Form 760PY

What is the Form 760PY

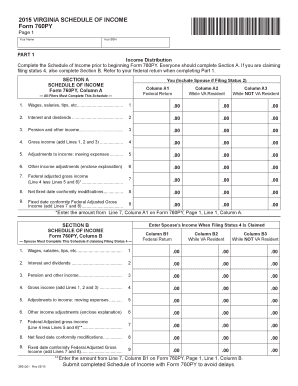

The Form 760PY is a tax document used by residents of Virginia to report their income and calculate their state taxes. This form is specifically designed for part-year residents, allowing them to account for income earned while living in Virginia as well as any income earned while residing in another state. It is essential for ensuring compliance with state tax laws and for determining the correct amount of tax owed or refund due.

How to use the Form 760PY

Using the Form 760PY involves several steps to accurately report your income and deductions. Begin by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, you will need to fill out the form by entering your personal information, including your name, address, and Social Security number. Follow the instructions to report your income, deductions, and credits. Finally, calculate your tax liability and determine if you owe taxes or are due a refund.

Steps to complete the Form 760PY

Completing the Form 760PY requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, such as income statements and deduction records.

- Fill in your personal information accurately at the top of the form.

- Report your total income from all sources, including income earned in and out of Virginia.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Review your completed form for accuracy before submission.

Legal use of the Form 760PY

The legal use of the Form 760PY is governed by Virginia state tax laws. To ensure compliance, it is crucial to follow all instructions and guidelines provided by the Virginia Department of Taxation. The form must be accurately completed and submitted by the designated filing deadline to avoid penalties. Additionally, using a secure and compliant method for eSigning and submitting the form will help maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form 760PY are critical for avoiding penalties. Typically, the form must be submitted by May 1 for the previous tax year. If May 1 falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing.

Required Documents

To complete the Form 760PY, you will need several important documents, including:

- W-2 forms from employers for income earned.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as mortgage interest statements or property tax records.

Form Submission Methods (Online / Mail / In-Person)

The Form 760PY can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the Virginia Department of Taxation's e-filing system, which is often the fastest option. Alternatively, the form can be printed and mailed to the appropriate address provided in the instructions. In-person submissions are also accepted at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete form 760py

Effortlessly Complete [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 760PY

Create this form in 5 minutes!

People also ask

-

What is Form 760PY and why is it important for businesses?

Form 760PY is the part-year resident income tax return form used in Virginia. It is crucial for businesses and individuals who have moved in or out of Virginia during the tax year, ensuring compliance with state tax laws. By using airSlate SignNow to manage Form 760PY, businesses can streamline the signing process and reduce errors.

-

How does airSlate SignNow simplify the process of filling out Form 760PY?

airSlate SignNow provides an intuitive platform that allows users to easily input their information and access templates specifically designed for Form 760PY. This simplifies the preparation process, ensuring that all necessary fields are accurately completed. The platform also allows users to securely eSign the document, saving time and effort.

-

What are the pricing options for using airSlate SignNow for Form 760PY?

airSlate SignNow offers a variety of pricing plans that cater to different business needs when handling Form 760PY. Plans are designed to be cost-effective, making it accessible for both small businesses and large enterprises. Prospective customers can choose a plan that fits their budget while taking advantage of robust features.

-

Can I integrate airSlate SignNow with other tools for managing Form 760PY?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow when handling Form 760PY. Whether it's linking to accounting software or document management systems, these integrations help centralize document handling and reduce manual input, promoting efficiency.

-

What security features does airSlate SignNow offer for Form 760PY documents?

airSlate SignNow prioritizes the security of your documents, including Form 760PY, by employing robust encryption and secure access protocols. This ensures that sensitive information remains protected during transmission and storage, giving users peace of mind when sending and signing documents.

-

How can I share Form 760PY with clients or teammates using airSlate SignNow?

Sharing your Form 760PY with clients or teammates is straightforward with airSlate SignNow. You can easily send documents via email or share them through secure links, allowing stakeholders to access and eSign the form quickly. The platform tracks all activity, so you can monitor the status of the document.

-

What are the benefits of eSigning Form 760PY with airSlate SignNow?

eSigning Form 760PY with airSlate SignNow enhances efficiency by eliminating the need for printing, scanning, or mailing documents. This not only saves time but also reduces costs associated with traditional signing methods. Additionally, the legal validity of eSignatures ensures compliance with regulations.

Get more for Form 760PY

Find out other Form 760PY

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document