1950 Form

What is the 1950 Form

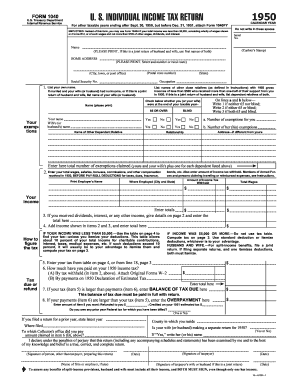

The 1950 form, often referred to as the 1950 tax form, is a crucial document used by individual taxpayers in the United States to report their income and calculate their tax liability. This form is part of the IRS forms collection and is essential for ensuring compliance with federal tax regulations. The 1950 form is specifically designed for individuals, allowing them to detail their earnings, deductions, and credits for the tax year. Understanding its purpose is vital for accurate tax reporting and avoiding potential penalties.

How to use the 1950 Form

Using the 1950 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, such as your name, address, and Social Security number. Then, report your income and any applicable deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays or audits. Once completed, review the form for accuracy before submission.

Steps to complete the 1950 Form

Completing the 1950 form requires attention to detail. Here are the key steps:

- Gather all relevant financial documents.

- Fill in your personal information at the top of the form.

- Report all sources of income in the designated sections.

- Include any deductions and credits you qualify for.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the 1950 Form

The 1950 form must be completed in accordance with IRS regulations to be legally valid. This includes ensuring that all information is accurate and that the form is signed. E-signatures are accepted under U.S. law, provided that the electronic signature complies with the ESIGN Act and UETA. Using a reliable digital solution, like airSlate SignNow, can enhance the legal standing of your completed form by providing a digital certificate and maintaining compliance with relevant laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1950 form are critical to avoid penalties. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website for any updates or changes to deadlines, especially during tax season. Filing on time ensures compliance and avoids unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The 1950 form can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online submission via IRS e-file, which is fast and secure.

- Mailing a paper copy to the appropriate IRS address based on your location.

- In-person submission at designated IRS offices, which may require an appointment.

Choosing the right submission method can streamline the filing process and ensure timely processing of your tax return.

Quick guide on how to complete 1950 form

Complete 1950 Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 1950 Form on any system with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign 1950 Form without hassle

- Find 1950 Form and click on Get Form to initiate.

- Employ the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your needs in document management with just a few clicks from any device. Edit and eSign 1950 Form and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the year 1950?

airSlate SignNow is an advanced eSigning solution that allows businesses to efficiently send and eSign documents online. The significance of the year 1950 highlights how far technology has come since the mid-20th century, making today's document processes faster and more secure than ever before.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides several flexible pricing plans that cater to different business needs. The plans are designed to be cost-effective, reflecting the evolution of document management from the cumbersome processes of the 1950s to a streamlined digital platform today.

-

What features does airSlate SignNow include?

airSlate SignNow includes a range of features, such as document templates, secure eSignature capabilities, and real-time tracking. These features help businesses enhance efficiency, contrasting starkly with document handling methods prevalent in the 1950s.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow can signNowly improve your business operations by reducing paperwork and accelerating document processing. Unlike the traditional methods of the 1950s, our platform enables seamless collaboration and faster transactions.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates with a variety of popular applications, enhancing your existing workflows. Just as the 1950s saw the beginning of technological integrations, our platform aligns with modern software to create a cohesive business ecosystem.

-

Is airSlate SignNow secure and compliant?

Yes, airSlate SignNow prioritizes security and compliance by utilizing advanced encryption protocols and ensuring adherence to legal standards. This level of security represents a signNow advancement from the document handling practices of 1950, ensuring your data is always protected.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to send and sign documents on-the-go. This mobile capability is a far cry from the stationary processes of the 1950s, giving users unprecedented flexibility.

Get more for 1950 Form

- New hampshire property management package new hampshire form

- Sample annual minutes for a new hampshire professional corporation new hampshire form

- Sample bylaws for a new hampshire professional corporation new hampshire form

- Sample corporate records for a new hampshire professional corporation new hampshire form

- New hampshire corporation form

- Sample transmittal letter for articles of incorporation new hampshire form

- New resident guide new hampshire form

- Satisfaction release or cancellation of mortgage by corporation new hampshire form

Find out other 1950 Form

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself