Application to Be a Qualified Employer TaxHow Taxhow Form

What is the Application To Be A Qualified Employer TaxHow Taxhow

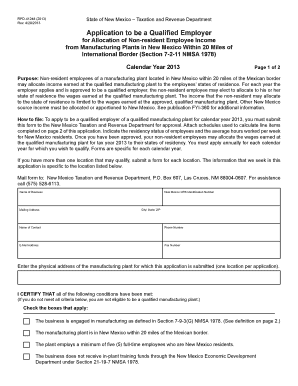

The Application To Be A Qualified Employer TaxHow Taxhow is a crucial document for businesses seeking to establish their status as qualified employers under specific tax regulations. This application is designed to help organizations navigate the complexities of tax compliance and eligibility for various tax benefits. By submitting this form, businesses can demonstrate their adherence to the necessary criteria set forth by the IRS, which can ultimately lead to significant financial advantages and incentives.

Steps to Complete the Application To Be A Qualified Employer TaxHow Taxhow

Completing the Application To Be A Qualified Employer TaxHow Taxhow involves several key steps to ensure accuracy and compliance. First, gather all the necessary information about your business, including its legal structure, tax identification number, and relevant financial details. Next, carefully fill out the application form, paying close attention to each section to avoid errors. After completing the form, review it for completeness and accuracy. Finally, submit the application through the designated method, whether online, by mail, or in person, depending on the requirements outlined by the IRS.

Eligibility Criteria

To qualify for the Application To Be A Qualified Employer TaxHow Taxhow, businesses must meet specific eligibility criteria. Generally, this includes being a registered entity within the United States, maintaining compliance with federal and state tax laws, and fulfilling any additional requirements related to the particular tax benefits being sought. It is essential for applicants to review the guidelines carefully to ensure they meet all necessary conditions before submitting their application.

Required Documents

When preparing to submit the Application To Be A Qualified Employer TaxHow Taxhow, businesses must compile a set of required documents. These typically include proof of business registration, tax identification numbers, financial statements, and any other documentation that supports the claims made in the application. Having these documents ready can streamline the application process and help avoid delays in approval.

Form Submission Methods

The Application To Be A Qualified Employer TaxHow Taxhow can be submitted through various methods, depending on the preferences of the applicant and the requirements set by the IRS. Common submission methods include online filing through the IRS website, mailing a hard copy of the application to the appropriate address, or delivering it in person at designated IRS offices. Each method has its own set of instructions and timelines, so it is crucial to choose the one that best fits your needs.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the Application To Be A Qualified Employer TaxHow Taxhow. These guidelines detail the necessary steps, eligibility criteria, and documentation required for a successful application. It is advisable for businesses to familiarize themselves with these guidelines to ensure compliance and to maximize their chances of approval. Regularly checking the IRS website for updates can also help applicants stay informed about any changes in the application process.

Penalties for Non-Compliance

Failing to comply with the regulations associated with the Application To Be A Qualified Employer TaxHow Taxhow can result in significant penalties. Businesses that do not meet the eligibility criteria or submit inaccurate information may face fines, loss of tax benefits, or other legal repercussions. Understanding these penalties emphasizes the importance of thorough preparation and adherence to all guidelines when completing the application.

Quick guide on how to complete application to be a qualified employer taxhow taxhow

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about misplaced files, exhausting form searches, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and facilitate smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application To Be A Qualified Employer TaxHow Taxhow

Create this form in 5 minutes!

People also ask

-

What is the Application To Be A Qualified Employer TaxHow Taxhow?

The Application To Be A Qualified Employer TaxHow Taxhow is a streamlined process that allows businesses to apply for employer qualification and optimize their tax-related benefits. This application ensures that businesses can take advantage of various tax incentives and credits effectively.

-

How does airSlate SignNow assist with the Application To Be A Qualified Employer TaxHow Taxhow?

airSlate SignNow provides an easy-to-use platform that simplifies the process of submitting the Application To Be A Qualified Employer TaxHow Taxhow. With features like eSignatures and document management, businesses can complete and send their applications securely and efficiently.

-

What are the benefits of using airSlate SignNow for the Application To Be A Qualified Employer TaxHow Taxhow?

Using airSlate SignNow for the Application To Be A Qualified Employer TaxHow Taxhow offers numerous benefits, including increased efficiency, reduced processing time, and improved compliance with tax regulations. Additionally, the platform's user-friendly interface enhances the overall experience.

-

Is there a cost associated with using the Application To Be A Qualified Employer TaxHow Taxhow through airSlate SignNow?

While the application process itself may not have a direct fee, using airSlate SignNow does involve subscription pricing. This investment ultimately pays off as it facilitates the Application To Be A Qualified Employer TaxHow Taxhow, streamlining your workflow and saving time.

-

What features does airSlate SignNow offer for tax applications like the Application To Be A Qualified Employer TaxHow Taxhow?

airSlate SignNow offers robust features like customizable templates, secure eSigning, document tracking, and integrated workflow automation. These features specifically cater to the needs of the Application To Be A Qualified Employer TaxHow Taxhow process, making it seamless and effective.

-

Can airSlate SignNow integrate with other software for managing the Application To Be A Qualified Employer TaxHow Taxhow?

Yes, airSlate SignNow integrates seamlessly with various CRM, project management, and accounting software. This means you can efficiently manage the Application To Be A Qualified Employer TaxHow Taxhow alongside other business operations without data silos.

-

How long does it take to complete the Application To Be A Qualified Employer TaxHow Taxhow using airSlate SignNow?

The duration to complete the Application To Be A Qualified Employer TaxHow Taxhow with airSlate SignNow varies based on document preparation and submission times. However, users often find that it signNowly reduces processing time compared to traditional methods.

Get more for Application To Be A Qualified Employer TaxHow Taxhow

- Tennessee exemption vaccination form

- Tennessee dmv vision form

- Tennessee department of safety petition for hearing form

- Annual mbe wbe affidavit city of austin austintexas form

- Scissor lift inspection form

- Fire hydrant meter for temporary water tmr form city of austin austintexas

- Tvfc eligibility form 2013

- Vendor permit application city of leander leandertx form

Find out other Application To Be A Qualified Employer TaxHow Taxhow

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate