Form 80 110 Mississippi Department of Revenue Taxhow

What is the Form 80-110 Mississippi Department of Revenue Taxhow

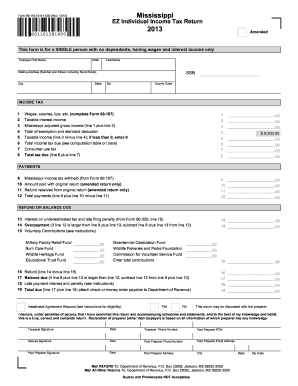

The Form 80-110 is a specific tax form issued by the Mississippi Department of Revenue. It is primarily used to report and remit various taxes owed by individuals and businesses within the state. This form plays a crucial role in ensuring compliance with state tax regulations and is essential for accurate tax reporting. Understanding the purpose of this form is important for taxpayers to fulfill their legal obligations and avoid potential penalties.

How to use the Form 80-110 Mississippi Department of Revenue Taxhow

Using the Form 80-110 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial information related to their income and expenses for the reporting period. Once the form is obtained, individuals should carefully fill out each section, ensuring that all figures are accurate and reflect the current tax year. After completing the form, it can be submitted either electronically or via mail, depending on the preferred submission method.

Steps to complete the Form 80-110 Mississippi Department of Revenue Taxhow

Completing the Form 80-110 requires attention to detail. Here are the key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Obtain the latest version of the Form 80-110 from the Mississippi Department of Revenue website.

- Fill in personal information, including name, address, and Social Security number.

- Report income and deductions accurately in the designated sections.

- Calculate the total tax owed based on the provided instructions.

- Review the completed form for accuracy before submission.

- Submit the form electronically or mail it to the appropriate address.

Legal use of the Form 80-110 Mississippi Department of Revenue Taxhow

The legal use of the Form 80-110 is governed by state tax laws. It is essential for taxpayers to ensure that the form is filled out accurately and submitted on time to avoid legal repercussions. Failure to comply with the requirements set forth by the Mississippi Department of Revenue can result in penalties, fines, or other legal actions. Therefore, understanding the legal implications of using this form is vital for all taxpayers in Mississippi.

Key elements of the Form 80-110 Mississippi Department of Revenue Taxhow

The Form 80-110 includes several key elements that are crucial for proper tax reporting. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Income reporting sections to detail all sources of income.

- Deductions and credits available to the taxpayer.

- Total tax calculation based on reported income and deductions.

- Signature line for the taxpayer or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form 80-110 are critical for compliance. Typically, taxpayers must submit this form by the designated due date, which aligns with the annual tax filing period. It is important to stay informed about any changes in deadlines, as these can vary from year to year. Missing the deadline can result in penalties or interest on unpaid taxes, making timely submission essential for all taxpayers.

Quick guide on how to complete form 80 110 mississippi department of revenue taxhow

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 80 110 Mississippi Department Of Revenue Taxhow

Create this form in 5 minutes!

People also ask

-

What is the Form 80 110 Mississippi Department Of Revenue Taxhow?

The Form 80 110 Mississippi Department Of Revenue Taxhow is a crucial document required for tax purposes in Mississippi. It serves as a declaration of tax liabilities and provides detailed information for accurate tax filing. Using airSlate SignNow, you can seamlessly prepare and eSign this form to ensure compliance and efficiency in your tax submissions.

-

How can airSlate SignNow help with the Form 80 110 Mississippi Department Of Revenue Taxhow?

airSlate SignNow streamlines the process of completing the Form 80 110 Mississippi Department Of Revenue Taxhow. Our platform offers an intuitive interface for filling out the form, along with features for electronic signatures that enhance speed and accuracy. This simplifies the entire tax documentation process, allowing businesses to focus on their operations.

-

Is there a cost associated with using airSlate SignNow for the Form 80 110 Mississippi Department Of Revenue Taxhow?

Yes, using airSlate SignNow involves a subscription fee, but it offers a cost-effective solution for managing the Form 80 110 Mississippi Department Of Revenue Taxhow. The pricing tiers are designed to meet the needs of various businesses, ensuring that you receive maximum value for your investment. Additionally, consider the potential savings in time and paper costs.

-

What features does airSlate SignNow offer for completing tax forms like the Form 80 110 Mississippi Department Of Revenue Taxhow?

airSlate SignNow offers a variety of features tailored for completing tax forms, including customizable templates, easy electronic signatures, and secure storage of your documents. With real-time collaboration tools, multiple parties can work on the Form 80 110 Mississippi Department Of Revenue Taxhow simultaneously. This ensures accuracy and compliance in your tax filings.

-

Can I integrate airSlate SignNow with other software for the Form 80 110 Mississippi Department Of Revenue Taxhow?

Absolutely! airSlate SignNow provides integrations with popular business software to streamline your workflow when preparing the Form 80 110 Mississippi Department Of Revenue Taxhow. Whether you use accounting software or customer relationship management (CRM) systems, our integrations enhance efficiency and allow for easy document sharing and management.

-

What are the benefits of eSigning the Form 80 110 Mississippi Department Of Revenue Taxhow?

eSigning the Form 80 110 Mississippi Department Of Revenue Taxhow offers numerous benefits, including increased security, reduced processing time, and improved document tracking. With airSlate SignNow, your signed form is securely stored, and you receive instant notifications upon completion. This enhances organizational efficiency and provides peace of mind during tax filing.

-

Is airSlate SignNow secure for handling sensitive documents like the Form 80 110 Mississippi Department Of Revenue Taxhow?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive documents, including the Form 80 110 Mississippi Department Of Revenue Taxhow. Our platform utilizes encryption, multi-factor authentication, and secure cloud storage to ensure that your data is safe and compliant with industry standards. You can confidently eSign and manage your tax documents with us.

Get more for Form 80 110 Mississippi Department Of Revenue Taxhow

Find out other Form 80 110 Mississippi Department Of Revenue Taxhow

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document