Filing Status 4, Also Complete Section B Form

What is the Filing Status 4, Also Complete Section B

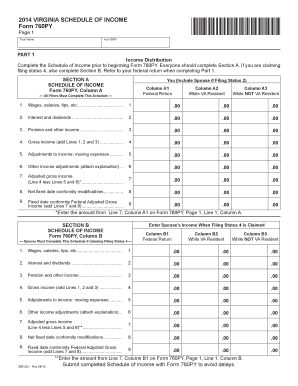

The Filing Status 4, Also Complete Section B form is a specific document used primarily for tax purposes in the United States. This form helps individuals categorize their tax filing status, which can significantly impact their tax obligations. Understanding the nuances of Filing Status 4 is essential for accurate tax reporting and compliance. This status may apply to various taxpayer scenarios, including those with dependents or specific income levels. Completing Section B is crucial, as it provides additional information required for the correct processing of the form.

Steps to complete the Filing Status 4, Also Complete Section B

Completing the Filing Status 4, Also Complete Section B form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal and financial information, including your Social Security number, income details, and any relevant deductions. Next, carefully fill out the first section of the form, ensuring that your filing status is correctly indicated. Proceed to Section B, where you will provide additional details that may affect your tax situation, such as dependent information or specific credits. Review the entire form for completeness and accuracy before submission.

Legal use of the Filing Status 4, Also Complete Section B

The Filing Status 4, Also Complete Section B form is legally binding when filled out correctly and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or audits. The form must be signed and dated to affirm its legality. Utilizing a reliable electronic signature solution can enhance the security and validity of the submission, ensuring compliance with eSignature laws such as ESIGN and UETA.

Required Documents

To complete the Filing Status 4, Also Complete Section B form, you will need several documents to provide the necessary information. These documents typically include:

- Social Security card or number for you and any dependents

- W-2 forms from employers

- 1099 forms for additional income

- Records of any tax deductions or credits

- Bank statements or financial records relevant to your income

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Filing Status 4, Also Complete Section B form is crucial for compliance. Typically, individual tax returns must be filed by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates regarding deadlines or extensions that may apply to your specific situation. Mark these dates on your calendar to avoid late submissions and potential penalties.

Examples of using the Filing Status 4, Also Complete Section B

Using the Filing Status 4, Also Complete Section B form can vary based on individual circumstances. For example, a single parent with one dependent may find that this filing status provides them with beneficial tax credits. Alternatively, a married couple filing jointly may also utilize this form to optimize their tax situation. Each scenario will require careful consideration of income levels and applicable deductions, making it essential to assess your specific situation when completing the form.

Quick guide on how to complete filing status 4 also complete section b

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Filing Status 4, Also Complete Section B

Create this form in 5 minutes!

People also ask

-

What is Filing Status 4, Also Complete Section B?

Filing Status 4, Also Complete Section B is a specific classification used for tax purposes that can impact your document processing. Utilizing airSlate SignNow, businesses can easily manage and file their documents by selecting the appropriate filing status. This feature ensures that all required sections, including Section B, are completed accurately and efficiently.

-

How does airSlate SignNow help with Filing Status 4, Also Complete Section B?

airSlate SignNow simplifies the process of completing documents by allowing users to mark Filing Status 4 and fill out Section B effortlessly. Our platform is designed to streamline document workflows, reducing errors and saving time. This means businesses can focus on their core activities instead of getting bogged down in paperwork.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our pricing is transparent, with options based on the number of users and features required, including tools to manage Filing Status 4, Also Complete Section B effectively. You can choose a plan that suits your budget and business needs.

-

What features does airSlate SignNow include for document management?

airSlate SignNow comes packed with essential features for document management, including eSigning, document routing, and templates. Specifically, our tools support Filing Status 4, Also Complete Section B, making it easier to handle tax-related documents. You can also collaborate with team members in real-time to ensure accuracy.

-

Is airSlate SignNow compliant with legal regulations?

Yes, airSlate SignNow is fully compliant with legal regulations such as ESIGN and UETA. This ensures that your documents, including those related to Filing Status 4, Also Complete Section B, are accepted by courts and government agencies. You can feel confident that your eSigned documents hold legal weight.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow supports a wide range of integrations with popular software like Google Drive, Salesforce, and many more. This flexibility allows you to streamline your workflows, especially when dealing with Filing Status 4, Also Complete Section B and related tasks across multiple platforms.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow offers numerous benefits, including time savings, increased accuracy, and improved collaboration among team members. By simplifying processes like Filing Status 4, Also Complete Section B, your business can enhance efficiency and boost productivity. Ultimately, this allows you to focus on growth and strategy rather than paperwork.

Get more for Filing Status 4, Also Complete Section B

- Terms of use penn vet form

- 241 erie street room 311 jersey city nj 07310 form

- Curriculum corner split pdf form

- Ca 12 2019 pdf remplissable form

- Asnt level 3 application form 2018

- Profit participation agreement template innet form

- Equipment request form coleysolutionscom

- Coe dat participant application form 2018 nato

Find out other Filing Status 4, Also Complete Section B

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template