W5 Form

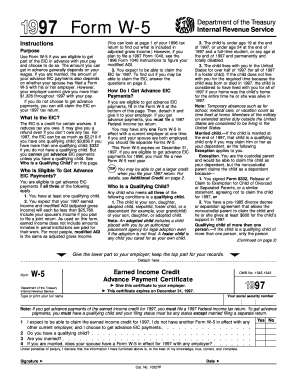

What is the W5 Form

The W5 form is a tax document used in the United States to provide information about an employee's eligibility for the Earned Income Tax Credit (EITC). It is primarily utilized by individuals who wish to claim this credit on their tax returns. The form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. Understanding the W5 form is essential for both employees and employers to ensure compliance with tax regulations and to maximize potential tax benefits.

How to use the W5 Form

Using the W5 form involves a few straightforward steps. First, an employee must complete the form by providing necessary personal information, including their name, address, and Social Security number. Next, the employee indicates their eligibility for the EITC by answering specific questions related to their income and family situation. Once completed, the form should be submitted to the employer, who will use the information to adjust tax withholdings accordingly. It is important to keep a copy of the submitted W5 form for personal records.

Steps to complete the W5 Form

Completing the W5 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Download the form: Obtain the latest version of the W5 form from the IRS website or through your employer.

- Fill in personal information: Enter your name, address, and Social Security number accurately.

- Answer eligibility questions: Provide truthful answers regarding your income and family status to determine your eligibility for the EITC.

- Review the form: Double-check all entries for accuracy and completeness.

- Submit to your employer: Hand in the completed form to your employer for processing.

Legal use of the W5 Form

The W5 form is legally binding when filled out correctly and submitted to an employer. It plays a crucial role in ensuring that employees receive the correct amount of tax credits and that employers comply with federal tax withholding requirements. To maintain legal validity, it is important to provide accurate information and to keep records of the submitted form. Misrepresentation on the W5 form can lead to penalties, including fines or additional tax liabilities.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for the use of the W5 form. These guidelines outline eligibility criteria for the Earned Income Tax Credit and detail how the form should be completed. It is essential for employees to familiarize themselves with these guidelines to ensure they meet the necessary requirements. The IRS also updates these guidelines periodically, so staying informed about any changes is important for compliance and accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the W5 form are typically aligned with the tax filing season. Employees should submit the form to their employer as soon as they determine their eligibility for the Earned Income Tax Credit, ideally before the end of the calendar year. Employers must then ensure that the appropriate tax withholdings are adjusted accordingly. It is advisable to keep track of any changes in deadlines announced by the IRS to avoid missing important dates.

Eligibility Criteria

To be eligible to use the W5 form, employees must meet certain criteria. This includes having earned income within specified limits, meeting residency requirements, and having qualifying children or dependents. Additionally, employees must not be claimed as a dependent on someone else's tax return. Understanding these criteria is essential for individuals seeking to benefit from the Earned Income Tax Credit and to ensure proper completion of the W5 form.

Quick guide on how to complete w5 form

Prepare W5 Form with ease on any gadget

Digital document management has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage W5 Form on any gadget using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign W5 Form effortlessly

- Find W5 Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow designed specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a customary wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, arduous form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and electronically sign W5 Form to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a W5 form and why is it important?

A W5 form is a crucial document used for tax purposes, primarily for independent contractors and freelancers. It helps in providing necessary information to the IRS for determining tax withholding. Understanding the W5 form is essential for ensuring compliance and avoiding potential tax issues.

-

How can airSlate SignNow help me manage W5 forms?

airSlate SignNow offers an intuitive platform for electronically signing and managing W5 forms seamlessly. Our solution allows you to upload, send, and store W5 forms securely, ensuring you never lose important documentation. This streamlines your workflow and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for W5 forms?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs, allowing you to manage W5 forms efficiently. Our cost-effective solutions provide excellent value for the features offered. Be sure to check our pricing page for detailed information on the plans available.

-

Can I integrate airSlate SignNow with other software for handling W5 forms?

Absolutely! airSlate SignNow supports integration with numerous software solutions to enhance your workflow when managing W5 forms. Integrate with platforms such as CRM systems or accounting software to streamline data transfer and ensure accuracy.

-

What features does airSlate SignNow offer for handling W5 forms?

airSlate SignNow provides features like electronic signatures, document templates, and secure storage specifically for W5 forms. These features empower users to complete documents quickly while maintaining a high level of security. Our platform is designed to simplify document management, making it a breeze for busy professionals.

-

How does airSlate SignNow ensure the security of my W5 forms?

We prioritize security at airSlate SignNow by employing advanced encryption and secure storage protocols for your W5 forms. Our platform complies with industry standards to protect sensitive information. You can confidently manage your documents knowing they are safe with us.

-

Can I track the status of my W5 forms with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your W5 forms. This means you can see whether the document has been sent, viewed, or signed. This feature enhances transparency and keeps all parties informed throughout the process.

Get more for W5 Form

Find out other W5 Form

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template