8863 Form

What is the 8863 Form

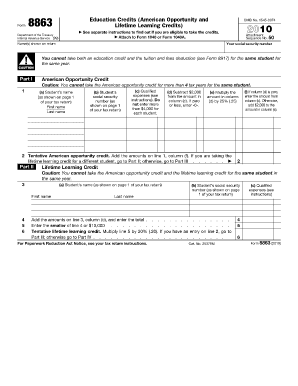

The 8863 form, officially known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is used by taxpayers to claim education-related tax credits. These credits can significantly reduce the amount of tax owed, making higher education more affordable. The form allows individuals to report qualified education expenses for themselves or their dependents, which can lead to substantial savings on federal taxes. Understanding the specifics of the 8863 form is essential for those looking to maximize their educational tax benefits.

How to use the 8863 Form

Using the 8863 form involves several steps to ensure that you correctly report your educational expenses. First, gather all necessary documentation, including tuition statements and receipts for qualified expenses. Next, fill out the form by entering your personal information and detailing the educational expenses incurred. Be sure to indicate whether you are claiming the American Opportunity Credit or the Lifetime Learning Credit, as each has different eligibility criteria and benefits. After completing the form, it should be submitted along with your federal tax return, either electronically or by mail.

Steps to complete the 8863 Form

Completing the 8863 form requires careful attention to detail. Follow these steps for successful completion:

- Gather documents: Collect all relevant documents, such as Form 1098-T from educational institutions and receipts for qualified expenses.

- Fill in personal information: Provide your name, Social Security number, and other identifying information at the top of the form.

- Detail education expenses: In the appropriate sections, list the qualified expenses for each student, including tuition and fees.

- Select the credit: Indicate whether you are claiming the American Opportunity Credit or the Lifetime Learning Credit, based on eligibility.

- Review and submit: Double-check all entries for accuracy before submitting the form with your tax return.

Eligibility Criteria

To qualify for the credits claimed on the 8863 form, certain eligibility criteria must be met. For the American Opportunity Credit, you must be enrolled at least half-time in a degree or certificate program, and the credit is available for the first four years of higher education. The Lifetime Learning Credit, on the other hand, is available for any level of post-secondary education and has no limit on the number of years you can claim it. Additionally, income limits apply, and taxpayers must have a valid Social Security number to claim these credits.

Filing Deadlines / Important Dates

Filing deadlines for the 8863 form align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you require an extension, you may file for an extension, which allows you to submit your tax return by October fifteenth. It is crucial to ensure that the 8863 form is included in your submission to avoid delays in processing your tax return and receiving any credits owed.

Form Submission Methods (Online / Mail / In-Person)

The 8863 form can be submitted through various methods, depending on how you file your federal tax return. If you are filing electronically, you can include the form as part of your e-filed return using tax software that supports the 8863 form. Alternatively, if you are filing a paper return, you must print and attach the completed form to your tax return before mailing it to the IRS. In-person submissions are not typical for this form, as most taxpayers file through electronic or mail methods.

Quick guide on how to complete 8863 form

Effortlessly Complete 8863 Form on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly with no delays. Handle 8863 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Simplest Method to Edit and eSign 8863 Form with Ease

- Locate 8863 Form and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign 8863 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 2010 credits and how do they work with airSlate SignNow?

2010 credits are a unique feature offered by airSlate SignNow that allows users to send a specified number of documents for eSignature. Each credit represents a single document eSigned, making it easy for businesses to manage their signing needs efficiently.

-

How much do 2010 credits cost?

The pricing for 2010 credits varies depending on the volume you choose to purchase. airSlate SignNow offers tiered pricing that provides savings on larger packages, ensuring that businesses can find a budget-friendly option that meets their needs.

-

What features do I get with 2010 credits?

With 2010 credits, you gain access to a suite of features including document templates, personalized branding, and secure storage. This empowers users to streamline their document signing processes while maintaining a professional image with clients.

-

Can I use 2010 credits for integrations with other applications?

Yes, airSlate SignNow allows you to use 2010 credits seamlessly with various integrations such as CRM and project management tools. This ensures that your document signing process can be incorporated into your existing workflows without hassle.

-

What are the benefits of using 2010 credits for my business?

Using 2010 credits provides several benefits including cost-effectiveness and flexibility in managing document signatures. It simplifies the signing process for your team and clients, ensuring faster turnaround times and improved business efficiency.

-

Is there a limit to the number of documents I can sign using 2010 credits?

The limits on document signing with 2010 credits depend on the number of credits purchased. You can always buy additional credits if you find that your document needs exceed your initial purchase, giving you scalability as your business grows.

-

How do I track my usage of 2010 credits?

airSlate SignNow provides intuitive dashboards that allow you to track your usage of 2010 credits in real-time. This feature ensures that you are always aware of how many credits you have left, allowing for better planning of your document signing needs.

Get more for 8863 Form

- New hampshire form 497318879

- Employment or job termination package new hampshire form

- Newly widowed individuals package new hampshire form

- Employment interview package new hampshire form

- Employment employee personnel file package new hampshire form

- Assignment of mortgage package new hampshire form

- Assignment of lease package new hampshire form

- Lease purchase agreements package new hampshire form

Find out other 8863 Form

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form