FORM for Tax Years After for Tax Year Beginning Attach This Form to the Original or Amended Return

What is the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

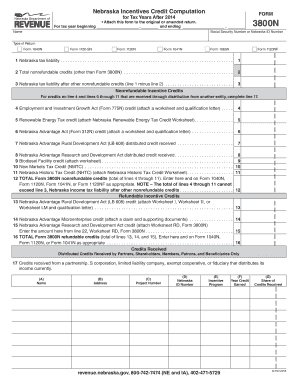

The form for tax years after 2014 for tax year beginning attach this form to the original or amended return is a crucial document used by taxpayers to report specific financial information to the IRS. This form is typically required when there are changes or corrections to previously submitted tax returns. It ensures that the IRS has the most accurate and up-to-date information regarding a taxpayer's financial situation, which can affect their tax liability and eligibility for certain credits or deductions.

How to use the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

Using the form for tax years after 2014 for tax year beginning attach this form to the original or amended return involves a few straightforward steps. First, determine if you need to amend your tax return; this is usually necessary when there are errors or new information that could change your tax outcome. Next, fill out the form accurately, ensuring that all required fields are completed. After filling out the form, attach it to your original or amended return before submitting it to the IRS. This process can be done electronically or via mail, depending on your preference.

Steps to complete the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

Completing the form for tax years after 2014 for tax year beginning attach this form to the original or amended return involves several key steps:

- Review the original tax return to identify any errors or omissions.

- Obtain the correct version of the form, ensuring it is for the appropriate tax year.

- Fill out the form with accurate information, including any necessary supporting documentation.

- Double-check all entries for accuracy and completeness.

- Attach the completed form to your original or amended return.

- Submit the return to the IRS, either electronically or by mail.

Legal use of the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

The legal use of the form for tax years after 2014 for tax year beginning attach this form to the original or amended return is essential for compliance with IRS regulations. When properly filled out and submitted, the form serves as an official record of any amendments made to your tax return. It is important to ensure that all information is accurate and supported by relevant documentation to avoid potential penalties or audits. Utilizing a reliable electronic signature solution can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the form for tax years after 2014 for tax year beginning attach this form to the original or amended return vary based on the specific tax year and the nature of the return. Generally, the IRS sets a deadline for submitting amended returns, which is typically three years from the original filing date. It is crucial to be aware of these deadlines to ensure timely compliance and avoid any penalties associated with late submissions.

Form Submission Methods (Online / Mail / In-Person)

The form for tax years after 2014 for tax year beginning attach this form to the original or amended return can be submitted through various methods. Taxpayers have the option to file electronically, which is often faster and more efficient. Alternatively, forms can be mailed to the appropriate IRS address, depending on the taxpayer's location. In-person submissions may also be possible at designated IRS offices, although this option is less common. Each method has its own guidelines, and it is important to follow the instructions provided by the IRS for successful submission.

Quick guide on how to complete form for tax years after 2014 for tax year beginning attach this form to the original or amended return

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to adjust and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

Create this form in 5 minutes!

People also ask

-

What is the purpose of the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

The FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return is designed to help taxpayers accurately report any amendments to their previous tax filings. By attaching this form, individuals can clarify errors or update information, ensuring compliance with tax regulations. This streamlined approach enhances efficiency for both taxpayers and the IRS.

-

How much does airSlate SignNow cost for those needing to file the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

airSlate SignNow offers a variety of pricing plans tailored for different business needs, enabling users to easily send and eSign documents, including the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return. Prices start at a competitive rate, making it an affordable option for businesses of all sizes. Additionally, free trials are available to explore the features.

-

Can airSlate SignNow help me prepare the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

Yes, airSlate SignNow provides tools and templates that can assist you in preparing the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return. With an intuitive interface, users can fill out necessary information and eSign documents efficiently. This simplifies the process and ensures all documents are properly completed and submitted.

-

What are the key features of airSlate SignNow that support filing the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

Key features of airSlate SignNow include electronic signatures, document tracking, and secure cloud storage, all of which are essential for filing the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return. These functionalities provide enhanced security and convenience, allowing businesses to manage their tax documentation effectively. Users can also collaborate on documents in real-time.

-

Is airSlate SignNow compliant with federal regulations for eSigning the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

Absolutely! airSlate SignNow complies with federal regulations regarding electronic signatures, ensuring that your FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return is legally binding and secure. This compliance guarantees that your documents will be accepted by the IRS and other authorities, streamlining your filing process.

-

How can I integrate airSlate SignNow with my existing accounting software for the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

airSlate SignNow offers seamless integrations with various accounting and financial software, making it easier to manage the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return. You can connect your existing systems to streamline document management and eSigning processes. This integration allows for a more efficient workflow during tax season.

-

What benefits does airSlate SignNow provide when managing the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return?

Using airSlate SignNow for the FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return delivers several benefits, including increased efficiency, reduced paper usage, and enhanced security. The electronic signing process speeds up approvals and submissions, while secure cloud storage ensures that your documents are accessible anytime and anywhere. Overall, it simplifies tax management for businesses.

Get more for FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

- Application for electrical permit lackawanna form

- Foil application inc village of malverne ny malvernevillage form

- Foil request form city of port jervis portjervisny

- Hwseta regnohw591pa1212477 form syracuse ny

- Short assessment form

- City of tonawanda plow permit form

- Mvr 2 how to form

- Military cdl waiver form nc 2013

Find out other FORM For Tax Years After For Tax Year Beginning Attach This Form To The Original Or Amended Return

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later