Zenith Bank Savings Account Limit Form

What is the Zenith Bank Savings Account Limit

The Zenith Bank Savings Account Limit refers to the maximum balance that can be maintained in a Zenith Bank savings account. This limit is crucial for account holders to understand, as it affects how much money can be deposited and retained without incurring additional fees or restrictions. Typically, this limit is set to encourage savings while also ensuring compliance with banking regulations. Knowing the limit helps account holders manage their finances effectively and avoid penalties associated with exceeding the specified balance.

How to Use the Zenith Bank Savings Account Limit

Utilizing the Zenith Bank Savings Account Limit effectively involves understanding how to manage your deposits and withdrawals within the defined boundaries. Account holders should regularly monitor their account balance to ensure it stays within the limit. This can be done through the bank's online banking platform, mobile app, or by contacting customer service. Additionally, setting up alerts for balance thresholds can help maintain compliance with the limit, allowing for better financial planning and avoiding unnecessary fees.

Eligibility Criteria for the Zenith Bank Savings Account Limit

To qualify for a Zenith Bank savings account and its associated limit, individuals typically need to meet certain eligibility criteria. These may include being a legal resident of the United States, providing valid identification, and meeting the minimum age requirement, which is usually eighteen years. Additionally, applicants may need to demonstrate a stable source of income or employment. Understanding these criteria is essential for a smooth account opening process.

Application Process & Approval Time for Zenith Bank Savings Account

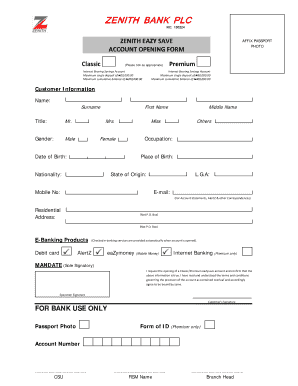

The application process for opening a Zenith Bank savings account is designed to be straightforward. Prospective account holders can start by filling out an application form, which is available online or at a local branch. Required documents usually include proof of identity, proof of address, and Social Security number. Once the application is submitted, approval times can vary but typically range from a few hours to a couple of days, depending on the completeness of the application and verification of documents.

Key Elements of the Zenith Bank Savings Account Limit

Understanding the key elements of the Zenith Bank Savings Account Limit is essential for effective account management. These elements include the maximum balance allowed, any fees associated with exceeding the limit, and the interest rates applicable to the account. Additionally, account holders should be aware of any specific terms and conditions that may apply, such as withdrawal restrictions or minimum balance requirements. Familiarity with these elements ensures that account holders can maximize their savings potential while adhering to bank policies.

Steps to Complete the Zenith Bank Savings Account Limit

Completing the necessary steps to manage the Zenith Bank Savings Account Limit involves several important actions. First, regularly check your account balance through online banking or mobile apps. Second, set up alerts to notify you when your balance approaches the limit. Third, plan your deposits and withdrawals strategically to avoid exceeding the limit. Lastly, maintain good communication with your bank to stay informed about any changes to account policies or limits that may affect your savings strategy.

Quick guide on how to complete zenith bank savings account limit

Prepare Zenith Bank Savings Account Limit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Zenith Bank Savings Account Limit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Zenith Bank Savings Account Limit with ease

- Find Zenith Bank Savings Account Limit and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from a device of your preference. Modify and eSign Zenith Bank Savings Account Limit and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is involved in the bank easy account opening process?

The bank easy account opening process involves a few simple steps, including filling out an online application, verifying your identity, and providing necessary documentation. With airSlate SignNow, you can easily eSign all required documents, making the entire process hassle-free and efficient. Experience a smooth bank easy account opening without any long waits.

-

What are the benefits of using airSlate SignNow for bank easy account opening?

Using airSlate SignNow for bank easy account opening offers numerous benefits, including a streamlined process, reduced paperwork, and enhanced security features. Our platform allows you to sign documents electronically, saving you time and effort. Moreover, you'll enjoy cost savings compared to traditional methods, making it a smart choice for individuals and businesses alike.

-

How does airSlate SignNow ensure the security of my bank easy account opening documents?

airSlate SignNow prioritizes document security during your bank easy account opening with robust encryption protocols and secure cloud storage. Our platform complies with industry standards to protect your sensitive information, ensuring that your documents are safe from unauthorized access. You can trust us to safeguard every part of your account opening experience.

-

Are there any fees associated with the bank easy account opening process through airSlate SignNow?

While airSlate SignNow offers affordable pricing options for its eSigning services, the specific fees related to your bank easy account opening will depend on your bank's policies. Typically, there might be no additional fees for using our platform, making it a cost-effective solution. Always check with your financial institution for any hidden charges related to account opening.

-

Can I integrate airSlate SignNow with my bank's systems for bank easy account opening?

Yes, airSlate SignNow can integrate seamlessly with various banking solutions to streamline the bank easy account opening process. Our platform supports API integrations that allow your bank's systems to work harmoniously with our eSigning services. This means you take advantage of a smooth workflow that enhances the overall experience.

-

Is airSlate SignNow suitable for both personal and business bank easy account opening?

Absolutely! airSlate SignNow is designed to cater to both personal and business needs for bank easy account opening. Whether you are opening an account for yourself or a business entity, our platform offers the flexibility and features necessary for a smooth experience. Choose airSlate SignNow for a reliable solution that meets diverse banking needs.

-

What features does airSlate SignNow provide for an efficient bank easy account opening?

airSlate SignNow provides various features that enhance the bank easy account opening experience, including customizable templates, user-friendly interfaces, and real-time tracking of documents. You can also set reminders for signing, ensuring a timely completion of the process. These features contribute to a faster and more organized account opening procedure.

Get more for Zenith Bank Savings Account Limit

- Nevada construction or mechanics lien package individual nevada form

- Nevada construction or mechanics lien package corporation or llc nevada form

- Storage business package nevada form

- Child care services package nevada form

- Special or limited power of attorney for real estate sales transaction by seller nevada form

- Special or limited power of attorney for real estate purchase transaction by purchaser nevada form

- Limited power of attorney where you specify powers with sample powers included nevada form

- Limited power of attorney for stock transactions and corporate powers nevada form

Find out other Zenith Bank Savings Account Limit

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast