Govform9465

What is the Govform9465

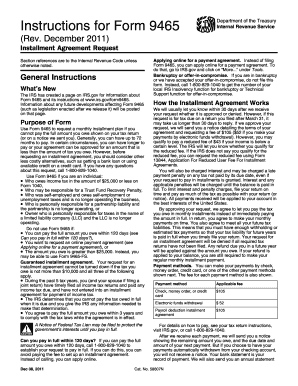

The Govform9465, also known as the Installment Agreement Request, is a form used by taxpayers in the United States to request a monthly installment plan for paying their federal income tax liabilities. This form is essential for individuals who are unable to pay their tax debt in full by the due date. By submitting the Govform9465, taxpayers can propose a manageable payment plan that allows them to settle their debts over time while remaining compliant with IRS regulations.

How to use the Govform9465

Using the Govform9465 involves several straightforward steps. First, ensure you have all necessary financial information, such as your total tax liability and current income. Next, fill out the form accurately, providing details about your financial situation and the proposed monthly payment amount. Once completed, submit the form to the IRS using the appropriate method, which can include online submission, mailing, or in-person delivery at designated IRS offices. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Govform9465

Completing the Govform9465 requires careful attention to detail. Follow these steps:

- Gather your financial documents, including your most recent tax return and any supporting income documentation.

- Download the Govform9465 from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your tax liability, including the total amount owed and the tax year.

- Indicate the proposed monthly payment amount and the preferred payment date.

- Sign and date the form to validate your request.

Legal use of the Govform9465

The Govform9465 is legally binding once submitted and accepted by the IRS. It is important to understand that entering into an installment agreement does not eliminate the tax liability; it merely allows for a structured repayment plan. Taxpayers must adhere to the terms of the agreement, making timely payments to avoid penalties and interest. Failure to comply with the agreement can result in the IRS taking further collection actions.

Filing Deadlines / Important Dates

When submitting the Govform9465, it is essential to be aware of relevant deadlines. Typically, the form should be filed as soon as a taxpayer realizes they cannot pay their tax bill in full. It is advisable to submit the form before the tax payment due date to avoid additional penalties. If you are requesting an installment agreement after the due date, be prepared for potential interest and penalties on the outstanding balance.

Required Documents

To successfully complete the Govform9465, certain documents may be required. These include:

- Your most recent federal tax return.

- Documentation of your income, such as pay stubs or bank statements.

- Details of any other debts or financial obligations.

Having these documents ready will facilitate the completion of the form and support your proposed payment plan.

Who Issues the Form

The Govform9465 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations and options for managing tax liabilities.

Quick guide on how to complete govform9465

Accomplish Govform9465 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the needed form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents quickly and efficiently. Manage Govform9465 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and electronically sign Govform9465 with ease

- Locate Govform9465 and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Alter and electronically sign Govform9465 and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Govform9465 and how can it benefit me?

Govform9465 is a form used to request a monthly installment agreement from the IRS. Utilizing airSlate SignNow to complete and eSign Govform9465 simplifies the process, making it efficient and user-friendly. This allows users to manage their tax obligations with ease and ensures they meet deadlines without hassle.

-

How much does airSlate SignNow cost for using Govform9465?

airSlate SignNow offers a range of pricing plans that accommodate various needs, including those who need to complete Govform9465. Pricing is competitive, and the features included, such as document templates and easy eSigning, provide excellent value. Get started with a free trial to see how it fits your budget.

-

Can I integrate Govform9465 with other software using airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing your workflow when handling Govform9465. Whether you need to connect with CRM systems or cloud storage solutions, these integrations allow you to maintain efficiency throughout your document management process. This flexibility is ideal for businesses of all sizes.

-

What features does airSlate SignNow offer for eSigning Govform9465?

airSlate SignNow provides robust eSigning features for Govform9465, including customizable signing workflows, secure electronic signatures, and tracking capabilities. These features enhance the document signing experience, ensuring that all parties can sign with confidence and security. Additionally, you receive notifications to stay updated on the signing status.

-

Is airSlate SignNow secure for submitting sensitive forms like Govform9465?

Absolutely, airSlate SignNow prioritizes security, featuring encryption and compliance with industry standards for submitting sensitive documents like Govform9465. All data is securely stored, and the platform regularly undergoes audits to ensure your information remains protected. You can confidently manage your tax agreements knowing your data is safe.

-

How do I create a template for Govform9465 in airSlate SignNow?

Creating a template for Govform9465 in airSlate SignNow is straightforward. Simply upload your document, customize the fields as needed, and save it as a template for future use. This streamlines the process for yourself or your team, allowing for quick and efficient submissions moving forward.

-

What benefits does airSlate SignNow provide for businesses managing Govform9465?

For businesses managing Govform9465, airSlate SignNow offers increased efficiency, reduced turnaround times, and enhanced compliance with IRS submission guidelines. The platform simplifies collaboration, allows for easy storage and retrieval of documents, and helps organize tax-related paperwork seamlessly. This leads to better management of financial obligations.

Get more for Govform9465

- Assignment of mortgage package ohio form

- Assignment of lease package ohio form

- Ohio purchase form

- Satisfaction cancellation or release of mortgage package ohio form

- Premarital agreements package ohio form

- Painting contractor package ohio form

- Framing contractor package ohio form

- Foundation contractor package ohio form

Find out other Govform9465

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document