13614 Nr Form

What is the 13614 NR?

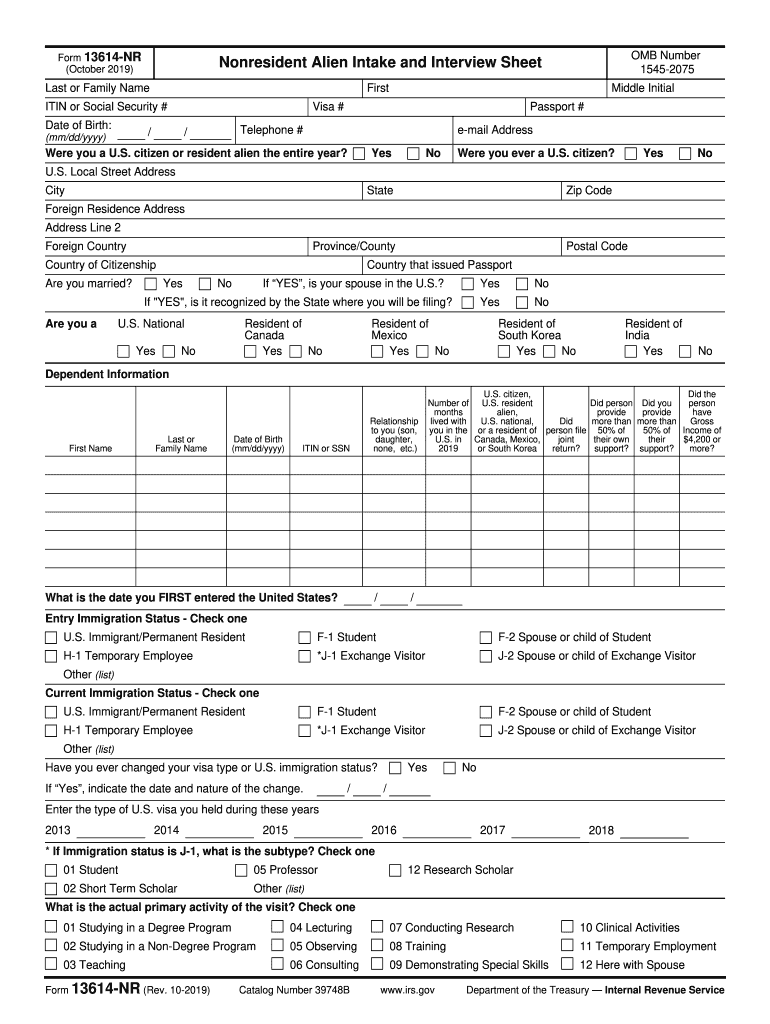

The 13614 NR form is a critical document used by non-resident aliens in the United States for tax purposes. It serves as a means for individuals who are not U.S. citizens or permanent residents to report their income and determine their tax obligations. This form is essential for ensuring compliance with U.S. tax laws, particularly for those who earn income from U.S. sources. Understanding the purpose and requirements of the 13614 NR is vital for non-resident taxpayers to avoid potential penalties and ensure accurate reporting.

How to use the 13614 NR

Using the 13614 NR form involves several key steps. First, gather all necessary documentation related to your income, deductions, and any applicable tax treaties between your home country and the U.S. Next, accurately complete the form by providing personal information, income details, and any relevant deductions. It is crucial to review the instructions carefully to ensure all sections are filled out correctly. Once completed, the form can be submitted electronically or via mail, depending on your specific situation.

Steps to complete the 13614 NR

Completing the 13614 NR form requires attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and taxpayer identification number.

- Report your income accurately in the designated sections, ensuring you include all sources of income.

- Apply any deductions or credits you are eligible for, referencing the appropriate guidelines.

- Review the form for accuracy and completeness before submission.

Legal use of the 13614 NR

The legal use of the 13614 NR form is governed by U.S. tax regulations. It is essential for non-resident aliens to use this form to report their income accurately and comply with federal tax laws. Failure to file the form correctly can result in penalties, including fines and interest on unpaid taxes. Additionally, the information provided on the form may be subject to review by the IRS, making accuracy paramount in maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 13614 NR form are critical for compliance. Typically, non-resident aliens must file their tax returns by April fifteenth of the following year. However, if you are a non-resident alien who is not receiving wages subject to U.S. income tax withholding, you may have until June fifteenth to file. It is essential to be aware of these dates to avoid penalties and ensure timely processing of your tax return.

Required Documents

To complete the 13614 NR form, certain documents are necessary. These include:

- Proof of identity, such as a passport or national identification card.

- Income statements, including W-2s or 1099s.

- Documentation of any deductions or credits claimed.

- Tax treaty information, if applicable, to determine eligibility for reduced tax rates.

Examples of using the 13614 NR

Examples of scenarios where the 13614 NR form is used include:

- A student from a foreign country studying in the U.S. who earns income through a part-time job.

- A non-resident alien providing freelance services to U.S.-based clients.

- An individual receiving rental income from property located in the United States.

Quick guide on how to complete 13614 nr

Effortlessly Prepare 13614 Nr on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 13614 Nr on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and Electronically Sign 13614 Nr

- Find 13614 Nr and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to apply your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 13614 Nr to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 13614 nr. plan offered by airSlate SignNow?

The 13614 nr. plan is a tailored pricing option from airSlate SignNow that provides businesses the flexibility to manage their eSigning needs efficiently. This plan is designed for companies that require a scalable solution to send and eSign documents securely. With features included in this plan, you can enhance your document workflow.

-

How does airSlate SignNow ensure the security of documents under the 13614 nr. plan?

AirSlate SignNow prioritizes security with its 13614 nr. plan by employing advanced encryption methods for document handling. All data is secured through SSL protocols, ensuring that sensitive information remains confidential during the signing process. Our compliance with industry standards reassures users of secure transactions.

-

What features are included in the 13614 nr. subscription?

The 13614 nr. subscription comes packed with essential features such as unlimited document signing, customizable templates, and real-time tracking of your documents. Additionally, users enjoy integration capabilities with popular tools, making it an ideal choice for a streamlined document management experience. These features collectively enhance productivity.

-

What are the advantages of using airSlate SignNow's 13614 nr. plan for businesses?

Using airSlate SignNow's 13614 nr. plan allows businesses to reduce paper usage, leading to cost savings and environmental benefits. This solution offers a user-friendly interface that simplifies the signing process, ensuring faster turnaround times. Overall, these advantages contribute to better efficiency and improved client satisfaction.

-

Can I integrate other software with the 13614 nr. plan?

Yes, the 13614 nr. plan is designed for flexibility and compatibility with various software applications. Users can integrate tools such as CRM systems, cloud storage services, and productivity apps to their workflow. This feature allows for a more cohesive and productive experience when managing documents.

-

What types of businesses benefit the most from the 13614 nr. plan?

The 13614 nr. plan is particularly beneficial for small to medium-sized enterprises that frequently handle contracts and agreements. Businesses in sectors like real estate, finance, and healthcare find this plan useful for its efficiency and security features. This enables companies to streamline their document processes while maintaining compliance.

-

How can customers get support for the 13614 nr. plan?

Customers using the 13614 nr. plan can access support through various channels, including email, live chat, and phone consultations. Our dedicated support team is available to assist with any inquiries or technical issues. This commitment to service ensures that users can fully leverage the capabilities of airSlate SignNow.

Get more for 13614 Nr

Find out other 13614 Nr

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile