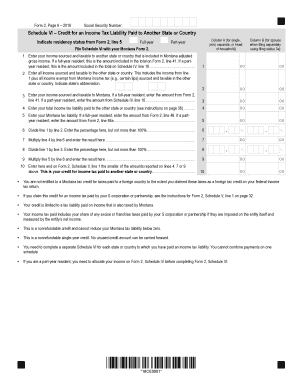

Form 2, Page 9 Revenue Mt

What is the Form 2, Page 9 Revenue Mt

The Form 2, Page 9 Revenue Mt is a specific document used for reporting revenue in various contexts, often related to tax filings or financial disclosures. This form is typically required by state or federal agencies to ensure accurate reporting of income and compliance with tax regulations. Understanding its purpose is crucial for individuals and businesses to meet their legal obligations effectively.

Steps to complete the Form 2, Page 9 Revenue Mt

Completing the Form 2, Page 9 Revenue Mt involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and receipts. Next, fill in the required fields, ensuring that all figures are accurate and reflect the correct reporting period. After completing the form, review it thoroughly for any errors or omissions. Finally, sign and date the form to validate it before submission.

Legal use of the Form 2, Page 9 Revenue Mt

The legal use of the Form 2, Page 9 Revenue Mt is essential for ensuring that all reported information meets regulatory standards. This form must be filled out correctly to avoid potential legal issues, such as fines or penalties. It serves as a formal declaration of revenue, and any discrepancies may lead to audits or investigations by tax authorities. Therefore, it is vital to adhere to all guidelines when completing this form.

How to obtain the Form 2, Page 9 Revenue Mt

The Form 2, Page 9 Revenue Mt can typically be obtained from the official website of the relevant state or federal agency. Many agencies provide downloadable versions of the form in PDF format, which can be printed and filled out manually. Additionally, some agencies may offer an online submission option, allowing users to complete the form digitally. It is important to ensure that you are using the most current version of the form to comply with any updated regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2, Page 9 Revenue Mt can vary based on the specific requirements of the state or federal agency. Generally, these deadlines align with tax filing periods, which may be quarterly or annually. It is crucial to be aware of these dates to avoid late submissions, which can result in penalties or interest charges. Always check the official agency website for the most accurate and updated information regarding deadlines.

Examples of using the Form 2, Page 9 Revenue Mt

Examples of using the Form 2, Page 9 Revenue Mt include reporting income for self-employed individuals, businesses filing annual tax returns, or organizations applying for grants that require financial disclosures. Each scenario may have specific requirements regarding the information to be reported, making it essential to tailor the completion of the form to the particular context in which it is being used.

Quick guide on how to complete form 2 page 9 2016 revenue mt

Complete Form 2, Page 9 Revenue Mt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 2, Page 9 Revenue Mt on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Form 2, Page 9 Revenue Mt with ease

- Locate Form 2, Page 9 Revenue Mt and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, such as email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 2, Page 9 Revenue Mt and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 2, Page 9 Revenue Mt. and why is it important?

Form 2, Page 9 Revenue Mt. is a specific section of financial documentation that organizations must accurately complete. It is crucial for ensuring compliance and providing a clear view of revenue streams. Utilizing airSlate SignNow can streamline this process, making it easier to manage and submit necessary forms without hassle.

-

How does airSlate SignNow help with Form 2, Page 9 Revenue Mt. submissions?

AirSlate SignNow simplifies the submission of Form 2, Page 9 Revenue Mt. by providing a user-friendly interface for eSigning and sealing documents securely. This ensures that businesses can quickly finalize their documentation without unnecessary delays. Our platform also keeps records of all transactions for easy reference.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans suited for businesses of all sizes. You can choose a plan that aligns with your needs, including essential features for managing documents such as Form 2, Page 9 Revenue Mt. We also provide a free trial so you can explore our functionalities before committing.

-

What features does airSlate SignNow offer for managing Form 2, Page 9 Revenue Mt.?

Our platform includes advanced features like customizable templates, automated workflows, and secure eSignatures specifically for managing documents like Form 2, Page 9 Revenue Mt. These features not only save time but also ensure accuracy and compliance in your processes.

-

Can I integrate airSlate SignNow with other software for Form 2, Page 9 Revenue Mt. management?

Yes, airSlate SignNow can seamlessly integrate with a variety of software solutions to enhance your Form 2, Page 9 Revenue Mt. management. Whether you use CRMs, accounting software, or other tools, our integrations ensure that you have a cohesive workflow, allowing for easier access and management of documents.

-

What are the benefits of using airSlate SignNow for Form 2, Page 9 Revenue Mt.?

Using airSlate SignNow for your Form 2, Page 9 Revenue Mt. processes offers numerous benefits such as increased efficiency, reduced paper use, and enhanced security. Our solution allows for quicker approvals and better tracking of documents, which ultimately leads to a more streamlined operation.

-

Is airSlate SignNow compliant with legal standards for Form 2, Page 9 Revenue Mt. eSignatures?

Absolutely, airSlate SignNow is built with compliance in mind and adheres to legal standards regarding eSignatures. This means that any Form 2, Page 9 Revenue Mt. submitted through our platform is legally binding and recognized, providing peace of mind for your business transactions.

Get more for Form 2, Page 9 Revenue Mt

- Hvac contract for contractor maine form

- Landscape contract for contractor maine form

- Commercial contract for contractor maine form

- Excavator contract for contractor maine form

- Renovation contract for contractor maine form

- Concrete mason contract for contractor maine form

- Demolition contract for contractor maine form

- Framing contract for contractor maine form

Find out other Form 2, Page 9 Revenue Mt

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer