FR 127 Extension of Time to File Otr Cfo Dc Form

What is the FR 127 Extension Of Time To File Otr Cfo Dc

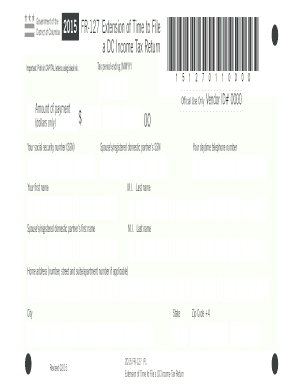

The FR 127 Extension Of Time To File Otr Cfo Dc is a formal request submitted to the Office of Tax and Revenue in Washington, D.C. This form allows taxpayers to request additional time to file their tax returns. It is particularly useful for individuals or businesses who may need extra time to gather necessary documentation or complete their tax filings accurately. By submitting this form, taxpayers can avoid penalties associated with late filings while ensuring compliance with local tax regulations.

How to use the FR 127 Extension Of Time To File Otr Cfo Dc

Using the FR 127 Extension Of Time To File Otr Cfo Dc involves a straightforward process. Taxpayers must fill out the form with accurate information, including their name, address, and tax identification number. It is essential to indicate the specific tax year for which the extension is being requested. Once completed, the form can be submitted electronically or via mail. Utilizing a digital platform can streamline this process, making it easier to track submissions and maintain records.

Steps to complete the FR 127 Extension Of Time To File Otr Cfo Dc

Completing the FR 127 Extension Of Time To File Otr Cfo Dc requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal and tax details.

- Access the FR 127 form through the Office of Tax and Revenue website or a trusted digital platform.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically or print it for mailing.

Legal use of the FR 127 Extension Of Time To File Otr Cfo Dc

The legal use of the FR 127 Extension Of Time To File Otr Cfo Dc is governed by local tax laws. This form is recognized as a valid request for an extension, provided it is submitted before the original filing deadline. Compliance with all requirements outlined in the form is crucial to ensure its acceptance by the Office of Tax and Revenue. Failure to adhere to these regulations may result in penalties or denial of the extension.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential for taxpayers requesting an extension using the FR 127. Typically, the extension must be filed before the original due date of the tax return. For most taxpayers, this date falls on April fifteenth. It is important to note that while the extension allows for additional time to file, it does not extend the deadline for any tax payments that may be due. Keeping track of these dates helps avoid unnecessary penalties.

Required Documents

When completing the FR 127 Extension Of Time To File Otr Cfo Dc, certain documents may be required. Taxpayers should have their previous year’s tax return, any relevant income statements, and supporting documentation for deductions or credits they plan to claim. Having these documents on hand will facilitate accurate completion of the form and ensure that all necessary information is provided.

Eligibility Criteria

Eligibility for the FR 127 Extension Of Time To File Otr Cfo Dc generally includes individuals and businesses who are required to file a tax return in Washington, D.C. There are no specific income limitations or restrictions based on filing status. However, it is important that the request for an extension is made in good faith and not solely to delay tax obligations.

Quick guide on how to complete 2015 fr 127 extension of time to file otr cfo dc

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular with companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] from any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FR 127 Extension Of Time To File Otr Cfo Dc

Create this form in 5 minutes!

People also ask

-

What is the FR 127 Extension Of Time To File Otr Cfo Dc?

The FR 127 Extension Of Time To File Otr Cfo Dc is a form that allows individuals and businesses in Washington, D.C. to request an extension for filing their tax returns. It ensures that you can avoid penalties by securing additional time for submitting your forms. This form is vital for taxpayers who need extra time but want to stay compliant.

-

How can airSlate SignNow help with the FR 127 Extension Of Time To File Otr Cfo Dc?

airSlate SignNow simplifies the process of submitting the FR 127 Extension Of Time To File Otr Cfo Dc by allowing users to eSign and send documents securely. Our platform automates your workflow and ensures that you meet deadlines without hassle. You can easily track the status of your extensions and manage documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the FR 127 Extension Of Time To File Otr Cfo Dc?

Yes, using airSlate SignNow does involve a subscription fee, but our pricing is designed to be cost-effective for businesses of all sizes. You can choose from various plans based on your usage requirements. Each plan provides access to essential features, making it a worthwhile investment for managing your tax documentation.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow offers numerous features for managing your tax forms, including eSigning, document templates, and secure cloud storage. These functionalities ensure that you can prepare and submit your FR 127 Extension Of Time To File Otr Cfo Dc seamlessly. Additionally, our platform provides reminders and alerts for upcoming deadlines, helping you stay organized.

-

Can I integrate airSlate SignNow with other applications for filing the FR 127 Extension Of Time To File Otr Cfo Dc?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow. This includes CRM software, accounting tools, and cloud storage services. Such integrations enable you to manage your documents and extensions more efficiently, ensuring your FR 127 Extension Of Time To File Otr Cfo Dc is processed smoothly.

-

How do I get started with airSlate SignNow for the FR 127 Extension Of Time To File Otr Cfo Dc?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, choose the right subscription plan, and begin exploring our features. You can access templates for the FR 127 Extension Of Time To File Otr Cfo Dc right away and start sending documents for eSignatures.

-

What benefits does eSigning provide for the FR 127 Extension Of Time To File Otr Cfo Dc?

eSigning the FR 127 Extension Of Time To File Otr Cfo Dc offers several advantages, including time savings, enhanced security, and legal validity. With airSlate SignNow, your documents are signed quickly and can be securely stored online. This digital approach reduces the risk of lost documents and ensures compliance with tax regulations.

Get more for FR 127 Extension Of Time To File Otr Cfo Dc

Find out other FR 127 Extension Of Time To File Otr Cfo Dc

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will