Estimated Payment Ohio Department of Taxation Ohio Gov Form

What is the Estimated Payment Ohio Department Of Taxation Ohio gov

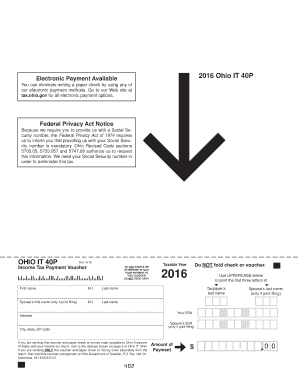

The Estimated Payment form from the Ohio Department of Taxation is a crucial document for individuals and businesses who need to report and pay estimated taxes. This form is typically used by taxpayers who expect to owe tax of $500 or more when filing their annual return. It allows for the prepayment of taxes to avoid penalties and interest associated with underpayment. Understanding this form is essential for effective tax planning and compliance with state tax laws.

Steps to complete the Estimated Payment Ohio Department Of Taxation Ohio gov

Completing the Estimated Payment form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income estimates and deductions. Next, calculate the estimated tax liability using the appropriate tax rates. Once the calculations are complete, fill out the form with your personal information and the calculated amounts. Ensure that you review the form for any errors before submission. Finally, choose your preferred method of payment, whether online or via mail, to finalize the process.

Legal use of the Estimated Payment Ohio Department Of Taxation Ohio gov

The Estimated Payment form is legally binding when completed correctly and submitted on time. To ensure its legality, taxpayers must comply with the Ohio Revised Code and follow the guidelines set forth by the Ohio Department of Taxation. Proper completion includes providing accurate financial information and adhering to filing deadlines. Failure to comply with these regulations may result in penalties or interest charges, emphasizing the importance of understanding the legal implications of this form.

Filing Deadlines / Important Dates

Timely filing of the Estimated Payment form is crucial to avoid penalties. For most taxpayers, the estimated payments are due quarterly, typically on the 15th of April, June, September, and January of the following year. It is important to keep track of these dates to ensure compliance with state tax laws. Missing a deadline may lead to additional charges, so staying informed about these critical dates is essential for effective tax management.

Key elements of the Estimated Payment Ohio Department Of Taxation Ohio gov

Key elements of the Estimated Payment form include personal identification details, income estimates, tax calculation methods, and payment options. Taxpayers must provide their Social Security number or Employer Identification Number, along with an accurate estimate of their income for the year. Additionally, understanding the tax rates applicable to their income bracket is essential for calculating the estimated tax owed. Finally, the form includes sections for selecting payment methods, which can be done electronically or by mail.

Who Issues the Form

The Estimated Payment form is issued by the Ohio Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to assist individuals and businesses in understanding their tax obligations, including the estimated payment process. Taxpayers can access the form and related information directly from the Ohio Department of Taxation's official website.

Quick guide on how to complete estimated payment ohio department of taxation ohiogov

Complete Estimated Payment Ohio Department Of Taxation Ohio gov seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Handle Estimated Payment Ohio Department Of Taxation Ohio gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Estimated Payment Ohio Department Of Taxation Ohio gov without breaking a sweat

- Obtain Estimated Payment Ohio Department Of Taxation Ohio gov and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specially designed by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Estimated Payment Ohio Department Of Taxation Ohio gov to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Estimated Payment Ohio Department Of Taxation Ohio gov process?

The Estimated Payment Ohio Department Of Taxation Ohio gov process involves taxpayers submitting their estimated tax payments to the state of Ohio. This process ensures that individuals and businesses meet their tax obligations throughout the year, avoiding penalties. Using airSlate SignNow can streamline this process by enabling users to easily fill out and eSign the necessary documents online.

-

How does airSlate SignNow assist with Estimated Payment Ohio Department Of Taxation Ohio gov?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign documents related to the Estimated Payment Ohio Department Of Taxation Ohio gov. This ensures a smooth and efficient process, reducing the time you spend on paperwork. By utilizing this solution, users can track their documents and ensure timely submission of estimated payments.

-

Are there any costs associated with using airSlate SignNow for Estimated Payment Ohio Department Of Taxation Ohio gov?

Yes, there are cost-effective plans available for using airSlate SignNow for your Estimated Payment Ohio Department Of Taxation Ohio gov needs. The pricing is designed to ensure that businesses of all sizes can affordably manage their document signing and eSigning requirements. Check our pricing page for detailed information on various plans.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers a range of features tailored for managing tax-related documents, including customizable templates, document tracking, and secure cloud storage. These features enhance the handling of the Estimated Payment Ohio Department Of Taxation Ohio gov forms, providing users with flexibility and control over their documents right at their fingertips.

-

Can airSlate SignNow integrate with other tools for Estimated Payment Ohio Department Of Taxation Ohio gov?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your workflow for the Estimated Payment Ohio Department Of Taxation Ohio gov. Whether it’s accounting software or CRM systems, these integrations can help you manage your tax documents more efficiently.

-

What are the benefits of using airSlate SignNow for my Estimated Payment Ohio Department Of Taxation Ohio gov?

Using airSlate SignNow for your Estimated Payment Ohio Department Of Taxation Ohio gov offers many benefits, including time savings and reduced errors. The platform is designed for ease of use, ensuring that you can complete your forms quickly and accurately. Moreover, secure eSigning features provide peace of mind when sending sensitive documents.

-

Is airSlate SignNow secure for handling my Estimated Payment Ohio Department Of Taxation Ohio gov documents?

Yes, airSlate SignNow prioritizes user security and compliance, making it a safe choice for handling your Estimated Payment Ohio Department Of Taxation Ohio gov documents. With strong encryption protocols and secure storage practices, you can rest assured that your information is protected throughout the signing process.

Get more for Estimated Payment Ohio Department Of Taxation Ohio gov

- Quitclaim deed timeshare from grantor to two grantees new jersey form

- Nj trusts form

- Quitclaim deed four individuals to four individuals new jersey form

- Special warranty deed new jersey form

- Nj husband wife 497319151 form

- New jersey deed sample form

- New jersey deed 497319153 form

- Deed husband wife 497319154 form

Find out other Estimated Payment Ohio Department Of Taxation Ohio gov

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter