Local Bankruptcy Rules Forms Central District of California United Cacb Uscourts

Legal use of the F 1002 1 form

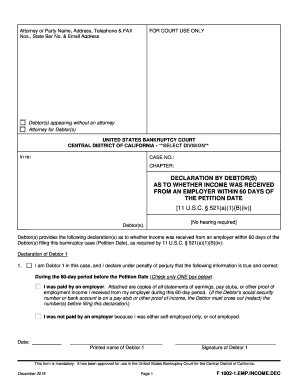

The F 1002 1 form, often referred to as the 1002 1 declaration, is essential in bankruptcy proceedings within the Central District of California. This form is designed to provide a comprehensive declaration of income and expenses, which is critical for determining eligibility for bankruptcy relief. To ensure its legal validity, it must be completed accurately and submitted in accordance with local bankruptcy rules. The form must be signed by the debtor, affirming that the information provided is true and correct to the best of their knowledge. Failure to adhere to these requirements may result in delays or complications in the bankruptcy process.

Steps to complete the F 1002 1 form

Completing the F 1002 1 form involves several key steps to ensure accuracy and compliance with legal standards:

- Gather necessary financial documents, including income statements, expense reports, and any other relevant financial information.

- Carefully fill out each section of the form, ensuring that all income sources and expenses are accurately reported.

- Review the completed form for any errors or omissions, as inaccuracies can lead to legal repercussions.

- Sign the form, certifying that the information is truthful and complete.

- Submit the form according to the guidelines set forth by the court, either electronically or via mail, as specified in local rules.

Who issues the F 1002 1 form?

The F 1002 1 form is issued by the United States Bankruptcy Court for the Central District of California. This court oversees all bankruptcy filings in its jurisdiction, ensuring that all forms and documents comply with federal and local bankruptcy laws. It is important for debtors to use the most current version of the form, as outdated forms may not be accepted by the court.

Required documents for the F 1002 1 form

To complete the F 1002 1 form effectively, several supporting documents are required. These include:

- Recent pay stubs or income statements to verify current earnings.

- Bank statements to provide a clear picture of financial activity.

- Documentation of monthly expenses, including bills and other financial obligations.

- Tax returns from the previous year, which may be requested to validate income claims.

Filing deadlines for the F 1002 1 form

Filing deadlines for the F 1002 1 form are crucial for maintaining compliance with bankruptcy proceedings. Typically, the form must be submitted alongside the bankruptcy petition, and specific deadlines may vary based on individual circumstances. It is essential to consult the court's calendar and local rules to ensure timely submission, as missing deadlines can lead to dismissal of the case or other legal complications.

Examples of using the F 1002 1 form

The F 1002 1 form is utilized in various scenarios within bankruptcy proceedings. For instance, individuals filing for Chapter Seven bankruptcy must provide this form to disclose their financial situation. Similarly, those seeking Chapter Thirteen bankruptcy must complete the form to outline their repayment plan. Each example highlights the importance of accurately detailing income and expenses to facilitate the bankruptcy process and ensure compliance with court requirements.

Quick guide on how to complete local bankruptcy rules forms central district of california united cacb uscourts

Complete Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts with ease

- Find Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to mislaid or lost documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the f 1002 incomedec and how does it work?

The f 1002 incomedec is a crucial document for reporting income information. With airSlate SignNow, you can easily send and eSign this document, ensuring fast and secure transaction processes. Our platform simplifies the management of the f 1002 incomedec by allowing you to template the document for repeated use.

-

What features does airSlate SignNow offer for the f 1002 incomedec?

airSlate SignNow offers an array of features specifically designed for handling the f 1002 incomedec. You can create, edit, and send documents with built-in eSignature functionality, making the process more efficient. Additionally, you can track the status of your documents and receive notifications when they are viewed or signed.

-

How much does airSlate SignNow cost for managing the f 1002 incomedec?

Our pricing for airSlate SignNow is cost-effective and flexible, especially for businesses that frequently manage documents like the f 1002 incomedec. We offer various plans, including monthly and annual subscriptions, tailored to different needs and usage levels. Visit our pricing page for a detailed breakdown of each plan.

-

Can I integrate airSlate SignNow with other tools for handling the f 1002 incomedec?

Yes, airSlate SignNow integrates with a variety of popular platforms, which enhances how you manage the f 1002 incomedec. You can connect it with CRMs, cloud storage, and other productivity tools to streamline your workflow. These integrations help you keep all your documents and data synchronized effortlessly.

-

What benefits does using airSlate SignNow for the f 1002 incomedec provide?

Using airSlate SignNow for the f 1002 incomedec ensures quicker turnaround times and increased productivity for businesses. The platform’s user-friendly interface encourages easy document handling, allowing teams to focus on what matters most. Additionally, our security measures protect your sensitive information during the eSigning process.

-

Is airSlate SignNow compliant with legal requirements for the f 1002 incomedec?

Absolutely, airSlate SignNow complies with legal requirements for electronic signatures, making it a reliable choice for managing the f 1002 incomedec. Our platform meets eSignature laws globally, ensuring that your legally binding documents are securely signed and stored. You can trust that your transactions are compliant with relevant regulations.

-

How can I get started with airSlate SignNow for the f 1002 incomedec?

Getting started with airSlate SignNow for the f 1002 incomedec is easy! Simply sign up for an account on our website, and you can start creating and sending your documents instantly. We also offer a free trial to help you explore our features without any commitment.

Get more for Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts

- Agreed written termination of lease by landlord and tenant oregon form

- Demand by mortgagee for list of labor and materials individual oregon form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497323748 form

- Notice breach lease 497323749 form

- Insurers report oregon form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497323751 form

- Insurer notice of closure summary oregon form

- Oregon provisions form

Find out other Local Bankruptcy Rules Forms Central District Of California United Cacb Uscourts

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF