another State Form

What is the M1CR, Credit For Income Tax Paid To Another State

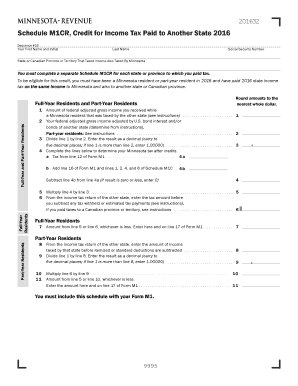

The M1CR, Credit For Income Tax Paid To Another State, is a tax form used by residents of Minnesota to claim a credit for income taxes paid to another state. This credit helps to prevent double taxation on income earned in states outside of Minnesota. By filing the M1CR, taxpayers can offset their Minnesota tax liability by the amount of tax they have already paid to another state, ensuring that they are not penalized for earning income in multiple jurisdictions.

Steps to complete the M1CR, Credit For Income Tax Paid To Another State

Completing the M1CR form involves several key steps:

- Gather documentation of income earned and taxes paid to the other state.

- Fill out the M1CR form with accurate personal and financial information.

- Calculate the credit based on the tax rate of the other state and the amount paid.

- Attach any required supporting documents, such as copies of the tax return filed in the other state.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the M1CR, Credit For Income Tax Paid To Another State

To qualify for the M1CR, taxpayers must meet specific eligibility criteria:

- Be a resident of Minnesota for the tax year in question.

- Have paid income tax to another state on income earned while a resident of Minnesota.

- File a tax return with the other state and provide proof of tax payment.

Required Documents for the M1CR, Credit For Income Tax Paid To Another State

When filing the M1CR, certain documents are necessary to support the claim:

- A copy of the tax return filed with the other state.

- Documentation of the income earned in the other state.

- Proof of payment of the state income tax, such as a tax payment receipt or bank statement.

Legal use of the M1CR, Credit For Income Tax Paid To Another State

The M1CR form is legally recognized as a valid means for Minnesota residents to claim a credit for taxes paid to other states. It is essential to ensure that all information provided is accurate and that the form is submitted in accordance with Minnesota tax regulations. Failure to comply with the legal requirements can result in penalties or denial of the credit.

Filing Deadlines / Important Dates for the M1CR, Credit For Income Tax Paid To Another State

Taxpayers should be aware of the following important dates regarding the M1CR:

- The M1CR must be filed by the same deadline as the Minnesota state tax return, typically April 15.

- Extensions for filing the state tax return also apply to the M1CR, but any taxes owed must still be paid by the original deadline.

Examples of using the M1CR, Credit For Income Tax Paid To Another State

Consider a Minnesota resident who works in Wisconsin and pays $2,000 in state income tax. When filing their Minnesota taxes, they can use the M1CR to claim a credit for the $2,000 paid to Wisconsin. This credit reduces their Minnesota tax liability, ensuring they are not taxed twice on the same income. Another example is a self-employed individual who earns income in multiple states; they can aggregate the taxes paid to each state and apply for credits accordingly using the M1CR.

Quick guide on how to complete 2016 m1cr credit for income tax paid to another state

Complete [SKS] with ease on any device

Digital document management has become increasingly popular among businesses and individuals alike. It represents a fantastic environmentally friendly option to traditional printed and signed documents, enabling you to access the correct file and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your paperwork quickly and without interruptions. Handle [SKS] on any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

Effortlessly modify and eSign [SKS]

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and guarantee excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1CR, Credit For Income Tax Paid To Another State

Create this form in 5 minutes!

People also ask

-

What is the M1CR, Credit For Income Tax Paid To Another State?

The M1CR, Credit For Income Tax Paid To Another State, is a tax credit that allows taxpayers to offset income taxes paid to another state against their Minnesota taxes. This credit helps prevent double taxation on income earned in different states. Understanding how to apply for this credit can signNowly reduce your tax liabilities.

-

How does airSlate SignNow facilitate the process of claiming M1CR, Credit For Income Tax Paid To Another State?

airSlate SignNow streamlines the document management process, enabling users to easily eSign and send their tax forms related to the M1CR, Credit For Income Tax Paid To Another State. With its user-friendly interface, signing and submitting documents is simple and efficient. This can save taxpayers time and ensure that their claims are processed accurately.

-

Is airSlate SignNow cost-effective for filing M1CR, Credit For Income Tax Paid To Another State?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for individuals and businesses managing tax documents, including the M1CR, Credit For Income Tax Paid To Another State. The value it provides through easy document management can outweigh the small investment required for its services.

-

What features does airSlate SignNow offer that support M1CR, Credit For Income Tax Paid To Another State?

airSlate SignNow includes features such as secure eSignature, document templates, and cloud storage, which enhance the process of managing documents related to the M1CR, Credit For Income Tax Paid To Another State. These tools facilitate seamless collaboration and ensure that all required documents are easily accessible during tax filing.

-

Can airSlate SignNow integrate with other tax software when filing for M1CR, Credit For Income Tax Paid To Another State?

Absolutely, airSlate SignNow offers integrations with various accounting and tax software. This allows users to seamlessly transfer documents and data needed for the M1CR, Credit For Income Tax Paid To Another State. Integration simplifies the overall workflow and ensures consistency across platforms.

-

How does airSlate SignNow enhance security for documents related to M1CR, Credit For Income Tax Paid To Another State?

Security is a top priority for airSlate SignNow, with advanced encryption methods and secure cloud storage for all user documents, including those for the M1CR, Credit For Income Tax Paid To Another State. This ensures that sensitive tax information remains confidential and protected against unauthorized access.

-

What customer support options does airSlate SignNow provide for M1CR, Credit For Income Tax Paid To Another State inquiries?

airSlate SignNow offers comprehensive customer support, including live chat, email assistance, and a robust knowledge base for inquiries related to the M1CR, Credit For Income Tax Paid To Another State. This ensures that users can easily find answers to their questions and get help whenever needed.

Get more for M1CR, Credit For Income Tax Paid To Another State

Find out other M1CR, Credit For Income Tax Paid To Another State

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document