Form 8283 Rev December Noncash Charitable Contributions Irs

What is the Form 8283 Rev December Noncash Charitable Contributions IRS

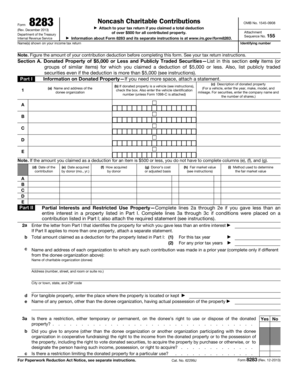

The Form 8283 Rev December Noncash Charitable Contributions is an IRS document used by taxpayers to report noncash charitable contributions. This form is essential for individuals who donate property or assets, such as clothing, vehicles, or real estate, to qualified charitable organizations. By completing this form, taxpayers can claim a deduction for these contributions on their federal income tax returns. It is important to accurately report the fair market value of the donated items and to ensure that the contributions meet IRS requirements.

How to use the Form 8283 Rev December Noncash Charitable Contributions IRS

Using the Form 8283 Rev December Noncash Charitable Contributions involves several steps. First, gather all necessary information about the donated items, including descriptions and fair market values. Next, fill out the form by providing details about the donor, the charity, and the contributions. If the total value of the noncash contributions exceeds $500, additional information is required, including appraisals for items valued over $5,000. Once completed, the form must be attached to your tax return when filing.

Steps to complete the Form 8283 Rev December Noncash Charitable Contributions IRS

Completing the Form 8283 involves a systematic approach:

- Begin by entering your name, Social Security number, and the tax year at the top of the form.

- Provide the name and address of the charitable organization receiving the donation.

- List each item donated, including a description and the fair market value.

- If applicable, complete Section B for items valued over $5,000, including obtaining a qualified appraisal.

- Sign and date the form, ensuring all information is accurate before submission.

Key elements of the Form 8283 Rev December Noncash Charitable Contributions IRS

The Form 8283 contains several key elements that are crucial for proper completion:

- Donor Information: Personal details of the donor, including name and Social Security number.

- Charity Information: Name and address of the charitable organization.

- Item Description: Specific details about each item donated, including its condition.

- Fair Market Value: An accurate assessment of the item's value at the time of donation.

- Signature: The donor's signature is required to validate the form.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8283. Taxpayers must ensure that the charitable organization is qualified under IRS rules to receive tax-deductible contributions. Additionally, the fair market value of donated items must be determined using accepted methods, such as appraisals or published valuation guides. It is essential to maintain records of the donations, including receipts and any correspondence with the charity, for at least three years after filing the tax return.

Penalties for Non-Compliance

Failure to comply with the IRS requirements related to the Form 8283 can result in penalties. If a taxpayer claims a deduction for noncash contributions without proper documentation or fails to file the form when required, they may face disallowance of the deduction. This can lead to additional taxes owed, interest, and potential penalties. Therefore, it is crucial to follow all guidelines and ensure accurate reporting to avoid these consequences.

Quick guide on how to complete form 8283 rev december 2013 noncash charitable contributions irs

Complete Form 8283 Rev December Noncash Charitable Contributions Irs effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your paperwork quickly without delays. Handle Form 8283 Rev December Noncash Charitable Contributions Irs on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to edit and eSign Form 8283 Rev December Noncash Charitable Contributions Irs with ease

- Obtain Form 8283 Rev December Noncash Charitable Contributions Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to preserve your adjustments.

- Choose how you wish to deliver your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 8283 Rev December Noncash Charitable Contributions Irs to maintain exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 8283 Rev December Noncash Charitable Contributions Irs?

Form 8283 Rev December Noncash Charitable Contributions Irs is a tax form used to report noncash contributions made to charitable organizations. This form is essential to ensure proper documentation of donated items, helping taxpayers to claim deductions on their tax returns. By accurately filling out this form, donors can ensure compliance with IRS regulations.

-

How does airSlate SignNow help with Form 8283 Rev December Noncash Charitable Contributions Irs?

airSlate SignNow streamlines the process of completing and signing Form 8283 Rev December Noncash Charitable Contributions Irs electronically. Our platform allows you to fill out, eSign, and share the form easily with all involved parties, ensuring that your charitable contributions are documented efficiently. This simplifies your tax preparation and ensures compliance with IRS requirements.

-

What are the pricing options for using airSlate SignNow for Form 8283 Rev December Noncash Charitable Contributions Irs?

airSlate SignNow offers various pricing plans to suit different business needs, including affordable monthly and yearly subscriptions. For those specifically aimed at managing forms like Form 8283 Rev December Noncash Charitable Contributions Irs, the plans include essential features that simplify the document management process. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 8283 Rev December Noncash Charitable Contributions Irs?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for Form 8283 Rev December Noncash Charitable Contributions Irs. These integrations allow you to connect your existing tools for document management, accounting, and more, enabling a more streamlined process. This flexibility helps in better tracking of your charitable contributions.

-

Is there an option for bulk processing of Form 8283 Rev December Noncash Charitable Contributions Irs?

Absolutely! airSlate SignNow offers features that allow for bulk processing of Form 8283 Rev December Noncash Charitable Contributions Irs. This is particularly beneficial for organizations that handle numerous donation forms, enabling efficient management and collection of signatures in one go, saving time and effort.

-

What features does airSlate SignNow offer for managing Form 8283 Rev December Noncash Charitable Contributions Irs?

airSlate SignNow provides an array of features specifically for managing Form 8283 Rev December Noncash Charitable Contributions Irs, including customizable templates, eSigning capabilities, secure storage, and audit trails. These features ensure that your contributions are tracked and documented correctly, enhancing the reliability of your tax filings. This makes the management of charitable donations more efficient and secure.

-

How can I ensure compliance while using airSlate SignNow for Form 8283 Rev December Noncash Charitable Contributions Irs?

To ensure compliance while using airSlate SignNow for Form 8283 Rev December Noncash Charitable Contributions Irs, users should follow IRS guidelines carefully. Our platform is designed to guide you through the process and includes checks to ensure all required fields are completed. Additionally, keeping your documentation organized and accessible aids in compliance with IRS scrutiny.

Get more for Form 8283 Rev December Noncash Charitable Contributions Irs

- Ok quitclaim form

- Quitclaim mineral deed form

- Quitclaim deed from husband wife and an individual to an individual oklahoma form

- Deed of distribution oklahoma form

- Notice to owner corporation 497322836 form

- Quitclaim deed from individual to two individuals in joint tenancy oklahoma form

- Ok lien 497322839 form

- Quitclaim deed by two individuals to husband and wife oklahoma form

Find out other Form 8283 Rev December Noncash Charitable Contributions Irs

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT