Download NM Form PIT X TaxHow

What is the Download NM Form PIT X TaxHow

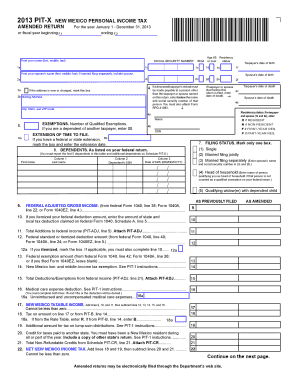

The Download NM Form PIT X TaxHow is a tax form used in New Mexico for reporting income and calculating tax liabilities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It provides a structured way to report various types of income and deductions, ultimately determining the amount of tax owed or the refund due. Understanding this form is crucial for accurate tax filing and maintaining good standing with the New Mexico Taxation and Revenue Department.

How to use the Download NM Form PIT X TaxHow

Using the Download NM Form PIT X TaxHow involves several steps. First, download the form from a reliable source. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form with accurate details regarding your income, deductions, and credits. Once completed, review the form for any errors before submitting it. This ensures that your tax return is processed smoothly and helps avoid potential issues with the state tax authorities.

Steps to complete the Download NM Form PIT X TaxHow

Completing the Download NM Form PIT X TaxHow requires attention to detail. Follow these steps:

- Download the form from a trusted website.

- Gather all necessary documentation, including W-2s, 1099s, and any relevant receipts.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report your total income accurately, including wages, interest, and dividends.

- Claim any deductions or credits you are eligible for, ensuring you have the proper documentation.

- Review the completed form for accuracy.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the Download NM Form PIT X TaxHow

The Download NM Form PIT X TaxHow is legally binding when completed and submitted according to New Mexico state laws. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, the form must be submitted within the specified deadlines to avoid penalties. Compliance with state regulations is crucial for the form to be recognized as an official document by the New Mexico Taxation and Revenue Department.

Filing Deadlines / Important Dates

Filing deadlines for the Download NM Form PIT X TaxHow are critical to ensure compliance and avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, taxpayers should verify specific dates each year, as they may vary. It is important to keep track of any extensions or changes announced by the New Mexico Taxation and Revenue Department to ensure timely submission.

Required Documents

When preparing to complete the Download NM Form PIT X TaxHow, several documents are necessary to provide accurate information. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts for business expenses or charitable contributions.

- Any prior year tax returns for reference.

Who Issues the Form

The Download NM Form PIT X TaxHow is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to help individuals and businesses understand their tax obligations and correctly complete necessary forms.

Quick guide on how to complete download nm form pit x taxhow

Complete Download NM Form PIT X TaxHow effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Handle Download NM Form PIT X TaxHow on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign Download NM Form PIT X TaxHow with ease

- Find Download NM Form PIT X TaxHow and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Download NM Form PIT X TaxHow to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to Download NM Form PIT X TaxHow using airSlate SignNow?

To Download NM Form PIT X TaxHow, simply log into your airSlate SignNow account, navigate to the documents section, and select the form you need. After filling it out, you can eSign it and download a copy directly to your device. The streamlined interface ensures a fast and efficient experience for all users.

-

Is there a cost associated with Downloading NM Form PIT X TaxHow?

Downloading NM Form PIT X TaxHow is included in your airSlate SignNow subscription at no additional charge. Our affordable plans are designed to provide every tool you need for document management, without unexpected fees. Explore our pricing page to find the right plan for your needs and learn more about our features.

-

What are the benefits of using airSlate SignNow to Download NM Form PIT X TaxHow?

Using airSlate SignNow to Download NM Form PIT X TaxHow allows you to enjoy a secure and compliant way to handle your tax documents. Our platform offers easy eSigning, tracking capabilities, and mobile access, making your tax filing process simpler. With airSlate SignNow, you can focus on what matters while enhancing efficiency.

-

Can I integrate airSlate SignNow with other tools while Downloading NM Form PIT X TaxHow?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, allowing you to Download NM Form PIT X TaxHow alongside your favorite tools. Popular integrations include cloud storage, CRM systems, and team collaboration apps. This connectivity boosts productivity and automates workflows for greater efficiency.

-

What features are available when I Download NM Form PIT X TaxHow?

When you Download NM Form PIT X TaxHow through airSlate SignNow, you access features like customizable templates, document tracking, and shared signing options. These capabilities streamline your workflow and ensure you know when documents are signed and returned. Additionally, the platform ensures compliance with legal standards for eSigning.

-

Is support available if I encounter issues while Downloading NM Form PIT X TaxHow?

Absolutely! Our dedicated customer support team is available to assist you whenever you encounter issues while Downloading NM Form PIT X TaxHow. You can signNow out via live chat, email, or our comprehensive help center. We prioritize customer satisfaction and are here to help every step of the way.

-

How long does it take to Download NM Form PIT X TaxHow?

Downloading NM Form PIT X TaxHow through airSlate SignNow is quick and efficient, often taking just a few minutes. After filling out the necessary fields and eSigning, your document will be ready for download almost instantly. This speed helps you meet your deadlines without unnecessary delays.

Get more for Download NM Form PIT X TaxHow

- Assumption agreement of deed of trust and release of original mortgagors nebraska form

- Nebraska small estate affidavit form

- Small estate affidavit for personal property of estates not more than 50000 nebraska form

- Summary administration package for small estates nebraska form

- Nebraska damages form

- Nebraska eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497318275 form

- Annual minutes nebraska nebraska form

Find out other Download NM Form PIT X TaxHow

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online