Kyc Form

What is the KYC Form

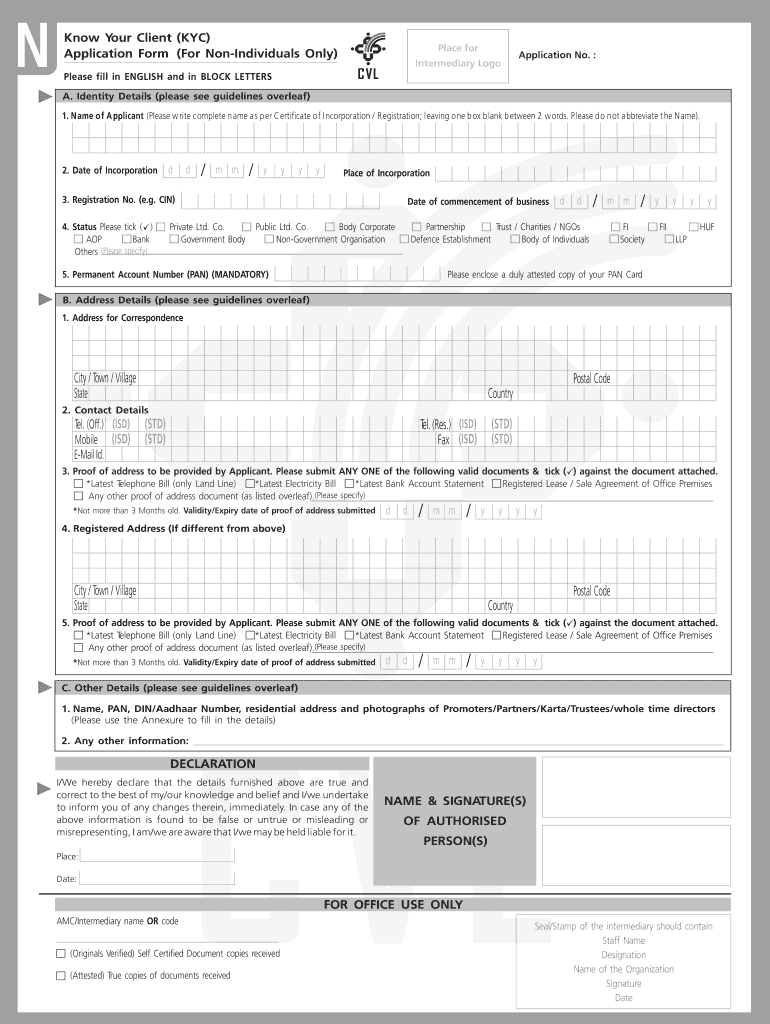

The KYC form, or Know Your Customer form, is a crucial document used by businesses to verify the identity of their clients. This form is essential for compliance with regulations aimed at preventing fraud, money laundering, and other illicit activities. By collecting personal information, such as name, address, and identification numbers, businesses can ensure they are engaging with legitimate customers. The KYC process helps maintain the integrity of financial systems and protects both businesses and consumers.

Steps to Complete the KYC Form

Completing the KYC form involves several straightforward steps. First, gather the required documents, which typically include a government-issued ID, proof of address, and any relevant financial information. Next, fill out the form accurately, ensuring all details match the documents provided. After completing the form, review it for any errors or omissions. Finally, submit the form through the designated method, which may include online submission or mailing it to the appropriate department. It is important to keep a copy of the completed form for your records.

Legal Use of the KYC Form

The legal use of the KYC form is governed by various regulations designed to protect against financial crimes. In the United States, laws such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act mandate financial institutions to implement KYC procedures. These regulations require businesses to verify the identity of their customers and maintain records of the information collected. Compliance with these laws not only helps prevent illegal activities but also fosters trust between businesses and their clients.

Required Documents

When filling out the KYC form, specific documents are typically required to verify identity and address. Commonly requested documents include:

- A government-issued photo ID (e.g., passport, driver's license)

- Proof of address (e.g., utility bill, bank statement)

- Social Security number or taxpayer identification number

Having these documents ready can streamline the process and ensure compliance with KYC requirements.

Form Submission Methods

Submitting the KYC form can be done through various methods, depending on the institution's requirements. Common submission methods include:

- Online submission via a secure portal

- Mailing a physical copy to the designated address

- In-person submission at a branch location

It is essential to follow the specific submission guidelines provided by the institution to ensure timely processing of the KYC form.

Examples of Using the KYC Form

The KYC form is utilized across various sectors, particularly in finance and banking. For instance, when opening a new bank account, customers are often required to complete a KYC form to verify their identity. Similarly, investment firms may request a KYC form from clients before allowing them to trade securities. These examples highlight the importance of KYC in maintaining regulatory compliance and fostering secure business relationships.

Quick guide on how to complete kyc form

Learn how to effortlessly navigate the Kyc Form completion with this simple guide

Electronic filing and completing documents online is becoming more popular and the preferred option for a diverse range of clients. It offers numerous advantages over traditional printed forms, such as ease of use, time savings, enhanced accuracy, and security.

With platforms like airSlate SignNow, you can locate, modify, validate, enhance, and dispatch your Kyc Form without being hindered by endless printing and scanning tasks. Follow this brief guide to begin and complete your form.

Follow these steps to obtain and complete Kyc Form

- Start by clicking the Get Form button to access your document in our editor.

- Pay attention to the green indicator on the left that highlights required fields to ensure you don’t forget them.

- Utilize our professional tools to comment, adjust, sign, secure, and enhance your document.

- Protect your file or convert it into a fillable format using the appropriate tab tools.

- Review the document and look for mistakes or inconsistencies.

- Click on DONE to finalize your edits.

- Rename your form or keep it as is.

- Select the preferred storage option for your document, send it via USPS, or click the Download Now button to save your document.

If Kyc Form isn’t what you needed, feel free to explore our extensive library of pre-uploaded templates that you can complete with minimal information. Try our service today!

Create this form in 5 minutes or less

FAQs

-

How can I fill out a KYC form online for SBI?

Fill out ? If you want to update your kyc, you can just write up a formal letter with your cif/ac details and attach photo copies of the proofs, self attested by you and send them by post to your home branch or you can do it yourself, if you have online banking facility.

-

What are the benefits of upgrading Paytm and filling out the KYC form?

You can open savings account in Paytm Payment Bank by upgrading it and submitting KYC documents. Read more about Paytm Payment Bank and its features.

-

Do I need to send a physical copy of the application form for a PAN card if I had filled it out online on NSDL using e-Sign/e-KYC?

Refer the following link for detail process for online pan application.How to apply for PAN card

-

How can I complete my KYC for a mutual fund in India?

To become KYC compliant for Mutual Funds, you need to fill out the KYC form and submit it to a KYC registration center along with copies of your Identity and address proof.You can download and print out the KYC form from here:CDSL Ventures Limited, IndiaYou can get a list of registration centers from the Moneycontrol website at the following link:List of Point of ServicesAlternatively, if you want to invest in Mutual Funds through the online route, you can register with http://www.fundsindia.com. They will help you with the KYC process as well.

-

How can I buy Tesla shares from India?

Apple, Microsoft, Amazon, Facebook. We all have grown up using these companies’ products/services. Obviously everyone’s interested in stock market would like to invest there too.But wait, since they won’t be listed on Indian stock exchange, how to do it?There are basically 3 ways you can invest in Tesla,Open an account with Indian Brokerage firm who has a tie-up with foreign broker. Like ICICIdirect, HDFC sec, Reliance Money etc.. They provides the service where you can open your overseas trading account with their foreign brokerage partner.Open account with foreign brokers. Some international brokers are out there who permits Indian citizen to open account and trade in US market like Interactive Brokers, TD Ameritrade, Charles Schwab International Account.Buy Indian MF(Mutual Fund)/ETF(Exchange Traded fund) with global equities. Mutual Fund basically invests in stock market, Government bonds and other securities. There are few firms which invest in international market. You can invest indirectly there but you will never know if your money went in Tesla or not. But this is probably safest option I know because you will not have to open Overseas trading account plus you will save the minimum deposit roughly $10,000. Here are few popular mutual funds who trade in global market, ICICI Pru US Bluechip Equity – D (G), Motilal MOSt Oswal NASDAQ 100 ETF, Reliance US Equity Opp. Fund DP (G), Edelweiss Greater China Eqty-Direct andKotak US Equity Fund – Direct (G).Now that you know the ways to invest, here are some food for thoughts.The reason why people invest in foreign stock exchanges.People want to invest in their favorite companies, of course Elon Musk/Steve Job are everyone’s idol. We all believe in them, their vision. Also Google, Amazon, Twitter, Facebook are darlings of this generation.Diversification - Investing in foreign companies helps in diversification. Investing in foreign companies mitigate the risk when Indian market gets crash.Bigger Opportunities - The point is there are thousands of better companies out there. There is no boundary anymore.Investors believe that foreign companies have better resources, facility, government cooperation. That makes them high rated.Some Critical Points to know before you invest in TeslaUp to $2,50,000 can be invested overseas by Indian resident as per RBI. That is roughly 1.7 crores. That’s enough, right?High Charges - Here you will be transecting in foreign money. You will be paying brokerage charges in their currency that is USD (1 USD~68.5 INR). So, will the AMC(annual Maintenance charges).Profit are subjected to currency exchange rate - Price of INR against USD will constantly change, so suppose you invested when it was 1$=₹68 , so when you sell the stock maybe the price changes to 1$=₹60. In such case you already lost 11.7%. That’s why when you invest in foreign stocks, profits are always subjected to the currency exchange rate.To know more about such topics please visit, Blog - Trade Brainsor Join Pundits of Stock market at Indian Stock Market Tribe- TRADE BRAINS.

-

How do I invest Rs.1000 a month in the Birla Sun Life Top 100 Fund SIP?

It is great that you have decided to invest through SIPs for the period of 20 years. It is an investment period that will yield you substantial long term capital gains. To start investments in Mutual Funds two things are mandatory:1. Bank account in any nationalised bank. Both public and private2. Filling out a Know Your Customer or KYC form which is a one time procedure before starting investments.How to get Mutual Funds done?1. Nationalized banks, both public and private, sell Mutual Funds as they act as distribution house for the Asset Management Companies. 2. You can invest through online investment platforms such as Myuniverse, Zipsip, ICICI Direct.3. You can get in touch with a distribution house who will help you with the investments.4. You can get in touch with a financial advisor. Both the options are easily available in Kolkata. 5. You can invest directly. Open a bank account first. Fill out a KYC form online here Mutual Funds portfolio, Forms and fact Sheets. In the investment form fill "DIRECT" as the broker code and submit it in the respective AMC office.Hope this helps!Priyanka Chakrabartywww.advisorkhoj.com

-

How do I write a letter for registering my PAN Card in my SBI bank account?

Do you really need to write a letter? These facilities are available on netbanking and phonebanking. The Bank will ask you for PAN updation, while opening an account, or a re-KYC done later.If you have to, the following basic format will suffice, along with a self-attested copy of the PAN card. Show the original for verification.The details such as full name, date of birth and photograph should match with those provided in the account-opening form. Banks perform online checks to confirm authenticity of PAN.

To,The Branch Manager——————-.SUB : Updation of PAN numberDear Sir/Madam,Please update the following PAN details in my account number …………………., with you. .Thanks and regards,Truly yours,…… -

How much time does it take for activation of Jio SIM?

I Would Suggest to Visit Reliance Digital Xpress Mini Store to Buy a JIO Sim Instead of a Retailer. Because they can Issue you a Reliance Jio Sim almost Instantly & The Best Part is you Don’t Even Need a Single Document Submission. Just a Bio-metric Test. That’s it.And It’s Not the All. You Don’t even need to Worry about the Activation Process also as you SIM will Get Activated in Less than 1 Day. Yes, That’t True. Please Refer my Below Post to Get More Updates on this Topic.I'm Here with a New Update about Reliance JIO Preview Offer. Here's the Process on How to Activate JIO Sim Cards Provided by Reliance in a Step-by-Step Manner.The SIMs will only work on the Device from which you Generated the Bar Code. So the First thing is Don't Buy or Purchase Bar Codes or Generate Fake Bar Codes by changing IMEI from Anyone. It won't Work. Use your own Device to Generate Bar Code and then Try your Luck on Reliance Digital Stores. Don't Worry. It's Legal as you got the Bar Code from your Device only.Install all JIO Apps Beforehand using WIFI or Mobile Data. Specially JioJoin App.After you Grab SIM, wait for the SMS: "Your Phone is Ready for Tele-Verification." Normally it will Come by at best 48 hours. Sometimes it took 2 hrs only. Always put SIM in Slot 1. Turn Internet On in Slot 1.Open JioJoin App. Accept Permissions. It will Automatically Verify your SIM. (Make Sure JIO Mobile Data is On)Now Call 1977 using JioJoin App with Mobile Data On. This is VoLTE Calling. Calling with Internet Data. Your Default Dialer Won't work.Tele-verify your Sim. You will Get Internet Settings via SMS and Some Subscription Plan SMS within 5 Minutes.All Done. Test your Internet by Downloading and Calling. (Yes, all Calls you do will be VoLTE Calls, and it needs Internet). You don't need Internet to Receive Calls however.Now Open MyJio App. Click Skip. It will Log you via Mobile No. Now you can see you got 2 GB Data and 100 Minute Call. Don't Worry you will Get Unlimited after you Consume them.Sim will NOT WORK on Non 4G Devices. You must Need 4G Device which may or may not Support Volte. If it Supports, then Better, you will Get Better Calling Experience. Even if it doesn't support VoLTE, Don't Worry, JioJoin will work Normally.To Know about the Reliance Jio Recharge Plans & Tariff, You Could also Refer my Blog for All Latest Recharge Tricks & Tips.

-

How will money transferring between countries look in five years?

This is an excellent question and there are many companies who believe they are shaping this answer (predominantly, SWIFT, Visa, Mastercard, WesternUnion, PayPal, and a whole lot of mobile companies).Very important note to the above, is an external player like say Facebook that can be a huge disruption in the money space, should it enter with a cunning plan, that is pragmatic, worldwide and affordable.Though it is very difficult to predict how the payment system will shape out in 5 years, especially between countries, it will most likely have the following touch points incorporated into it [I do want to stress, this is strictly IMHO - feel free to differ]:TRANSACTION & SETTLEMENT TIMES: The biggest change you would see is the ability to make the end-to-end transaction as near to real-time as possible for the two parties between which money is being remitted. The second factor is the near real-time settlement between the two financial institutions that were doing the remittance (i.e. Sender's Bank and Beneficiary's Bank).ANTI-MONEY LAUNDERING: Money laundering would be more difficult (as more correlated reporting and systems integration of various financial institutions will make it so)KNOW YOUR CUSTOMER: The KYC would be inherently more advance. By more advance, I imply that the KYC system would be able to tap into periphery system to verify what as already been submitted. Eg: A credit card KYC may query your bank account for address verification / name match.MOBILE: Money would be more mobile than it is today, and you guessed it - it would reside in/on your phone. Your phone would be in some crude sense a financial instrument. Expect to see a sharp rise in QR Codes. No more lengthy forms to fill out for money transfer/payments.SUSPICIOUS ACTIVITY REPORTING: SAR checks are currently performed in the US and in different countries (under various different nomenclature / taxonomy). To nib the money laundering bud, and to better have a more accurate visibility on suspicious transactions, it is my belief that SAR checks (albeit performed) would most likely also be cross-referenced across the border.FINANCIAL ROUTERS/ROUTING: More companies will prop up providing financial routing services. Take money from your PayPal and credit it to your ATM card. Take money from ATM card to credit to your Visa card, Take money from your Bank and credit the money to Micro-Wallet payment company. For example, if you want to transfer money from your Prepaid VISA card to PayPal (and they are not connected), you will be able to do so. Or if you are travelling overseas and you buy a Deutsche Telekom SIM card (that does payments as well) and you want to transfer $50 to it from your Bank, you will be able to do so.MONEY EXCHANGE COMPANIES: You traditional money exchange companies with walk-in customers will eventually consolidate and business for walk-in clients will diminish drastically.INTERNATIONAL PAYMENTS (CROSS-BORDER): International payments would become much more easier (as KYC, AML check would be a whole lot better). The Person-to-Person element would become more common and speedier, economical and reliable.EXCHANGE RATE: You would get a whole lot more competitive exchange rate on your international transactions (I believe less than 1% exchange parity between Internbank and Open-Market rate).MICRO-PAYMENTS: Yes, the world will finally have a micropayment setup. One that allows micro-payments in multiple currencies.VIRTUAL CURRENCIES / CREDITS: More and more companies will start to offer exchange and settlement of virtual currencies and credits that may be specific to a social network, gaming network, etc. Even Bitcoins. This could also be part and parcel of the Financial Routers.

Create this form in 5 minutes!

How to create an eSignature for the kyc form

How to create an electronic signature for the Kyc Form online

How to make an eSignature for the Kyc Form in Google Chrome

How to create an electronic signature for putting it on the Kyc Form in Gmail

How to make an eSignature for the Kyc Form right from your mobile device

How to generate an electronic signature for the Kyc Form on iOS devices

How to create an eSignature for the Kyc Form on Android devices

People also ask

-

What is a KYC Form and why is it important?

A KYC Form, or Know Your Customer Form, is a crucial document used by businesses to verify the identity of their clients. This form helps in preventing fraud and ensuring compliance with legal regulations. By using a KYC Form, businesses can build trust with their customers and create a secure environment for transactions.

-

How does airSlate SignNow simplify the KYC Form process?

airSlate SignNow streamlines the KYC Form process by allowing businesses to easily create, send, and eSign documents online. The platform's user-friendly interface makes it simple to manage multiple KYC Forms, ensuring a smooth experience for both the sender and receiver. Additionally, the electronic signature feature speeds up the approval process, making it more efficient.

-

Is there a free trial for using airSlate SignNow's KYC Form features?

Yes, airSlate SignNow offers a free trial that allows users to explore its KYC Form capabilities without any commitment. During the trial, you can experience how easy it is to create and manage KYC Forms, and test the platform's eSigning functionality. This trial helps businesses understand the benefits before making a financial commitment.

-

What are the pricing plans for airSlate SignNow's KYC Form services?

airSlate SignNow provides flexible pricing plans tailored to fit various business needs. Pricing typically depends on the number of users and the features required for managing KYC Forms. You can choose from monthly or annual subscriptions, with options for businesses of all sizes.

-

Can airSlate SignNow integrate with other software for KYC Forms?

Absolutely! airSlate SignNow offers integrations with various software platforms, enhancing the functionality of your KYC Forms. You can connect it with CRM systems, payment processors, and other tools to streamline your document management process and improve workflow efficiency.

-

What security measures does airSlate SignNow implement for KYC Forms?

airSlate SignNow prioritizes security for all documents, including KYC Forms, by utilizing encryption and secure storage practices. The platform complies with industry standards to protect sensitive customer information from unauthorized access. This ensures that your KYC Forms and the data they contain remain safe and secure.

-

How can I track the status of my KYC Forms in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your KYC Forms in real time. The platform provides notifications and updates on when a form is sent, viewed, and signed. This tracking feature allows businesses to manage their KYC processes more effectively and stay informed about document statuses.

Get more for Kyc Form

- A roadmap to accounting for income taxes deloitte form

- Ampquotadditional rentampquot and a tenants ampquotproportionate shareampquot form

- Tax desk book associate of corporate counsel form

- Example 6 provision defining the taxable components falling into form

- Amendment no 1 to form n 2

- Example 1 clause assuring utilization of a broad range of common form

- General code of ordinances for marathon county chapter 17 form

- Ex 105 form

Find out other Kyc Form

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed