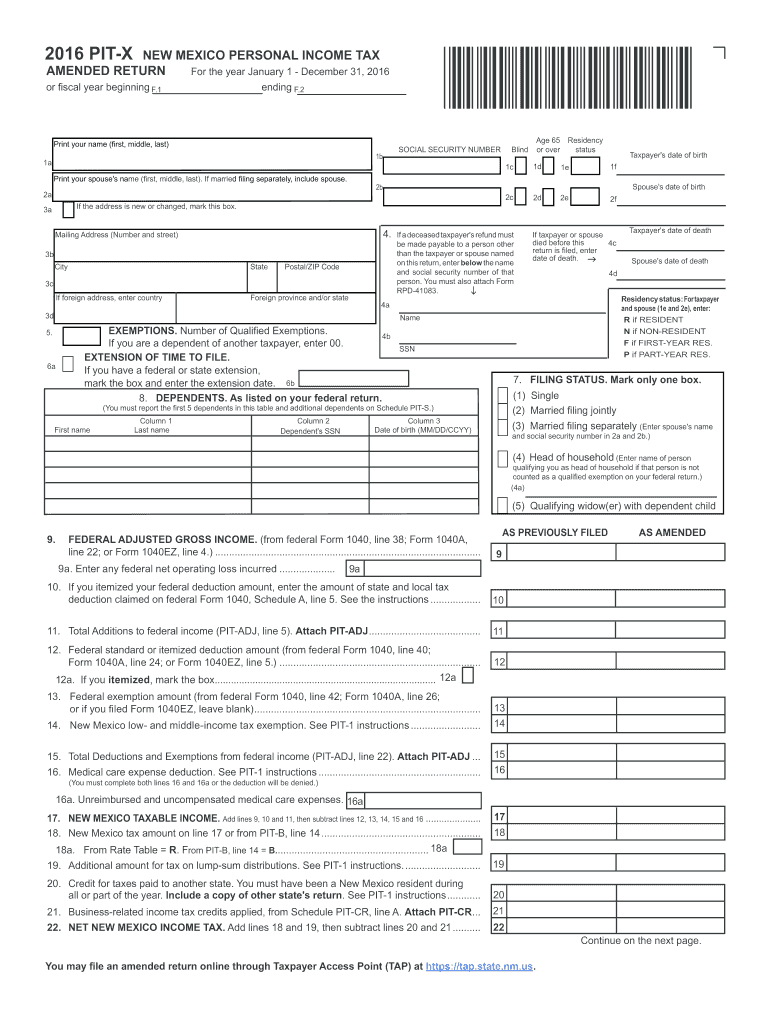

Or Fiscal Year Beginning F Form

What is the Or Fiscal Year Beginning F

The Or Fiscal Year Beginning F form is a crucial document used primarily by businesses and organizations to establish their fiscal year. This form indicates the specific starting date of the fiscal year, which is essential for accounting and tax purposes. By defining the fiscal year, entities can streamline their financial reporting, budgeting, and compliance with tax regulations. Understanding the implications of the fiscal year can help organizations better manage their financial health and obligations.

How to use the Or Fiscal Year Beginning F

Using the Or Fiscal Year Beginning F form involves several straightforward steps. First, identify the appropriate fiscal year start date that aligns with your business operations. Next, fill out the required information on the form, ensuring accuracy in all entries. Once completed, submit the form to the relevant tax authority or governing body. It’s important to retain a copy for your records. Utilizing digital tools like signNow can simplify this process, allowing for easy completion and secure electronic submission.

Steps to complete the Or Fiscal Year Beginning F

Completing the Or Fiscal Year Beginning F form requires careful attention to detail. Follow these steps:

- Determine your desired fiscal year start date.

- Gather necessary information, including your business name, address, and tax identification number.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference and requirements.

Legal use of the Or Fiscal Year Beginning F

The legal use of the Or Fiscal Year Beginning F form is governed by various tax laws and regulations. This form must be completed in compliance with IRS guidelines to ensure that the designated fiscal year is recognized for tax reporting purposes. Proper use of the form helps avoid potential penalties and ensures that financial records align with legal standards. Organizations should consult with tax professionals to ensure compliance with all applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the Or Fiscal Year Beginning F form can vary based on the entity type and the fiscal year chosen. Generally, it is advisable to submit the form well in advance of the start of the fiscal year to avoid any complications. Key dates include:

- Initial submission deadline: Typically at least 75 days before the start of the fiscal year.

- Annual review and updates: Should be conducted regularly to ensure ongoing compliance.

Who Issues the Form

The Or Fiscal Year Beginning F form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. These entities provide the necessary guidelines and requirements for completing the form. It is crucial for businesses to refer to the official resources provided by these authorities to ensure they are using the most current version of the form and adhering to all legal requirements.

Quick guide on how to complete or fiscal year beginning f

Effortlessly Create Or Fiscal Year Beginning F on Any Device

Online document management is gaining traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Or Fiscal Year Beginning F using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to Alter and eSign Or Fiscal Year Beginning F with Ease

- Locate Or Fiscal Year Beginning F and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Alter and eSign Or Fiscal Year Beginning F and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Or Fiscal Year Beginning F?

airSlate SignNow is a comprehensive eSignature solution designed for businesses to streamline their document management processes. By utilizing airSlate SignNow, companies can efficiently send and eSign documents right from the start of their Or Fiscal Year Beginning F, ensuring compliance and fostering better collaboration among teams.

-

How does airSlate SignNow's pricing structure work?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, catering to various needs associated with Or Fiscal Year Beginning F. Whether you are a small startup or a large enterprise, you can choose a plan that aligns with your budget and document signing requirements.

-

What key features does airSlate SignNow provide?

airSlate SignNow includes features like customizable templates, reusable fields, real-time tracking, and advanced security measures. These features optimize your document workflows, especially signNow during critical times such as the Or Fiscal Year Beginning F, ensuring efficient management of your signed documents.

-

How can airSlate SignNow benefit my business operations?

By implementing airSlate SignNow, businesses can reduce the time spent on traditional paperwork and improve overall efficiency. The ease of eSigning during crucial periods like the Or Fiscal Year Beginning F minimizes delays in approvals and enhances operational productivity.

-

Can airSlate SignNow integrate with my existing software?

Absolutely! airSlate SignNow can seamlessly integrate with various platforms, including CRM and project management tools. This capability allows businesses to streamline processes, especially during signNow transitions such as the Or Fiscal Year Beginning F.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security with robust encryption and compliance with industry standards. This level of protection is particularly essential during the Or Fiscal Year Beginning F when handling sensitive financial documents and contracts.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides multiple support options, including live chat, email, and extensive online resources. Users can access essential assistance, especially around important periods like the Or Fiscal Year Beginning F, ensuring they maximize their use of the platform.

Get more for Or Fiscal Year Beginning F

- Commercial rental lease application questionnaire maine form

- Apartment lease rental application questionnaire maine form

- Residential rental lease application maine form

- Salary verification form for potential lease maine

- Landlord agreement to allow tenant alterations to premises maine form

- Notice of default on residential lease maine form

- Landlord tenant lease co signer agreement maine form

- Application for sublease maine form

Find out other Or Fiscal Year Beginning F

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy