Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup Form

What is the Supplemental Schedule CT 1040WH?

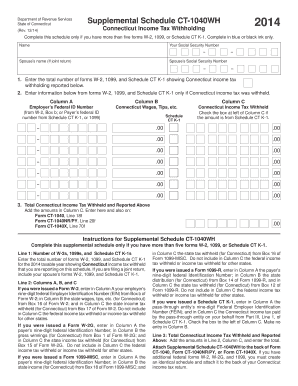

The Supplemental Schedule CT 1040WH is a form used by residents of Connecticut to report income tax withholding. This schedule is an essential part of the Connecticut income tax filing process, allowing taxpayers to detail their withholding amounts from various sources of income. It is particularly relevant for individuals who receive income from multiple employers or sources, as it helps ensure accurate tax calculations and compliance with state tax laws.

How to use the Supplemental Schedule CT 1040WH

To effectively use the Supplemental Schedule CT 1040WH, taxpayers should first gather all necessary documentation related to their income and withholding amounts. This includes W-2 forms from employers and any 1099 forms for additional income. Once the relevant information is collected, the taxpayer can fill out the schedule by entering the total withholding amounts for each income source. This information will then be combined with the main tax return to determine the overall tax liability or refund.

Steps to complete the Supplemental Schedule CT 1040WH

Completing the Supplemental Schedule CT 1040WH involves several key steps:

- Gather all relevant income documents, including W-2 and 1099 forms.

- Enter your personal information at the top of the schedule.

- List each source of income along with the corresponding withholding amounts.

- Review the totals to ensure accuracy.

- Attach the completed schedule to your Connecticut income tax return.

Legal use of the Supplemental Schedule CT 1040WH

The Supplemental Schedule CT 1040WH must be completed and submitted in accordance with Connecticut tax laws to be considered legally valid. This means that all information provided must be accurate and reflect the actual withholding amounts. Failure to comply with these requirements can lead to penalties or audits by the Connecticut Department of Revenue Services.

Key elements of the Supplemental Schedule CT 1040WH

Important elements of the Supplemental Schedule CT 1040WH include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Sources: Detailed listing of all income sources and corresponding withholding amounts.

- Total Withholding: A summary of total withholding that will be reported on the main tax return.

Filing Deadlines for the Supplemental Schedule CT 1040WH

Taxpayers must submit the Supplemental Schedule CT 1040WH by the same deadline as their Connecticut income tax return. Typically, this deadline is April 15 for most taxpayers. It is essential to ensure that the schedule is filed on time to avoid any late fees or penalties associated with late tax submissions.

Quick guide on how to complete supplemental schedule ct 1040wh 2014 connecticut income tax withholding supplemental schedule 2014 connecticut income tax

Accomplish Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup effortlessly on any gadget

Digital document management has gained immense traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly without delays. Handle Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest method to modify and eSign Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup without hassle

- Obtain Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your adjustments.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management within a few clicks from any device of your choice. Modify and eSign Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Supplemental Schedule CT 1040WH and how do I use it?

The Supplemental Schedule CT 1040WH is a form used by Connecticut taxpayers to report income tax withholding. To use it, taxpayers fill out the schedule based on their income and withholding amounts, then submit it with their Connecticut income tax return. This ensures that your tax withholding is reported accurately, simplifying the filing process.

-

How does airSlate SignNow assist with the Supplemental Schedule CT 1040WH?

airSlate SignNow allows users to easily eSign and send documents, including the Supplemental Schedule CT 1040WH. Our user-friendly platform streamlines the process, ensuring timely submission of your Connecticut Income Tax Withholding Supplemental Schedule, and enhances collaboration with tax professionals.

-

What features does airSlate SignNow offer for tax document handling?

airSlate SignNow provides features like eSigning, document templates, secure storage, and real-time tracking. These features help ensure that your Supplemental Schedule CT 1040WH and other vital tax documents are handled efficiently and securely, making tax season hassle-free.

-

Is there a cost associated with using airSlate SignNow for my Supplemental Schedule CT 1040WH?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The benefits of using our platform, such as time saved and reduced paperwork, often outweigh the costs, especially when managing documents like the Connecticut Income Tax Withholding Supplemental Schedule.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow offers various integrations with popular accounting and tax software. This means you can easily import or export information related to the Supplemental Schedule CT 1040WH, making it a seamless part of your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for my Connecticut Income Tax Withholding Supplemental Schedule?

Using airSlate SignNow to manage your Connecticut Income Tax Withholding Supplemental Schedule streamlines the eSigning and submission process. It provides you with a secure and efficient way to handle your tax documents, ensuring you meet deadlines and reduce errors.

-

How can I ensure the security of my Supplemental Schedule CT 1040WH with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, utilizing encryption and secure storage options. When you eSign your Supplemental Schedule CT 1040WH, you can trust that your sensitive information is protected throughout the process.

Get more for Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup

- Company employment policies and procedures package new hampshire form

- New hampshire attorney form

- Newly divorced individuals package new hampshire form

- Contractors forms package new hampshire

- Power of attorney for sale of motor vehicle new hampshire form

- Wedding planning or consultant package new hampshire form

- Hunting forms package new hampshire

- Identity theft recovery package new hampshire form

Find out other Supplemental Schedule CT 1040WH, Connecticut Income Tax Withholding Supplemental Schedule Connecticut Income Tax Withholding Sup

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself