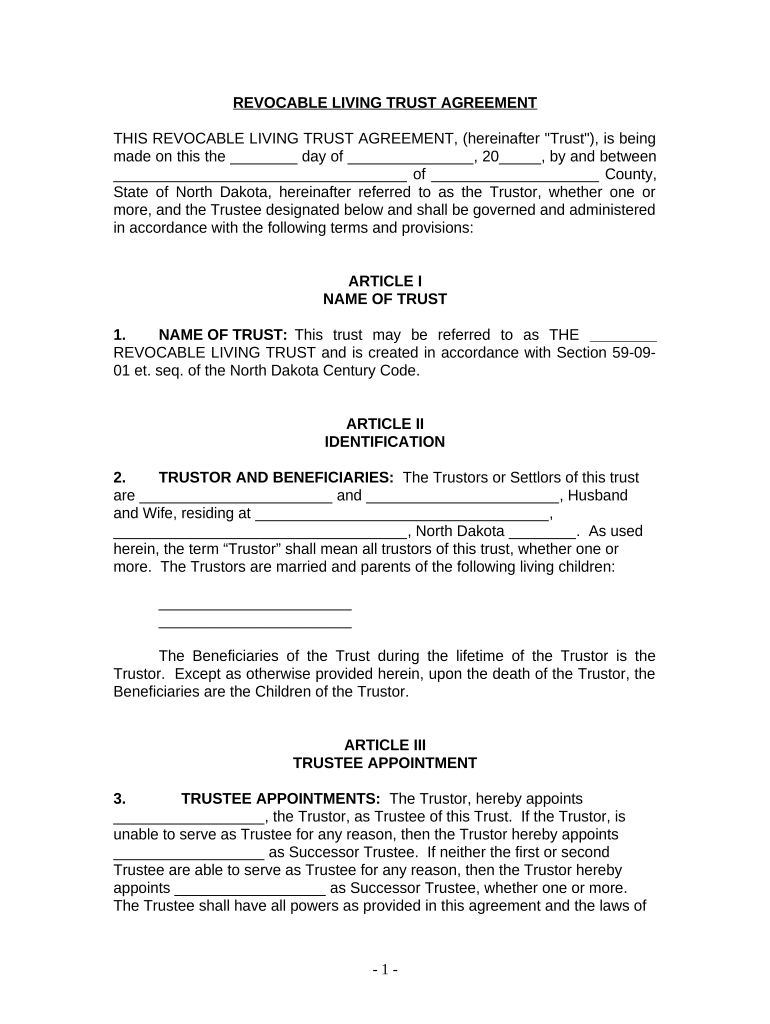

Living Trust for Husband and Wife with Minor and or Adult Children North Dakota Form

What is the Living Trust for Husband and Wife with Minor and or Adult Children in North Dakota

A living trust for husband and wife with minor and or adult children in North Dakota is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust is particularly beneficial for couples with children, as it provides a clear framework for asset management and ensures that the couple's wishes are honored regarding their children's inheritance. The trust can hold various assets, including real estate, bank accounts, and investments, making it a versatile estate planning tool.

Key Elements of the Living Trust for Husband and Wife with Minor and or Adult Children in North Dakota

Several key elements define a living trust for husband and wife with minor and or adult children in North Dakota:

- Grantors: The couple creating the trust, who retain control over the assets during their lifetime.

- Trustee: The individual or institution responsible for managing the trust assets. Often, one or both spouses serve as trustees.

- Beneficiaries: The couple's children or other designated individuals who will inherit the assets upon the death of the grantors.

- Asset Management: The living trust allows for the management of assets, including provisions for minor children, such as stipulations on when and how they receive their inheritance.

- Revocability: Most living trusts are revocable, meaning the grantors can modify or dissolve the trust as their circumstances change.

Steps to Complete the Living Trust for Husband and Wife with Minor and or Adult Children in North Dakota

Completing a living trust involves several important steps:

- Determine your assets: List all assets you wish to include in the trust.

- Choose a trustee: Decide who will manage the trust, which could be one or both spouses.

- Draft the trust document: This document outlines the terms of the trust, including asset distribution and management provisions.

- Sign the trust document: Both spouses must sign the document in the presence of a notary to ensure its legal validity.

- Fund the trust: Transfer ownership of the selected assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust for Husband and Wife with Minor and or Adult Children in North Dakota

The living trust for husband and wife with minor and or adult children is legally recognized in North Dakota, allowing couples to manage their estate planning effectively. This trust helps avoid probate, a legal process that can be lengthy and costly. By using a living trust, couples can ensure a smoother transition of assets to their beneficiaries, providing peace of mind that their wishes will be honored without the complications of probate court.

State-Specific Rules for the Living Trust for Husband and Wife with Minor and or Adult Children in North Dakota

North Dakota has specific rules governing living trusts that couples should consider:

- Signing Requirements: The trust document must be signed by the grantors in the presence of a notary public.

- Asset Transfer: Properly transferring assets into the trust is essential for the trust to be effective.

- Tax Considerations: While living trusts generally do not incur taxes, it's important to consult with a tax professional regarding potential implications for estate taxes.

How to Obtain the Living Trust for Husband and Wife with Minor and or Adult Children in North Dakota

Obtaining a living trust involves several options:

- Consulting an attorney: Engaging an estate planning attorney can ensure that the trust is tailored to your specific needs and complies with North Dakota laws.

- Using online resources: Various online platforms provide templates and guidance for creating a living trust, though it's advisable to have a legal professional review any documents.

- Estate planning workshops: Some community organizations offer workshops that provide information on creating living trusts and other estate planning tools.

Quick guide on how to complete living trust for husband and wife with minor and or adult children north dakota

Complete Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota effortlessly on any device

Online document administration has gained immense traction among organizations and individuals alike. It presents an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to acquire the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Manage Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The most effective method to alter and electronically sign Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota with ease

- Obtain Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from any device you prefer. Modify and electronically sign Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota and ensure outstanding communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota?

A Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota is a legal document that allows you to transfer assets into a trust during your lifetime. This helps ensure that your minor and adult children benefit from your estate according to your wishes. It can simplify the distribution of assets and avoid probate, making the process faster and more efficient.

-

How much does it cost to create a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota?

The cost of creating a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota can vary depending on the complexity of your estate and whether you choose to hire an attorney. On average, you can expect to spend anywhere from $1,000 to $3,000. Using tools like airSlate SignNow can help reduce costs by providing an easy-to-use, cost-effective solution to manage your documents.

-

What are the benefits of having a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota?

One of the primary benefits of a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota is that it allows you to control how your assets are distributed after your death or in case of incapacity. Additionally, it can provide privacy, as trusts do not go through probate, keeping your financial affairs out of public record. This can save time and money for your beneficiaries.

-

Can a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota be modified?

Yes, a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota is flexible and can be modified as circumstances change. You can add or remove assets, change beneficiaries, or adjust the terms of the trust. It’s important to review your trust regularly to ensure it still reflects your intentions.

-

What happens if I don't have a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota?

If you do not have a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota, your assets will be distributed according to the state laws in North Dakota. This often leads to a lengthy probate process that can impose additional costs on your loved ones. Without a trust, you lose the ability to dictate how and when your minor children will receive their inheritance.

-

Does airSlate SignNow integrate with estate planning software for Living Trusts?

Yes, airSlate SignNow can integrate with various estate planning software to streamline the creation of your Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota. This integration allows for seamless document management and electronic signatures, making the process quicker and more efficient for both you and your attorney.

-

How long does it take to set up a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota?

Setting up a Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota can take anywhere from a few days to several weeks, depending on how complex your estate is and the responsiveness of your legal team. When using airSlate SignNow, the process can be expedited as document preparation and signing can occur online, saving you valuable time.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota

- Three day notice to pay rent or quit for use in oakland ebrha form

- Client due diligence form

- Ny police form

- School annual accrual report certification form

- Kum and go w2 form

- Aris solutions universal timesheet form

- Major declaration form american university in bulgaria

- Bed bugs and beyone prevention and control workshop irem form

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children North Dakota

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed