New York State Earned Income Credit New York City Earned Income Credit Form

What is the New York State Earned Income Credit New York City Earned Income Credit

The New York State Earned Income Credit (NYS EIC) and the New York City Earned Income Credit (NYC EIC) are tax credits designed to assist low- to moderate-income working individuals and families. These credits aim to reduce the tax burden and provide financial relief, encouraging employment and supporting economic stability. The NYS EIC is available to eligible taxpayers who file a New York State income tax return, while the NYC EIC is an additional credit for those residing in New York City. Both credits are based on income levels, family size, and filing status.

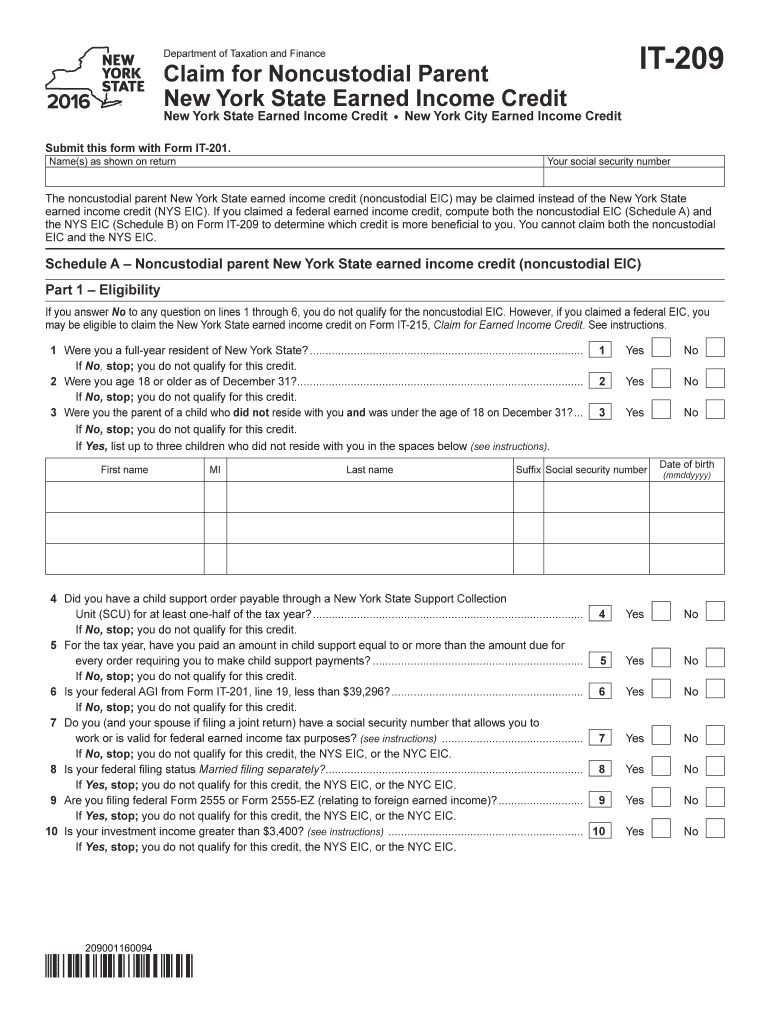

Eligibility Criteria

To qualify for the New York State Earned Income Credit and the New York City Earned Income Credit, taxpayers must meet specific eligibility requirements. Key criteria include:

- Filing status: Must file as single, married filing jointly, or head of household.

- Income limits: Must have earned income below a certain threshold, which varies based on family size.

- Age: Generally, the taxpayer must be at least 18 years old.

- Residency: Must be a resident of New York State and, for the NYC EIC, a resident of New York City.

- Qualifying children: Must have a qualifying child or meet certain criteria if filing without children.

Steps to complete the New York State Earned Income Credit New York City Earned Income Credit

Completing the New York State Earned Income Credit and New York City Earned Income Credit forms involves several steps:

- Gather necessary documents, including your W-2 forms and any other income statements.

- Determine your eligibility by reviewing the income limits and filing status requirements.

- Complete the New York State income tax return, ensuring to include the Earned Income Credit section.

- If eligible for the NYC EIC, fill out the corresponding section on the tax return.

- Review your completed tax return for accuracy before submitting.

- File your tax return electronically or by mail, ensuring to keep copies for your records.

How to obtain the New York State Earned Income Credit New York City Earned Income Credit

To obtain the New York State Earned Income Credit and New York City Earned Income Credit, taxpayers must file their annual income tax return. The credits are calculated based on the information provided in the tax return. Taxpayers can access the necessary forms through the New York State Department of Taxation and Finance website or use tax preparation software that supports these credits. It is essential to ensure that all eligibility criteria are met to receive the credits accurately.

Required Documents

When applying for the New York State Earned Income Credit and the New York City Earned Income Credit, certain documents are necessary for verification. These include:

- W-2 forms from all employers for the tax year.

- Any 1099 forms if applicable.

- Proof of residency in New York State and New York City, if claiming the NYC EIC.

- Documentation for any qualifying children, such as birth certificates or adoption papers.

Legal use of the New York State Earned Income Credit New York City Earned Income Credit

The New York State Earned Income Credit and New York City Earned Income Credit are legally binding tax credits that can significantly reduce tax liability for eligible individuals and families. To ensure legal compliance, it is crucial to accurately report income and adhere to the eligibility criteria. Misrepresentation or failure to meet the requirements can lead to penalties, including repayment of the credits received and potential fines. Taxpayers should maintain thorough records of their income and any documents related to their claims to support their eligibility.

Quick guide on how to complete new york state earned income credit new york city earned income credit

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Earned Income Credit New York City Earned Income Credit

Create this form in 5 minutes!

People also ask

-

What is the New York State Earned Income Credit New York City Earned Income Credit?

The New York State Earned Income Credit New York City Earned Income Credit is a refundable tax credit designed to provide financial relief to low- to moderate-income working individuals and families. This credit can reduce the amount of taxes owed and may result in a refund, helping eligible individuals boost their financial stability.

-

Who is eligible for the New York State Earned Income Credit New York City Earned Income Credit?

Eligibility for the New York State Earned Income Credit New York City Earned Income Credit typically requires you to have earned income below a certain threshold, a valid Social Security number, and meet specific filing status criteria. Additionally, individuals must meet family size requirements, which can vary based on the number of qualifying children.

-

How do I apply for the New York State Earned Income Credit New York City Earned Income Credit?

To apply for the New York State Earned Income Credit New York City Earned Income Credit, you must file your New York State tax return and meet the necessary eligibility criteria. By completing the appropriate tax forms and including the credit on your return, you can claim this valuable financial incentive.

-

What are the benefits of the New York State Earned Income Credit New York City Earned Income Credit?

The New York State Earned Income Credit New York City Earned Income Credit offers signNow benefits, including reducing overall tax liability and potentially providing a refund that can enhance your financial situation. This credit is designed to incentivize work and support low-income families in achieving greater economic stability.

-

Is the New York State Earned Income Credit New York City Earned Income Credit available for self-employed individuals?

Yes, the New York State Earned Income Credit New York City Earned Income Credit can be available for self-employed individuals, provided they meet the eligibility requirements. Self-employed individuals must report their earned income accurately, ensuring they comply with tax regulations to qualify.

-

How does the New York State Earned Income Credit New York City Earned Income Credit impact my tax refund?

The New York State Earned Income Credit New York City Earned Income Credit can signNowly increase your tax refund as it reduces the amount you owe to the state. If your refundable credit exceeds the taxes you owe, you will receive the difference back in your refund, which can be a substantial financial boost.

-

Can I use airSlate SignNow to eSign documents related to the New York State Earned Income Credit New York City Earned Income Credit?

Absolutely! airSlate SignNow allows users to easily eSign documents related to the New York State Earned Income Credit New York City Earned Income Credit, making the filing process straightforward and efficient. Our user-friendly platform ensures you can securely sign and manage your tax documents with ease.

Get more for New York State Earned Income Credit New York City Earned Income Credit

Find out other New York State Earned Income Credit New York City Earned Income Credit

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure