160180200 Form

What is the NM PIT 1 Fillable Form?

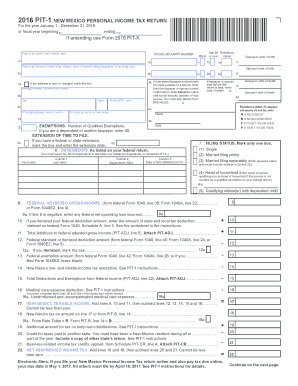

The NM PIT 1 fillable form is the New Mexico Personal Income Tax Return form, specifically designed for individuals to report their income and calculate their tax obligations. This form is essential for residents and non-residents who earn income in New Mexico. It allows taxpayers to detail their income sources, claim deductions, and determine their tax liability for the year. Utilizing a fillable version of this form facilitates easier completion and submission, enhancing accuracy and efficiency in the filing process.

Steps to Complete the NM PIT 1 Fillable Form

Completing the NM PIT 1 fillable form involves several key steps:

- Gather Required Information: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Access the Fillable Form: Obtain the NM PIT 1 fillable form from a reliable source, ensuring it is the correct version for the tax year.

- Fill Out Personal Information: Enter your name, address, Social Security number, and filing status at the top of the form.

- Report Income: Input your total income from various sources, including wages, interest, and dividends.

- Claim Deductions: Identify and enter any deductions you are eligible for, which can reduce your taxable income.

- Calculate Tax Liability: Follow the instructions to compute your total tax owed or refund due.

- Review and Submit: Double-check all entries for accuracy before submitting the form electronically or by mail.

Legal Use of the NM PIT 1 Fillable Form

The NM PIT 1 fillable form is legally binding when completed and submitted according to New Mexico state tax laws. To ensure its validity, taxpayers must adhere to the guidelines set forth by the New Mexico Taxation and Revenue Department. This includes using a secure method for electronic submission and maintaining compliance with applicable eSignature laws. The form must be signed and dated, affirming the accuracy of the information provided, which can be verified by the state if necessary.

Filing Deadlines / Important Dates

Timely submission of the NM PIT 1 fillable form is crucial to avoid penalties. The typical deadline for filing personal income tax returns in New Mexico aligns with the federal tax deadline, usually falling on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they file any necessary forms to avoid late fees.

Form Submission Methods

The NM PIT 1 fillable form can be submitted through various methods:

- Online Submission: Taxpayers can file electronically using approved e-filing services, which often streamline the process and provide immediate confirmation of receipt.

- Mail: The completed form can be printed and sent via postal mail to the designated address provided in the form instructions.

- In-Person: Individuals may also choose to deliver their completed form directly to local tax offices if they prefer face-to-face assistance.

Who Issues the NM PIT 1 Fillable Form?

The NM PIT 1 fillable form is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and collecting revenue in New Mexico. They provide the necessary forms and guidelines for taxpayers to ensure compliance with state tax regulations. It is important for individuals to use the most current version of the form to reflect any updates or changes in tax laws.

Quick guide on how to complete 160180200

Effortlessly Prepare 160180200 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Handle 160180200 on any device with airSlate SignNow Android or iOS applications and ease any document-related task today.

How to Modify and Electronically Sign 160180200 Effortlessly

- Obtain 160180200 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign 160180200 and ensure effective communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nm pit 1 fillable form?

The nm pit 1 fillable form is a document used for reporting personal income tax in New Mexico. It allows users to fill out their tax information electronically, making the submission process more efficient. With airSlate SignNow, you can easily create and manage this form, ensuring compliance with state regulations.

-

How can I create a nm pit 1 fillable form using airSlate SignNow?

Creating a nm pit 1 fillable form with airSlate SignNow is straightforward. Simply select the fillable form option, input your required tax information, and customize fields as needed. The platform's user-friendly interface ensures that even those unfamiliar with digital forms can complete their submissions with ease.

-

Is the nm pit 1 fillable form legally binding?

Yes, the nm pit 1 fillable form is legally binding when signed using airSlate SignNow. The platform utilizes secure eSignature technology, ensuring the validity and security of your submissions. This gives users peace of mind when it comes to electronic document management.

-

What are the pricing plans for airSlate SignNow related to the nm pit 1 fillable form?

airSlate SignNow offers various pricing plans tailored to different business needs. These plans include cost-effective options that accommodate the use of documents like the nm pit 1 fillable form. By exploring our pricing page, you can find the plan that suits your requirements while optimizing your document management processes.

-

Can I integrate the nm pit 1 fillable form with other tools?

Absolutely! airSlate SignNow allows seamless integrations with numerous applications and systems, including CRM and accounting software. By integrating the nm pit 1 fillable form with your existing tools, you can streamline your workflow and enhance productivity.

-

What are the benefits of using the nm pit 1 fillable form with airSlate SignNow?

Using the nm pit 1 fillable form with airSlate SignNow offers several benefits, including increased efficiency and reduced paperwork. The ability to eSign documents eliminates the need for physical signatures, saving time and resources. Additionally, you gain access to tracking and management features that ensure compliance and organization.

-

Is support available for issues related to the nm pit 1 fillable form?

Yes, airSlate SignNow provides robust customer support for users encountering issues with the nm pit 1 fillable form. Our dedicated support team is available to assist with any questions or challenges you may face during the form completion process. We aim to ensure a smooth experience for all our users.

Get more for 160180200

- Letter from landlord to tenant as notice to remove wild animals in premises nebraska form

- Ne landlord tenant form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497318056 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair nebraska form

- Letter from tenant to landlord containing notice that doors are broken and demand repair nebraska form

- Letter from tenant to landlord with demand that landlord repair broken windows nebraska form

- Letter from tenant to landlord with demand that landlord repair plumbing problem nebraska form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497318061 form

Find out other 160180200

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later