Instructions Form 8863

What is the Instructions Form 8863

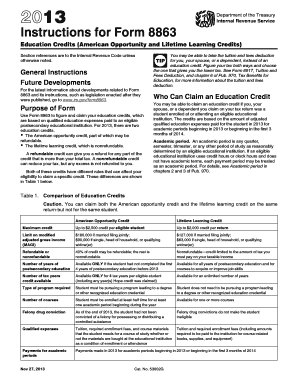

The Instructions Form 8863 is a document provided by the Internal Revenue Service (IRS) that outlines how to claim education credits on your tax return. Specifically, it helps taxpayers understand how to complete Form 8863, which is used to claim the American Opportunity Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed, making education more affordable for eligible students and their families.

How to use the Instructions Form 8863

Using the Instructions Form 8863 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your educational expenses and the details of the qualified educational institution. Next, follow the step-by-step guidance provided in the instructions to fill out Form 8863 correctly. This includes entering personal information, calculating the credits, and understanding any limitations or eligibility criteria. Finally, attach the completed form to your tax return when filing.

Steps to complete the Instructions Form 8863

Completing the Instructions Form 8863 requires careful attention to detail. Start by reading the instructions thoroughly to understand the requirements. Then, proceed with the following steps:

- Gather your tax documents, including Form 1098-T from your educational institution.

- Determine your eligibility for the American Opportunity Credit or the Lifetime Learning Credit.

- Fill out the form by providing necessary information, such as your name, Social Security number, and educational expenses.

- Calculate the credits you are eligible for based on the provided guidelines.

- Review the completed form for accuracy before submission.

Legal use of the Instructions Form 8863

The Instructions Form 8863 is legally recognized as part of the tax filing process in the United States. To ensure its legal validity, it is important to follow the IRS guidelines closely. This includes accurately reporting educational expenses and ensuring that all information provided is truthful and complete. The form must be submitted along with your tax return to claim the credits, and any discrepancies could result in penalties or delays in processing your return.

Eligibility Criteria

To qualify for the credits claimed on Form 8863, taxpayers must meet specific eligibility criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and must not have completed four years of post-secondary education before the tax year. The Lifetime Learning Credit is available for students enrolled in courses to acquire or improve job skills, with no limit on the number of years it can be claimed. Income limits also apply, which can affect the amount of credit available.

Filing Deadlines / Important Dates

Filing deadlines for submitting the Instructions Form 8863 coincide with the general tax return deadlines. For most taxpayers, this is typically April 15 of the following year. However, if you are unable to file by this date, you may apply for an extension. It is important to note that any credits claimed must be submitted with your tax return by the deadline to ensure eligibility for that tax year. Keeping track of these dates is crucial for a smooth filing process.

Quick guide on how to complete instructions form 8863 2013

Accomplish Instructions Form 8863 effortlessly on any device

Digital document organization has gained traction with companies and individuals alike. It offers a superb eco-conscious substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to generate, modify, and eSign your documents quickly without delays. Manage Instructions Form 8863 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Instructions Form 8863 without hassle

- Find Instructions Form 8863 and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Instructions Form 8863 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the instructions form 8863 2013 used for?

The instructions form 8863 2013 are primarily used for claiming education credits on your tax return. This form helps taxpayers understand the eligible expenses and how to fill out the form accurately to receive their benefits. Understanding these instructions is crucial for ensuring you maximize your education-related tax breaks.

-

How can I access the instructions form 8863 2013?

You can access the instructions form 8863 2013 through the IRS website or various tax preparation software. These resources often provide a downloadable PDF of the instructions for easy reference. Having the right tools and information will facilitate the completion of this important form.

-

What features does airSlate SignNow offer for handling forms like the instructions form 8863 2013?

airSlate SignNow provides features like customizable templates, electronic signatures, and document sharing to handle forms efficiently. With these features, you can streamline the process of completing forms such as the instructions form 8863 2013 and ensure that all necessary signatures are collected promptly. This makes managing your documentation a seamless experience.

-

Is airSlate SignNow cost-effective for small businesses needing the instructions form 8863 2013?

Yes, airSlate SignNow is a cost-effective solution for small businesses in need of streamlined document processes, including the instructions form 8863 2013. With flexible pricing plans, it allows businesses to choose the options that best fit their budget. The investment pays off by saving time and reducing the hassle associated with paperwork.

-

Can I integrate airSlate SignNow with other tools while working on the instructions form 8863 2013?

Absolutely! airSlate SignNow integrates seamlessly with various CRM systems, cloud storage services, and productivity tools. This means you can manage your documents and complete tasks related to the instructions form 8863 2013 without needing to switch between multiple platforms, enhancing your efficiency.

-

What benefits does using airSlate SignNow offer when processing the instructions form 8863 2013?

Using airSlate SignNow streamlines the processing of the instructions form 8863 2013, allowing for faster completion times and improved accuracy. The platform's electronic signature capability ensures secure and legally-binding agreements. Additionally, team collaboration features enable efficient document handling among multiple users.

-

How does airSlate SignNow ensure the security of documents related to the instructions form 8863 2013?

airSlate SignNow employs industry-standard security measures to protect documents associated with the instructions form 8863 2013. This includes data encryption, secure cloud storage, and compliance with regulatory standards. You can rest assured that sensitive information is safeguarded during the document signing process.

Get more for Instructions Form 8863

- Plumbing contractor package ohio form

- Brick mason contractor package ohio form

- Roofing contractor package ohio form

- Electrical contractor package ohio form

- Sheetrock drywall contractor package ohio form

- Flooring contractor package ohio form

- Trim carpentry contractor package ohio form

- Fencing contractor package ohio form

Find out other Instructions Form 8863

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF