Form 990 or 990 EZ Schedule C Irs

What is the Form 990 Or 990 EZ Schedule C Irs

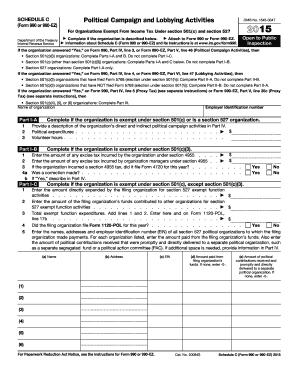

The Form 990 and Form 990-EZ Schedule C are essential documents used by tax-exempt organizations in the United States. These forms provide the IRS with information about the organization’s revenue, expenses, and activities. Form 990 is generally required for larger organizations, while Form 990-EZ is a simplified version for smaller entities. Both forms include a Schedule C that details the organization’s professional fundraising services, including the nature of the services provided and the fees paid to fundraisers. Understanding these forms is crucial for compliance and transparency in financial reporting.

How to use the Form 990 Or 990 EZ Schedule C Irs

Using the Form 990 or 990-EZ Schedule C involves several steps. Organizations must first determine which form applies to them based on their size and revenue. Once the appropriate form is identified, organizations should gather necessary financial information, including income from contributions, grants, and other sources. The Schedule C section requires detailed reporting of fundraising activities, including any contracts with professional fundraisers. Accurate completion of this form is vital to ensure compliance with IRS regulations and to provide transparency to the public.

Steps to complete the Form 990 Or 990 EZ Schedule C Irs

To complete the Form 990 or 990-EZ Schedule C, follow these steps:

- Identify the appropriate form based on your organization’s gross receipts and total assets.

- Gather financial data, including revenue and expenses related to fundraising activities.

- Fill out the basic information sections, including the organization’s name, address, and EIN.

- Complete the Schedule C section, detailing professional fundraising services and associated fees.

- Review the completed form for accuracy and ensure all required signatures are included.

- File the form electronically or via mail by the designated deadline.

Legal use of the Form 990 Or 990 EZ Schedule C Irs

The legal use of Form 990 and 990-EZ Schedule C is governed by IRS regulations. These forms must be filed annually by tax-exempt organizations to maintain their status. Accurate reporting is essential, as discrepancies can lead to penalties or loss of tax-exempt status. Organizations must ensure that all information is truthful and complete, as the IRS may audit filings for compliance. Understanding the legal implications of these forms helps organizations uphold their obligations and maintain transparency with stakeholders.

Filing Deadlines / Important Dates

Filing deadlines for Form 990 and Form 990-EZ Schedule C are critical for compliance. Generally, these forms are due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. Extensions may be requested, but organizations must file Form 8868 to obtain additional time. It is essential to adhere to these deadlines to avoid penalties and maintain good standing with the IRS.

Examples of using the Form 990 Or 990 EZ Schedule C Irs

Examples of using Form 990 or 990-EZ Schedule C include various nonprofit organizations that engage in fundraising activities. For instance, a charity that conducts annual fundraising events must report the income generated and any fees paid to professional fundraisers on Schedule C. Another example is a nonprofit that partners with a fundraising consultant; they must disclose the terms of the agreement and the compensation structure. These examples illustrate the importance of transparency in fundraising practices and compliance with IRS regulations.

Quick guide on how to complete 2015 form 990 or 990 ez schedule c irs

Complete Form 990 Or 990 EZ Schedule C Irs effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal green alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Form 990 Or 990 EZ Schedule C Irs on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and electronically sign Form 990 Or 990 EZ Schedule C Irs seamlessly

- Locate Form 990 Or 990 EZ Schedule C Irs and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form 990 Or 990 EZ Schedule C Irs and ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 990 Or 990 EZ Schedule C Irs?

Form 990 Or 990 EZ Schedule C Irs is a tax form used by nonprofits to report their income, expenses, and other financial details to the IRS. It provides transparency regarding the organization’s activities and ensures compliance with federal requirements. Understanding this form is crucial for businesses and organizations that want to maintain their tax-exempt status.

-

How does airSlate SignNow help with Form 990 Or 990 EZ Schedule C Irs?

airSlate SignNow simplifies the process of managing documents related to Form 990 Or 990 EZ Schedule C Irs. It allows users to send, sign, and archive important tax forms easily and securely. Our platform ensures that your documents are organized and accessible, making tax filing less stressful.

-

Is airSlate SignNow a cost-effective solution for handling Form 990 Or 990 EZ Schedule C Irs?

Yes, airSlate SignNow offers cost-effective plans that cater to various organizational needs, providing excellent value for managing Form 990 Or 990 EZ Schedule C Irs and other documents. By utilizing our service, users can save on operational costs and reduce paperwork-related expenses. We also provide a free trial so you can explore our features before committing.

-

What features does airSlate SignNow provide for Form 990 Or 990 EZ Schedule C Irs integrations?

airSlate SignNow offers robust features designed for seamless integration with various financial and tax software, optimizing the handling of Form 990 Or 990 EZ Schedule C Irs. Users can easily import and export data, ensuring that their documents align with other tools they are using. This maximizes efficiency and minimizes errors during the tax filing process.

-

Can I collaborate with my team on Form 990 Or 990 EZ Schedule C Irs using airSlate SignNow?

Absolutely! airSlate SignNow supports collaboration by allowing multiple team members to review and sign Form 990 Or 990 EZ Schedule C Irs documents in real-time. This feature enhances teamwork and ensures that the documents are processed faster, improving compliance and overall workflow efficiency.

-

How secure is airSlate SignNow for filing Form 990 Or 990 EZ Schedule C Irs?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and access controls to safeguard sensitive information related to Form 990 Or 990 EZ Schedule C Irs. Rest assured that your documents are safe and compliant with industry standards.

-

What types of organizations benefit from using airSlate SignNow for Form 990 Or 990 EZ Schedule C Irs?

Nonprofit organizations, charities, and other tax-exempt entities can greatly benefit from airSlate SignNow for managing Form 990 Or 990 EZ Schedule C Irs. Our solution streamlines document handling, ensuring a smooth filing process that meets IRS regulations. Both small and large organizations can find value in our easy-to-use platform.

Get more for Form 990 Or 990 EZ Schedule C Irs

- Brick mason contract for contractor minnesota form

- Minnesota contractor form

- Electrical contract for contractor minnesota form

- Sheetrock drywall contract for contractor minnesota form

- Flooring contract for contractor minnesota form

- Mn deed form

- Notice of intent to enforce forfeiture provisions of contact for deed minnesota form

- Final notice of forfeiture and request to vacate property under contract for deed minnesota form

Find out other Form 990 Or 990 EZ Schedule C Irs

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter