Schedule I Montana Department of Revenue Form

What is the Schedule I Montana Department Of Revenue

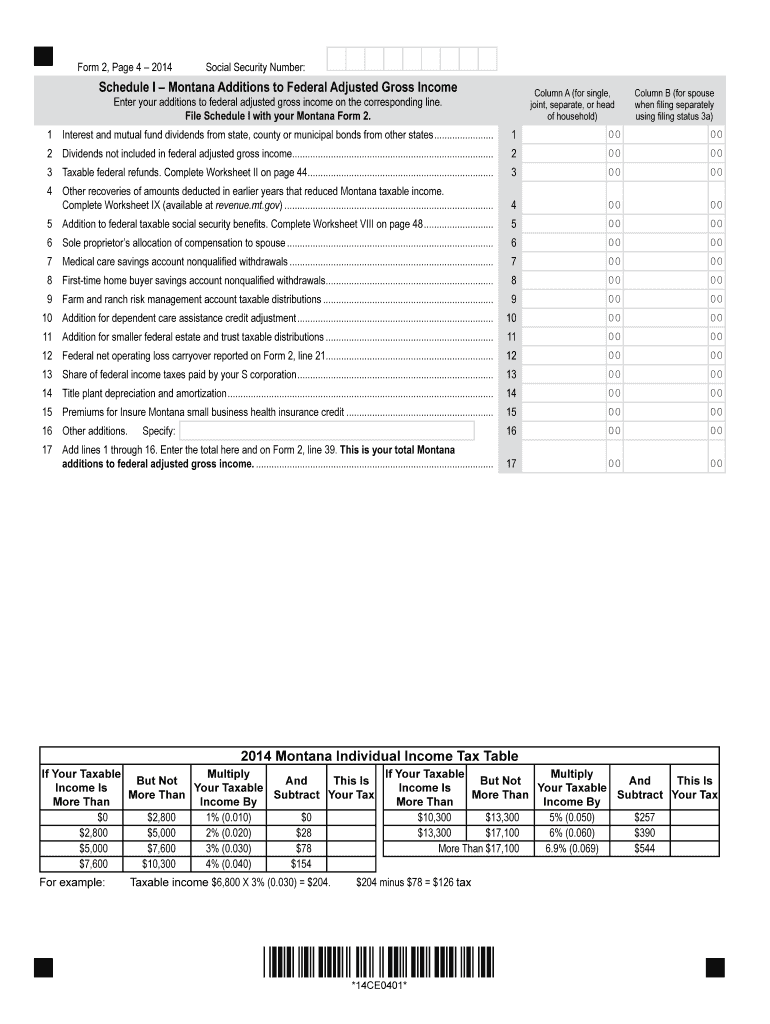

The Schedule I Montana Department Of Revenue is a specific form used for reporting various types of income that are subject to taxation in the state of Montana. This form is essential for individuals and businesses to accurately disclose their income to ensure compliance with state tax regulations. It includes detailed sections for reporting different income sources, deductions, and credits that may apply to the taxpayer’s situation. Proper completion of this form is crucial for determining the correct state tax liability.

How to use the Schedule I Montana Department Of Revenue

Using the Schedule I Montana Department Of Revenue involves several steps to ensure accurate reporting of income. Taxpayers should first gather all necessary documentation related to their income sources. This may include W-2 forms, 1099 forms, and records of any other income received. After collecting the required documents, individuals can begin filling out the form by entering their income details in the designated sections. It is important to review all entries for accuracy before submission to avoid any potential issues with the Montana Department of Revenue.

Steps to complete the Schedule I Montana Department Of Revenue

Completing the Schedule I Montana Department Of Revenue requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant income documents, such as W-2s and 1099s.

- Begin filling out the form, starting with personal information at the top.

- Report all sources of income in the appropriate sections, ensuring accuracy.

- Include any deductions or credits that apply to your situation.

- Review the completed form thoroughly for any errors or omissions.

- Submit the form by the designated filing deadline, either online or via mail.

Key elements of the Schedule I Montana Department Of Revenue

The Schedule I Montana Department Of Revenue contains several key elements that are essential for accurate tax reporting. These include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Reporting: Sections for various types of income, including wages, interest, and dividends.

- Deductions and Credits: Areas to claim any applicable deductions or tax credits.

- Signature Section: A space for the taxpayer's signature to validate the form.

Legal use of the Schedule I Montana Department Of Revenue

The legal use of the Schedule I Montana Department Of Revenue is governed by state tax laws. Properly completing and submitting this form ensures compliance with Montana's tax regulations. Failure to accurately report income can result in penalties or legal repercussions. It is advisable for taxpayers to familiarize themselves with the specific legal requirements associated with the form to avoid any issues during the tax filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule I Montana Department Of Revenue are critical for compliance. Typically, the form must be submitted by April 15 of each year for the previous tax year. However, it is important to verify specific dates, as they may vary based on weekends or holidays. Taxpayers should mark their calendars to ensure timely submission to avoid penalties.

Quick guide on how to complete schedule i montana department of revenue

Easily Prepare [SKS] on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Effortlessly Edit and Electrically Sign [SKS]

- Obtain [SKS] and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your files or conceal sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule I Montana Department Of Revenue

Create this form in 5 minutes!

People also ask

-

What is the Schedule I Montana Department Of Revenue?

The Schedule I Montana Department Of Revenue is a form used by taxpayers to report various types of income in Montana. This document is essential for filing accurate income tax returns, as it outlines important deductions and credits. By utilizing airSlate SignNow, you can efficiently manage and eSign your Schedule I documents in a secure environment.

-

How can airSlate SignNow help with the Schedule I Montana Department Of Revenue?

airSlate SignNow provides a user-friendly platform to create, edit, and eSign the Schedule I Montana Department Of Revenue. Our solution streamlines the document process, ensuring that you can complete your filing quickly and without errors. This efficiency allows you to focus on your business, while we handle the documentation.

-

Is there a cost associated with using airSlate SignNow for Schedule I Montana Department Of Revenue?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs, from individual to enterprise solutions. Each plan provides access to tools for eSigning and managing documents, including the Schedule I Montana Department Of Revenue. Check our website for specific pricing details and available features.

-

What features does airSlate SignNow offer for Schedule I Montana Department Of Revenue?

airSlate SignNow includes features like eSignature capabilities, document templates, and secure storage designed to ease the process of handling the Schedule I Montana Department Of Revenue. Our intuitive platform allows for easy collaboration and tracking of your tax documents, ensuring compliance and accuracy in your submissions.

-

Can I integrate airSlate SignNow with other applications for handling my Schedule I Montana Department Of Revenue?

Absolutely! airSlate SignNow offers a range of integrations with popular applications such as Google Drive, Dropbox, and accounting software. These integrations allow for seamless access and management of your Schedule I Montana Department Of Revenue documents, enhancing workflow efficiency across platforms.

-

How secure is my information when using airSlate SignNow for Schedule I Montana Department Of Revenue?

Your security is our priority at airSlate SignNow. We implement advanced encryption protocols and compliance measures to protect your sensitive data while handling the Schedule I Montana Department Of Revenue. This ensures that your information remains confidential and secure throughout the entire document process.

-

How do I get started with airSlate SignNow for my Schedule I Montana Department Of Revenue?

Getting started with airSlate SignNow is simple! Visit our website to sign up for a free trial, where you can explore the features designed for managing the Schedule I Montana Department Of Revenue. Once registered, you can begin creating, signing, and managing your tax documents effortlessly.

Get more for Schedule I Montana Department Of Revenue

- C1601 presentation of goods for export arrival this form is only to be used to arrivepresent goods at uk locations where

- Ca1890 form

- P45 forms

- Bd510 bingo duty promoters monthly return use this form to submit your promoters monthly return hmrc gov

- Caa form 2129 civil aviation authority of new zealand

- New zealand form statutory

- Ks10 opt out form nzqa ird govt

- House sharing agreement form

Find out other Schedule I Montana Department Of Revenue

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter