Ohio Tax Return Form

What is the Ohio Tax Return

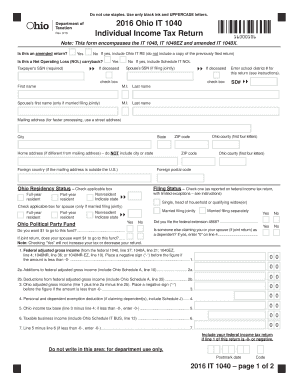

The Ohio tax return is a crucial document that residents and businesses in Ohio must complete to report their income and calculate their state income tax obligations. This return is typically filed annually and is essential for determining the amount of tax owed or the refund due. The primary form used for individual income tax is the Ohio IT 1040, which collects information about various income sources, deductions, and credits applicable to Ohio taxpayers.

Steps to Complete the Ohio Tax Return

Completing the Ohio tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms, 1099s, and any relevant receipts for deductions. Next, fill out the Ohio IT 1040 form, ensuring that all income is reported accurately. After calculating your taxable income, apply any applicable deductions and credits to determine your final tax liability. Finally, review the completed form for accuracy before submitting it.

How to Obtain the Ohio Tax Return

To obtain the Ohio tax return, individuals can visit the Ohio Department of Taxation's official website, where the Ohio IT 1040 form and its instructions are available for download. Alternatively, physical copies can often be requested from local tax offices or libraries. It is important to ensure that you are using the correct version of the form for the applicable tax year.

Legal Use of the Ohio Tax Return

The Ohio tax return serves as a legally binding document when filed correctly and on time. It is essential for taxpayers to understand that submitting false information or failing to file can result in penalties, including fines and interest on unpaid taxes. Compliance with state laws and regulations is critical to avoid legal repercussions, making it necessary to ensure that all information reported on the return is truthful and complete.

Filing Deadlines / Important Dates

Taxpayers in Ohio should be aware of key deadlines related to the filing of their state tax returns. Typically, the deadline for filing the Ohio IT 1040 is the same as the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

Ohio taxpayers have multiple options for submitting their tax returns. The Ohio IT 1040 can be filed electronically through approved e-filing software, which is a convenient and efficient method. Alternatively, taxpayers can mail a completed paper form to the appropriate address provided in the instructions. For those who prefer in-person assistance, local tax offices may offer options for filing directly with a tax professional.

Quick guide on how to complete ohio tax return

Effortlessly prepare Ohio Tax Return on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, once you can obtain the required form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Ohio Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest method to alter and electronically sign Ohio Tax Return seamlessly

- Locate Ohio Tax Return and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Ohio Tax Return and guarantee effective communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ohio state tax form and how can I access it?

The ohio state tax form is a document required for filing taxes in Ohio. You can access it through the Ohio Department of Taxation's website or via e-signature platforms like airSlate SignNow, which streamlines the process.

-

How can airSlate SignNow help with completing the ohio state tax form?

airSlate SignNow simplifies the process of completing the ohio state tax form by allowing you to fill out, sign, and send documents electronically. This solution saves time and reduces the hassle of paperwork, ensuring a more efficient filing experience.

-

Is there a cost associated with using airSlate SignNow for the ohio state tax form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. Whether you're an individual or a business preparing the ohio state tax form, you can choose a plan that suits your budget while benefiting from its features.

-

What features does airSlate SignNow offer for managing the ohio state tax form?

airSlate SignNow offers features such as electronic signatures, templates, and real-time collaboration to help you manage the ohio state tax form efficiently. This makes it easier to ensure that all necessary information is included and signatures are collected quickly.

-

How does airSlate SignNow integrate with other applications for the ohio state tax form?

airSlate SignNow integrates seamlessly with various applications, including cloud storage services and productivity tools, facilitating easy access to documents when filling out the ohio state tax form. This integration enhances your workflow and saves you time.

-

Can I track the status of my ohio state tax form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your ohio state tax form in real-time. Notifications will alert you when the document has been viewed, signed, or completed, reducing the uncertainty in your filing process.

-

What are the benefits of using airSlate SignNow for the ohio state tax form?

Using airSlate SignNow for the ohio state tax form offers numerous benefits, including ease of use, efficiency, and security. It streamlines the filing process and ensures that your documents are handled safely and promptly.

Get more for Ohio Tax Return

- Commercial rental lease application questionnaire nebraska form

- Apartment lease rental application questionnaire nebraska form

- Residential rental lease application nebraska form

- Salary verification form for potential lease nebraska

- Landlord agreement to allow tenant alterations to premises nebraska form

- Notice of default on residential lease nebraska form

- Landlord tenant lease co signer agreement nebraska form

- Application for sublease nebraska form

Find out other Ohio Tax Return

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF