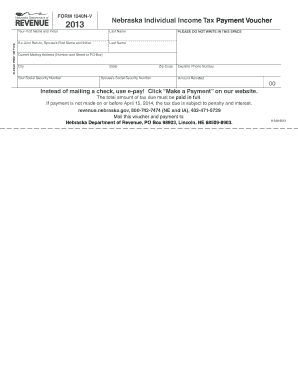

1040n V Form

What is the 1040n V

The 1040n V form is a specific tax document used by residents of certain states in the United States to report their income and calculate their tax liability. This form is part of the broader 1040 series, which is essential for individual income tax filings. It is designed to accommodate specific state tax regulations and requirements, ensuring compliance with local tax laws.

How to use the 1040n V

Using the 1040n V form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form by entering your personal information, income details, and applicable deductions. Ensure that you double-check all entries for accuracy. Once completed, the form can be submitted electronically or by mail, depending on state guidelines.

Steps to complete the 1040n V

Completing the 1040n V form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources.

- Apply any deductions or credits you qualify for.

- Calculate your total tax liability.

- Sign and date the form before submission.

Legal use of the 1040n V

The 1040n V form holds legal significance as it is used to report income to the Internal Revenue Service (IRS) and state tax authorities. Properly completing and filing this form ensures compliance with tax laws, which can help avoid penalties or legal issues. It is crucial to ensure that all information provided is accurate and truthful to maintain the form's legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the 1040n V form typically align with the federal tax deadlines. Generally, individual tax returns must be filed by April 15 of each year. However, it is essential to check for any state-specific deadlines or extensions that may apply, as these can vary. Marking these dates on your calendar can help ensure timely submission and avoid late fees.

Required Documents

To complete the 1040n V form accurately, you will need several documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as investments.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Form Submission Methods (Online / Mail / In-Person)

The 1040n V form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online filing through state tax websites or authorized e-filing services.

- Mailing a paper copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete 1040n v

Complete 1040n V effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and safely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage 1040n V on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign 1040n V with ease

- Locate 1040n V and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important portions of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign 1040n V and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1040n v. form and how can airSlate SignNow assist with it?

The 1040n v. form is a crucial document for tax filings, and airSlate SignNow provides a seamless way to eSign these forms digitally. With our platform, you can fill out, send, and securely eSign your 1040n v. forms without the hassle of printing. This ensures compliance and saves time during the tax season.

-

What are the pricing options for using airSlate SignNow for 1040n v. forms?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes that need to work with 1040n v. forms. We provide comprehensive packages that cater to various usage levels, ensuring you can find a cost-effective solution for your document signing needs. Additionally, there is a free trial available to explore our features before committing.

-

Can I integrate airSlate SignNow with my current accounting software for 1040n v. forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your 1040n v. forms. This integration allows for streamlined document workflows, helping you to efficiently handle tax documents and signatures in one place. Our API also supports custom integrations to fit your business processes.

-

What security features does airSlate SignNow offer for handling 1040n v. forms?

airSlate SignNow prioritizes the security of your data, implementing industry-leading encryption and authentication protocols for 1040n v. forms. Our platform also complies with eSignature laws, ensuring that your electronic signatures on tax documents are legally binding and secure. Additionally, access controls ensure that only authorized personnel can view or modify sensitive information.

-

How does airSlate SignNow enhance collaboration for 1040n v. submissions?

airSlate SignNow facilitates collaboration by enabling teams to work together on 1040n v. forms in real-time. You can easily share documents, request eSignatures, and track the status of submissions within the platform. This collaborative approach minimizes errors and keeps everyone aligned on tax document deadlines.

-

Is there customer support available for using airSlate SignNow with 1040n v. forms?

Certainly! airSlate SignNow provides excellent customer support for all users, including those working with 1040n v. forms. Our team is available through multiple channels, including phone, email, and live chat, to assist you with any questions or issues you may encounter, ensuring a smooth experience.

-

What are the key benefits of using airSlate SignNow for 1040n v. forms?

Using airSlate SignNow for your 1040n v. forms offers numerous benefits, including time savings, enhanced efficiency, and reduced errors. The ability to eSign documents quickly accelerates the tax filing process, while our intuitive interface makes it easy for users of all skill levels. Furthermore, the cost-effectiveness of our solution helps keep your budget in check.

Get more for 1040n V

- Legal last will and testament form for divorced person not remarried with minor children north dakota

- Legal last will and testament form for divorced person not remarried with adult and minor children north dakota

- Mutual wills package with last wills and testaments for married couple with adult children north dakota form

- Mutual wills package with last wills and testaments for married couple with no children north dakota form

- Mutual wills package with last wills and testaments for married couple with minor children north dakota form

- North dakota will 497317881 form

- North dakota legal 497317882 form

- North dakota minor form

Find out other 1040n V

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later