15CE0401 Montana Form

What is the 15CE0401 Montana

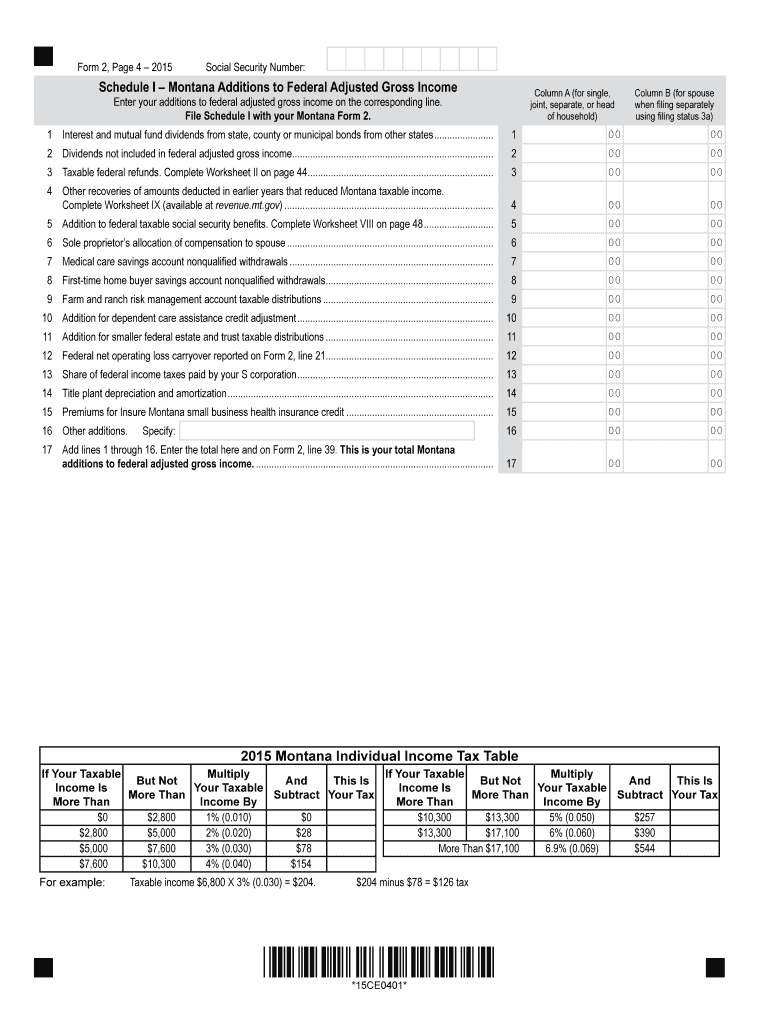

The 15CE0401 Montana form is a specific document used within the state of Montana for various administrative purposes. This form is primarily associated with tax filings, particularly concerning the assessment of property taxes. It serves as a crucial tool for individuals and businesses to report relevant information to the state authorities accurately. Understanding the purpose and requirements of the 15CE0401 is essential for compliance with Montana's tax regulations.

How to use the 15CE0401 Montana

Using the 15CE0401 Montana form involves several key steps. First, gather all necessary information related to your property or business that needs to be reported. This may include details about ownership, property value, and any applicable deductions. Next, complete the form by filling in the required fields accurately. Once completed, the form can be submitted electronically or via mail, depending on the specific instructions provided by the Montana Department of Revenue. Ensure that you retain a copy of the submitted form for your records.

Steps to complete the 15CE0401 Montana

Completing the 15CE0401 Montana form requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including property deeds and previous tax assessments.

- Fill out the form with accurate information, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the designated state portal or mail it to the appropriate address.

- Keep a copy of the completed form and any confirmation of submission for your records.

Legal use of the 15CE0401 Montana

The legal use of the 15CE0401 Montana form is governed by state tax laws and regulations. It is essential to ensure that the information provided is truthful and accurate to avoid potential legal issues. The form must be submitted within the specified deadlines to maintain compliance with Montana's tax requirements. Failure to submit the form correctly may result in penalties or additional scrutiny from tax authorities.

Key elements of the 15CE0401 Montana

Key elements of the 15CE0401 Montana form include:

- Identification of the property or business being reported.

- Details regarding ownership and property value.

- Information on any exemptions or deductions applicable.

- Signature of the individual or authorized representative submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the 15CE0401 Montana form are critical to ensure compliance with state regulations. Typically, the form must be submitted by a specific date each year, often aligned with the property tax assessment cycle. It is advisable to check the Montana Department of Revenue's website for the most current deadlines and any changes that may occur annually.

Form Submission Methods (Online / Mail / In-Person)

The 15CE0401 Montana form can be submitted through various methods to accommodate different preferences. Individuals may choose to file the form online via the Montana Department of Revenue's electronic filing system, which offers convenience and immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate office or submitted in person at designated locations. Each method has its own guidelines, so it is important to follow the instructions provided for the chosen submission method.

Quick guide on how to complete 15ce0401 montana

Complete [SKS] seamlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, since you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 15CE0401 Montana certification process?

The 15CE0401 Montana certification process is designed to ensure compliance with state regulations. It involves submitting relevant documents and adhering to outlined guidelines. By utilizing airSlate SignNow, businesses can streamline this process, making it easier to obtain necessary certifications.

-

How can airSlate SignNow help with 15CE0401 Montana documentation?

airSlate SignNow provides a user-friendly platform to send and eSign documents required for the 15CE0401 Montana certification. This tool saves time and reduces paperwork by allowing users to manage all relevant documents electronically. Enhanced security measures ensure that sensitive information is protected throughout the process.

-

What are the pricing options for airSlate SignNow regarding the 15CE0401 Montana solution?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those seeking 15CE0401 Montana compliance. Pricing is designed to be cost-effective, providing access to essential features without breaking the bank. Businesses can choose from monthly or annual subscriptions for added convenience.

-

What features does airSlate SignNow offer for the 15CE0401 Montana requirements?

Key features of airSlate SignNow that benefit users dealing with 15CE0401 Montana include document templates, eSigning capabilities, and automated workflows. These tools provide a seamless experience by simplifying the document management process. Additionally, the platform offers tracking and reporting features to monitor progress.

-

How does airSlate SignNow ensure compliance with 15CE0401 Montana standards?

airSlate SignNow prioritizes compliance by incorporating industry best practices and legal standards relevant to the 15CE0401 Montana certification. The platform regularly updates its features to align with changing regulations. This ensures that users can confidently manage their documents while remaining compliant.

-

Can I integrate airSlate SignNow with other tools for 15CE0401 Montana?

Yes, airSlate SignNow offers various integrations with popular business tools to enhance the 15CE0401 Montana workflow. Integration with platforms like Google Drive, Dropbox, and Slack allows for smooth collaboration and document sharing. This helps users maintain efficiency in their operations.

-

What are the benefits of using airSlate SignNow for 15CE0401 Montana documentation?

Using airSlate SignNow for 15CE0401 Montana offers numerous benefits including time savings, improved accuracy, and cost efficiency. Automated workflows reduce manual errors and streamline the document approval process. As a result, businesses can focus more on their core operations instead of managing paperwork.

Get more for 15CE0401 Montana

Find out other 15CE0401 Montana

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application