Govtax Iowa Sales Tax Exemption Certificate Energy Used in Processing Agriculture This is Not a Claim for Refund Form 2011

What is the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

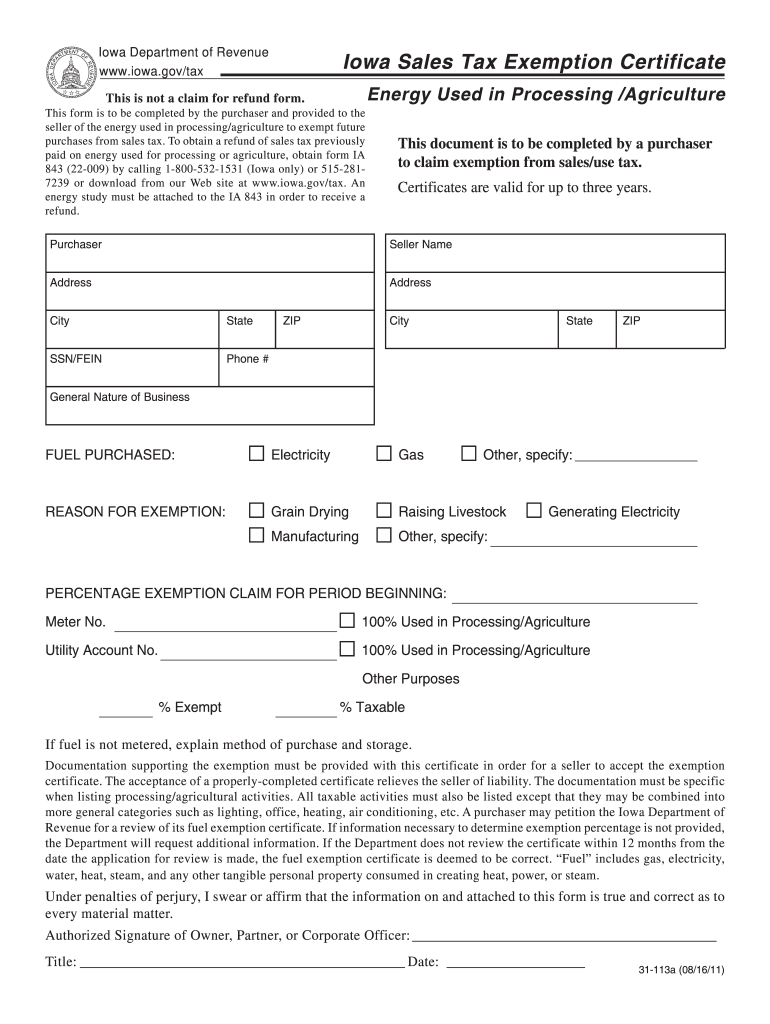

The Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form is a specific document designed for agricultural businesses in Iowa. It allows these entities to claim an exemption from sales tax on energy used in their processing activities. This form is not intended for refund claims, but rather to certify that the energy is being used directly in agricultural processing, which qualifies for tax exemption under Iowa law. Understanding the purpose of this form is crucial for compliance and accurate tax reporting.

Steps to complete the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

Completing the Govtax Iowa Sales Tax Exemption Certificate involves several key steps to ensure accuracy and compliance. Begin by gathering the necessary information, including your business name, address, and tax identification number. Next, fill in the details regarding the energy usage, specifying the type and amount of energy consumed in processing agricultural products. It is essential to review the form for completeness and accuracy before signing it. Finally, submit the form to the appropriate vendor or utility company to validate your exemption status.

Legal use of the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

The legal use of the Govtax Iowa Sales Tax Exemption Certificate is governed by Iowa state tax laws. This form must be used exclusively for energy consumed in processing activities related to agriculture. Misuse of the certificate, such as applying it for non-qualifying energy consumption, can lead to penalties or audits. It is important for businesses to maintain accurate records and ensure that the energy claimed on the certificate is directly related to agricultural processing to comply with legal requirements.

Key elements of the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

Key elements of the Govtax Iowa Sales Tax Exemption Certificate include the business identification details, the specific type of energy being exempted, and a declaration that the energy is used for agricultural processing. The form also requires the signature of an authorized representative of the business, affirming the accuracy of the information provided. Each of these components is essential for the validity of the exemption claim and must be completed thoroughly to avoid issues with tax compliance.

Eligibility Criteria

To qualify for the Govtax Iowa Sales Tax Exemption Certificate, businesses must meet specific eligibility criteria set forth by Iowa tax regulations. Primarily, the business must be engaged in agricultural processing, which includes activities such as manufacturing, processing, or packaging agricultural products. Additionally, the energy consumed must be directly related to these processing activities. Businesses must also possess a valid Iowa sales tax permit to apply for the exemption.

Form Submission Methods (Online / Mail / In-Person)

The Govtax Iowa Sales Tax Exemption Certificate can be submitted through various methods, depending on the preferences of the business and the requirements of the utility provider. Businesses may submit the completed form online through the utility company's designated portal, mail it directly to the vendor, or deliver it in person at the utility provider's office. Each submission method has its own timeline and processing protocols, so it is advisable to confirm the preferred method with the utility provider to ensure timely processing.

Quick guide on how to complete govtax iowa sales tax exemption certificate energy used in processing agriculture this is not a claim for refund form

Your assistance manual on how to prepare your Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

If you’re curious about how to finalize and send your Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form, here are a few brief guidelines on how to simplify tax processing.

To get started, you simply need to set up your airSlate SignNow account to innovate the way you manage documents online. airSlate SignNow is a very intuitive and powerful document solution that enables you to edit, create, and finalize your tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit areas to modify responses when necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form in a short time:

- Register your account and start working on PDFs almost immediately.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form in our editor.

- Complete the required fillable sections with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Please remember that submitting on paper can lead to mistakes on returns and delay refunds. Obviously, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct govtax iowa sales tax exemption certificate energy used in processing agriculture this is not a claim for refund form

Create this form in 5 minutes!

How to create an eSignature for the govtax iowa sales tax exemption certificate energy used in processing agriculture this is not a claim for refund form

How to generate an eSignature for the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form in the online mode

How to create an eSignature for your Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form in Google Chrome

How to create an electronic signature for putting it on the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form in Gmail

How to make an eSignature for the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form right from your mobile device

How to make an electronic signature for the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form on iOS

How to create an eSignature for the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form on Android devices

People also ask

-

What is the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form?

The Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form is a document that allows agricultural businesses to claim exemption from sales tax on energy used in their processing operations. This form is essential for farmers and agricultural producers to ensure compliance with Iowa tax laws while maximizing their cost savings.

-

How can airSlate SignNow help with the Govtax Iowa Sales Tax Exemption Certificate?

airSlate SignNow offers a streamlined platform to easily create, send, and eSign the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form. Our user-friendly interface simplifies the document management process, making it easier for agricultural businesses to handle their tax exemption paperwork efficiently.

-

Are there any costs associated with using airSlate SignNow for the Govtax Iowa Sales Tax Exemption Certificate?

Yes, airSlate SignNow provides a cost-effective solution for managing documents, including the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form. We offer various pricing plans to accommodate different business needs, ensuring you only pay for the features you require.

-

What features does airSlate SignNow offer for managing tax exemption certificates?

airSlate SignNow includes robust features for managing the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form, such as customizable templates, secure eSigning, and automated workflows. These features help streamline the process and reduce the risk of errors, making it easier for businesses to stay compliant.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax management software, allowing you to manage the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form alongside your existing systems. This integration helps improve efficiency and keeps all your documents organized.

-

Is it easy to share the Govtax Iowa Sales Tax Exemption Certificate with clients or vendors?

Yes, airSlate SignNow makes it simple to share the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form with clients or vendors. You can send documents via email or generate a shareable link, ensuring easy access for all parties involved.

-

What benefits does airSlate SignNow provide for agricultural businesses?

By using airSlate SignNow, agricultural businesses can benefit from enhanced efficiency when managing the Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form. Our platform ensures secure eSigning, reduces paperwork, and allows for quicker processing times, ultimately saving you time and money.

Get more for Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

- United states v reed petitionosgdepartment of justice form

- United states v woodardfindlaw form

- Criminal tax manual 2300 conspiracy to commit offense form

- 18 us code3056 powers authorities and duties of form

- 18 us code1028 fraud and related activity in form

- Counterfeit uttering 18 usc 472 form

- 18 us code473 dealing in counterfeit obligations or form

- 1462 forged endorsements charged under 18 usc 495 or form

Find out other Govtax Iowa Sales Tax Exemption Certificate Energy Used In Processing Agriculture This Is Not A Claim For Refund Form

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement