1042A740 M 0003 Indd Kentucky Department of Revenue Form

What is the 1042A740 M 0003 indd Kentucky Department Of Revenue

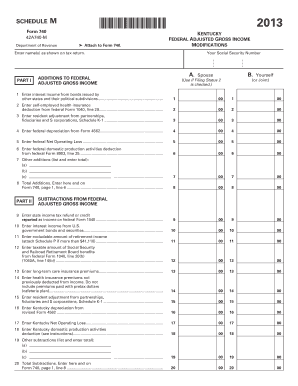

The 1042A740 M 0003 indd form is a tax document issued by the Kentucky Department of Revenue. It is primarily used for reporting income that is subject to withholding for non-resident individuals or entities. This form is essential for ensuring compliance with state tax regulations, particularly for those who receive income from Kentucky sources but do not reside in the state. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the 1042A740 M 0003 indd Kentucky Department Of Revenue

Using the 1042A740 M 0003 indd form involves several key steps. First, gather all necessary information regarding the income earned and the corresponding withholding amounts. Next, accurately fill out the form, ensuring that all details are correct to prevent delays or issues with processing. After completing the form, it can be submitted either electronically or by mail, depending on the preferences and capabilities of the taxpayer. Ensuring that the form is filled out correctly and submitted on time is vital for compliance with Kentucky tax laws.

Steps to complete the 1042A740 M 0003 indd Kentucky Department Of Revenue

Completing the 1042A740 M 0003 indd form requires a systematic approach:

- Collect all relevant financial documents, including income statements and withholding records.

- Fill in the taxpayer's identification information, including name, address, and Social Security number or taxpayer identification number.

- Report the total income earned from Kentucky sources and the total amount withheld.

- Review the completed form for accuracy, checking for any errors or omissions.

- Submit the form by the specified deadline, ensuring that it is sent to the correct address or electronically filed as required.

Legal use of the 1042A740 M 0003 indd Kentucky Department Of Revenue

The legal use of the 1042A740 M 0003 indd form is governed by Kentucky tax laws, which mandate its use for reporting income subject to withholding for non-residents. Proper completion and submission of this form ensure that taxpayers meet their obligations under state law. Failure to use the form correctly can result in penalties or legal repercussions, making it essential for taxpayers to understand the legal implications of their filings.

Key elements of the 1042A740 M 0003 indd Kentucky Department Of Revenue

The key elements of the 1042A740 M 0003 indd form include:

- Taxpayer identification information, which is necessary for processing.

- Details of income earned, including types of income and amounts.

- Withholding amounts, which indicate how much tax has been withheld from the income.

- Signature and date, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 1042A740 M 0003 indd form are critical for compliance. Typically, the form must be submitted by the due date specified by the Kentucky Department of Revenue, which is often aligned with the annual tax filing deadline. It is important for taxpayers to be aware of these dates to avoid late fees or penalties. Keeping track of any changes in deadlines announced by the state can also help ensure timely submissions.

Quick guide on how to complete 1042a740 m 0003indd kentucky department of revenue

Complete [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the needed form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and then click Obtain Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact confidential information with resources that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your adjustments.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1042A740 M 0003 indd Kentucky Department Of Revenue

Create this form in 5 minutes!

People also ask

-

What is the 1042A740 M 0003 indd Kentucky Department Of Revenue form?

The 1042A740 M 0003 indd Kentucky Department Of Revenue form is an important document used for reporting income and taxes withheld for non-resident individuals. It is essential for compliance with state regulations and helps businesses ensure they meet their tax obligations.

-

How can airSlate SignNow assist with the 1042A740 M 0003 indd Kentucky Department Of Revenue form?

airSlate SignNow facilitates the electronic signing and sending of the 1042A740 M 0003 indd Kentucky Department Of Revenue form, making the process quicker and more efficient. With its user-friendly interface, you can easily prepare and share your documents while ensuring they meet all necessary compliance requirements.

-

What are the pricing options for using airSlate SignNow for the 1042A740 M 0003 indd Kentucky Department Of Revenue?

airSlate SignNow offers various pricing plans, tailored to fit different business needs. You can choose a subscription that includes features for efficiently managing and eSigning documents like the 1042A740 M 0003 indd Kentucky Department Of Revenue form, ensuring you get the best value for your investment.

-

Why should I choose airSlate SignNow for managing the 1042A740 M 0003 indd Kentucky Department Of Revenue?

Choosing airSlate SignNow allows you to leverage a secure and effective platform to manage your 1042A740 M 0003 indd Kentucky Department Of Revenue form. It enhances collaboration, reduces turnaround time, and ensures compliance with state regulations, making it an ideal solution for businesses.

-

Does airSlate SignNow integrate with other software for the 1042A740 M 0003 indd Kentucky Department Of Revenue?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow when handling the 1042A740 M 0003 indd Kentucky Department Of Revenue. This integration allows you to easily import, sign, and manage documents, ensuring a streamlined experience.

-

What features does airSlate SignNow offer for the 1042A740 M 0003 indd Kentucky Department Of Revenue?

airSlate SignNow provides essential features such as template creation, bulk sending, and tracking of the 1042A740 M 0003 indd Kentucky Department Of Revenue forms. These features enhance efficiency and simplify the process of document management, making it easier for users to maintain compliance.

-

Is airSlate SignNow secure for handling the 1042A740 M 0003 indd Kentucky Department Of Revenue?

Absolutely. airSlate SignNow employs advanced security measures, including data encryption and secure access, ensuring that your 1042A740 M 0003 indd Kentucky Department Of Revenue forms are protected at all times. You can trust that your sensitive information remains confidential and secure.

Get more for 1042A740 M 0003 indd Kentucky Department Of Revenue

Find out other 1042A740 M 0003 indd Kentucky Department Of Revenue

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form