Form 1040 Schedule C

What is the Form 1040 Schedule C

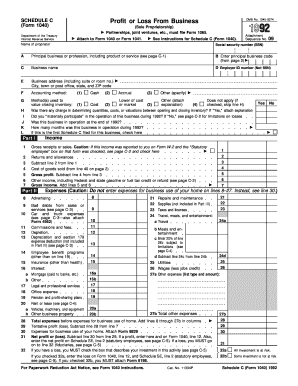

The Form 1040 Schedule C, also known as the Profit or Loss from Business form, is a crucial document for self-employed individuals and sole proprietors in the United States. It allows taxpayers to report income or loss from a business they operated or a profession they practiced. This form is essential for calculating the net profit or loss, which ultimately affects the overall income tax obligation. The Schedule C is filed alongside the individual income tax return, Form 1040, making it an integral part of the tax filing process for those who earn income outside of traditional employment.

How to use the Form 1040 Schedule C

Using the Form 1040 Schedule C involves several key steps. First, gather all relevant financial information related to your business, including income, expenses, and any applicable deductions. Next, fill out the form by providing details such as your business name, address, and the type of business activity. You will also need to report gross receipts or sales, cost of goods sold, and various expenses, which may include advertising, car and truck expenses, and home office deductions. It is important to ensure that all information is accurate and complete to avoid potential issues with the IRS.

Steps to complete the Form 1040 Schedule C

Completing the Form 1040 Schedule C can be broken down into several steps:

- Step 1: Begin by filling in your personal information, including your name and Social Security number.

- Step 2: Provide details about your business, such as the name, address, and the principal business activity.

- Step 3: Report your gross receipts or sales from your business operations.

- Step 4: Calculate the cost of goods sold if applicable, and subtract this from your gross receipts to determine your gross income.

- Step 5: List all business expenses in the appropriate categories, ensuring you keep thorough records to support your claims.

- Step 6: Deduct your total expenses from your gross income to arrive at your net profit or loss.

- Step 7: Transfer the net profit or loss to your Form 1040.

Legal use of the Form 1040 Schedule C

The legal use of the Form 1040 Schedule C is governed by IRS regulations. It is important to ensure that the information reported is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be filed annually as part of your tax return, and it is essential to maintain proper documentation for all reported income and expenses. This documentation serves as evidence in case of an IRS inquiry or audit, reinforcing the importance of compliance with tax laws.

Filing Deadlines / Important Dates

The filing deadline for the Form 1040 Schedule C is typically the same as the individual income tax return, which is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time to prepare your return, you can file for an extension, which typically gives you until October 15 to submit your tax return, including the Schedule C. However, it is crucial to note that any taxes owed are still due by the original deadline to avoid penalties and interest.

Key elements of the Form 1040 Schedule C

Several key elements make up the Form 1040 Schedule C, which include:

- Business Information: This section requires details about the business, including its name, address, and type of operation.

- Income: Report all sources of income generated from the business.

- Expenses: List all deductible business expenses, categorized by type, such as utilities, rent, and supplies.

- Net Profit or Loss: The final calculation that determines the taxable income from the business.

Quick guide on how to complete 1992 form 1040 schedule c

Complete Form 1040 Schedule C effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 1040 Schedule C on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Form 1040 Schedule C without any hassle

- Find Form 1040 Schedule C and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose how you wish to deliver your form: via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Edit and electronically sign Form 1040 Schedule C while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1992 c. pricing model for airSlate SignNow?

The 1992 c. pricing model for airSlate SignNow offers flexible options tailored to different business sizes. You can choose from monthly or annual subscriptions, allowing you to select a plan that fits your budget and needs. Each plan includes a variety of features to enhance your document management experience.

-

What features are included in the 1992 c. package of airSlate SignNow?

The 1992 c. package includes essential features like eSignature capabilities, document templates, and real-time collaboration. It also offers advanced security measures to ensure that your documents are safe. These features are designed to streamline your workflows and enhance productivity.

-

How does airSlate SignNow ensure document security within the 1992 c. framework?

airSlate SignNow incorporates robust security measures into its 1992 c. offering, including encryption and compliance with standards like GDPR and HIPAA. These features protect sensitive information and ensure that your documents are handled securely. You can confidently manage your eSignatures knowing your data is well-protected.

-

What are the benefits of using airSlate SignNow's 1992 c. solution?

The 1992 c. solution by airSlate SignNow provides numerous benefits including cost-effectiveness, ease of use, and enhanced efficiency. You can easily manage and sign documents from anywhere, which boosts productivity. This flexible solution is perfect for businesses looking to optimize their document processes.

-

Can airSlate SignNow integrate with other software tools within the 1992 c. package?

Yes, airSlate SignNow's 1992 c. package allows seamless integration with a wide range of software tools like CRM systems, cloud storage, and project management applications. This capability enables users to create a comprehensive workflow tailored to their needs. Integration enhances efficiency and allows for better data management.

-

Is there a mobile app for the 1992 c. version of airSlate SignNow?

Absolutely! The 1992 c. version of airSlate SignNow comes with a mobile app that allows you to manage your documents and eSign on the go. This feature is particularly useful for businesses that require quick access to documents from anywhere. You'll never miss a signing opportunity with the mobile app.

-

How can businesses benefit from the user-friendly interface of airSlate SignNow's 1992 c. solution?

The user-friendly interface of airSlate SignNow’s 1992 c. solution makes it easy for anyone to navigate and utilize its features effectively. Businesses can train their employees quickly, minimizing downtime and maximizing productivity. The intuitive design ensures a smooth experience for users of all tech levels.

Get more for Form 1040 Schedule C

- Annual financial checkup package new hampshire form

- New hampshire bill sale form

- Living wills and health care package new hampshire form

- Last will and testament package new hampshire form

- Subcontractors package new hampshire form

- Nh minors form

- New hampshire identity form

- Protecting deceased persons from identity theft new hampshire form

Find out other Form 1040 Schedule C

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form