Form 1040N V Nebraska Individual Income Tax Payment

What is the Form 1040N V Nebraska Individual Income Tax Payment

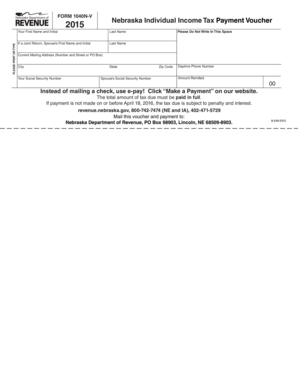

The Form 1040N V is a payment voucher used by residents of Nebraska to submit their individual income tax payments. This form is specifically designed for taxpayers who owe money to the state and need to remit their payment in a structured manner. It is important to note that this form is not a tax return; rather, it serves as a means to facilitate the payment of taxes owed after completing the primary income tax return, Form 1040N.

How to use the Form 1040N V Nebraska Individual Income Tax Payment

To effectively use the Form 1040N V, taxpayers should first complete their Nebraska Individual Income Tax Return. Once the tax liability is determined, the taxpayer can fill out the Form 1040N V, indicating the amount owed. The form requires basic personal information, including the taxpayer's name, address, and Social Security number. After filling out the form, the taxpayer should attach a check or money order for the payment amount and submit it to the appropriate address provided by the Nebraska Department of Revenue.

Steps to complete the Form 1040N V Nebraska Individual Income Tax Payment

Completing the Form 1040N V involves several straightforward steps:

- Obtain the Form 1040N V from the Nebraska Department of Revenue website or through other official sources.

- Fill in your personal details, including your name, address, and Social Security number.

- Indicate the amount you are paying, based on your completed Form 1040N.

- Attach your payment, either by check or money order, made out to the Nebraska Department of Revenue.

- Review the completed form for accuracy before submission.

- Mail the form and payment to the designated address for processing.

Legal use of the Form 1040N V Nebraska Individual Income Tax Payment

The Form 1040N V is legally recognized by the Nebraska Department of Revenue as a valid method for submitting individual income tax payments. To ensure its legal standing, it is essential that the form is filled out accurately and submitted within the designated deadlines. The payment made via this form is considered a formal acknowledgment of the taxpayer's tax obligation and can be used as evidence in case of disputes or audits.

Filing Deadlines / Important Dates

Taxpayers should be aware of the critical deadlines associated with the Form 1040N V. Payments must be submitted by the due date specified by the Nebraska Department of Revenue to avoid penalties and interest. Generally, individual income tax payments are due on April 15 of each year, but taxpayers should verify any changes or extensions that may apply for the current tax year. Keeping track of these dates is essential for maintaining compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040N V can be submitted in various ways to accommodate different preferences. Taxpayers can mail the completed form along with their payment to the Nebraska Department of Revenue. While electronic submission of payments is not typically available for this specific form, taxpayers can check for any updates regarding online payment options through the Nebraska Department of Revenue website. In-person submissions may also be possible at designated state offices, allowing for immediate processing of the payment.

Quick guide on how to complete form 1040n v 2015 nebraska individual income tax payment

Complete Form 1040N V Nebraska Individual Income Tax Payment effortlessly on any device

Managing documents online has gained increased popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 1040N V Nebraska Individual Income Tax Payment on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 1040N V Nebraska Individual Income Tax Payment with ease

- Find Form 1040N V Nebraska Individual Income Tax Payment and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1040N V Nebraska Individual Income Tax Payment and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Form 1040N V Nebraska Individual Income Tax Payment?

The Form 1040N V Nebraska Individual Income Tax Payment is a payment voucher used for individuals filing their Nebraska income tax returns. It allows taxpayers to submit their payments electronically or by mail efficiently. Utilizing this form helps ensure timeliness and accuracy in fulfilling state tax obligations.

-

How can airSlate SignNow help with submitting Form 1040N V Nebraska Individual Income Tax Payment?

airSlate SignNow streamlines the process of signing and submitting the Form 1040N V Nebraska Individual Income Tax Payment by providing a secure, user-friendly eSignature platform. You can easily upload, sign, and send your tax payment documents without the need for printing or mailing. Our solution saves time and simplifies compliance.

-

Is there a cost associated with using airSlate SignNow for Form 1040N V Nebraska Individual Income Tax Payment?

Yes, airSlate SignNow offers a range of pricing plans tailored to individuals and businesses. You can choose a plan that fits your budget and needs while enjoying features designed to expedite the processing of your Form 1040N V Nebraska Individual Income Tax Payment. Visit our pricing page for more details.

-

What features does airSlate SignNow offer for eSigning Form 1040N V Nebraska Individual Income Tax Payment?

airSlate SignNow provides several features, including audit trails, templates for reusable documents, and secure cloud storage for your Form 1040N V Nebraska Individual Income Tax Payment. These features enhance compliance and ensure that all signed documents are legally binding and easily accessible.

-

Can airSlate SignNow integrate with other applications to assist with Form 1040N V Nebraska Individual Income Tax Payment?

Yes, airSlate SignNow offers integrations with various applications and tools to help you manage your Form 1040N V Nebraska Individual Income Tax Payment efficiently. This includes tools for accounting, document management, and CRM systems, enabling seamless workflow and data management.

-

How secure is airSlate SignNow when submitting Form 1040N V Nebraska Individual Income Tax Payment?

Security is a top priority at airSlate SignNow. We employ encryption protocols and stringent data protection measures to ensure that your Form 1040N V Nebraska Individual Income Tax Payment and other sensitive information remain secure. Our platform is also compliant with industry standards for document safety.

-

What are the benefits of using airSlate SignNow for Form 1040N V Nebraska Individual Income Tax Payment?

Using airSlate SignNow for your Form 1040N V Nebraska Individual Income Tax Payment provides convenience, security, and efficiency. It eliminates the need for physical paperwork, reduces processing time, and increases the chances of on-time payments, helping you avoid penalties associated with late submissions.

Get more for Form 1040N V Nebraska Individual Income Tax Payment

- Landlord agreement to allow tenant alterations to premises nebraska form

- Notice of default on residential lease nebraska form

- Landlord tenant lease co signer agreement nebraska form

- Application for sublease nebraska form

- Inventory and condition of leased premises for pre lease and post lease nebraska form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out nebraska form

- Property manager agreement nebraska form

- Agreement for delayed or partial rent payments nebraska form

Find out other Form 1040N V Nebraska Individual Income Tax Payment

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement