Tax Exemption Certificates University of Delaware Form

Understanding the Tax Exemption Certificates University of Delaware

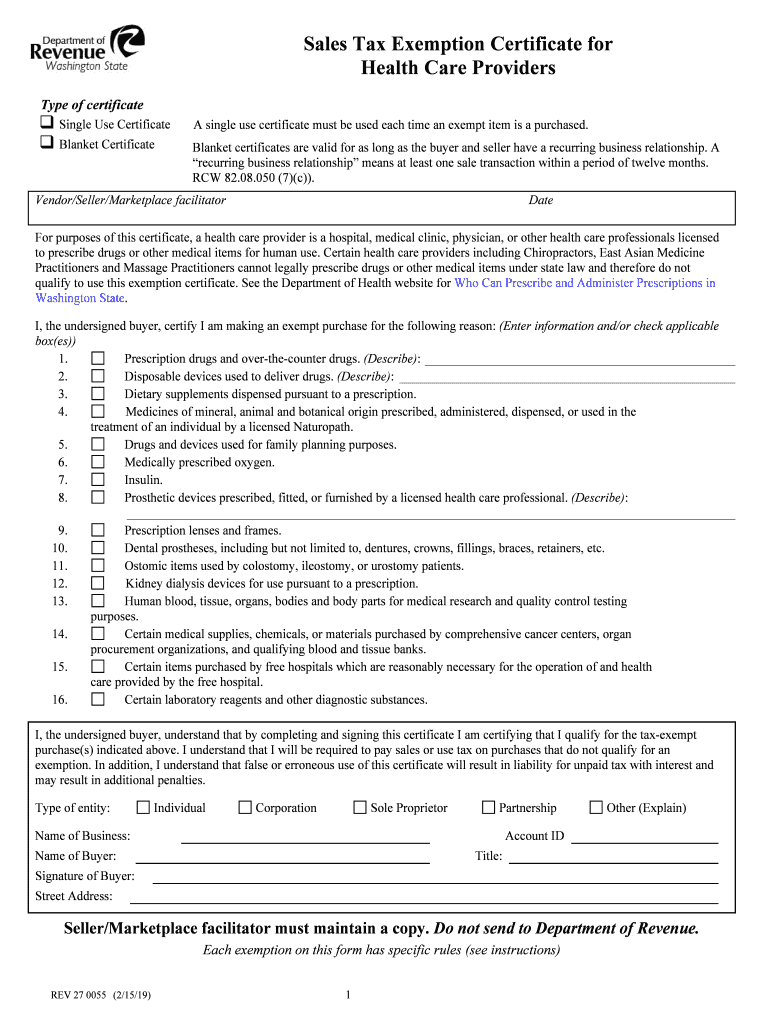

The Tax Exemption Certificates University of Delaware form is designed for entities seeking to purchase goods and services without incurring sales tax. This form is essential for qualifying organizations, such as educational institutions and non-profits, to demonstrate their tax-exempt status. By providing this certificate to vendors, these organizations can ensure compliance with state tax regulations while minimizing unnecessary expenses.

Steps to Complete the Tax Exemption Certificates University of Delaware

Completing the Tax Exemption Certificates University of Delaware involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including the organization's name, address, and tax-exempt identification number.

- Clearly indicate the purpose of the purchase and the specific items being acquired.

- Provide the signature of an authorized representative to validate the form.

- Ensure all sections of the form are filled out completely to avoid delays or rejections.

Legal Use of the Tax Exemption Certificates University of Delaware

The legal use of the Tax Exemption Certificates University of Delaware is governed by state tax laws. This form must be presented to vendors at the time of purchase to exempt qualifying transactions from sales tax. Misuse of the form, such as using it for personal purchases or non-qualifying items, can lead to penalties, including fines and loss of tax-exempt status.

Obtaining the Tax Exemption Certificates University of Delaware

To obtain the Tax Exemption Certificates University of Delaware, organizations typically need to follow these steps:

- Visit the official University of Delaware website or contact the university's finance department for the latest version of the form.

- Complete the required sections with accurate information about the organization.

- Submit the form to the appropriate department for verification, if necessary.

Examples of Using the Tax Exemption Certificates University of Delaware

Organizations may use the Tax Exemption Certificates University of Delaware in various scenarios, such as:

- Purchasing educational materials for classroom use.

- Acquiring equipment for research projects.

- Ordering supplies for non-profit events hosted by the institution.

Eligibility Criteria for the Tax Exemption Certificates University of Delaware

Eligibility for using the Tax Exemption Certificates University of Delaware typically includes:

- Being a recognized tax-exempt organization, such as a 501(c)(3) non-profit or educational institution.

- Having a valid tax-exempt identification number issued by the state.

- Using the certificate solely for purchases that directly support the organization’s mission.

Quick guide on how to complete tax exemption certificates university of delaware

Effortlessly Prepare Tax Exemption Certificates University Of Delaware on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb sustainable alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and keep it securely stored online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Tax Exemption Certificates University Of Delaware on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and eSign Tax Exemption Certificates University Of Delaware Seamlessly

- Obtain Tax Exemption Certificates University Of Delaware and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure private information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Modify and eSign Tax Exemption Certificates University Of Delaware to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tax exempt form and why do I need it?

A tax exempt form is a document that allows qualifying organizations and individuals to make purchases without paying sales tax. This form is essential for non-profits, government entities, and certain businesses to maintain compliance and save money on taxable purchases.

-

How can airSlate SignNow help me manage my tax exempt forms?

airSlate SignNow offers a user-friendly platform to easily create, sign, and store tax exempt forms. With our solution, you can streamline the process of obtaining signatures and ensuring your transactions remain tax exempt.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms?

Our pricing plans are designed to be cost-effective, offering various options that cater to different needs. You can start with a free trial to explore how our service can efficiently handle your tax exempt forms without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax exempt form management?

Yes, airSlate SignNow provides seamless integrations with various applications, allowing you to manage your tax exempt forms alongside your other business tools. This interoperability makes it easier to track documentation and streamline workflows.

-

What features does airSlate SignNow provide for tax exempt forms?

Our platform includes features like customizable templates, real-time tracking, and secure cloud storage, all tailored for managing tax exempt forms. These features enhance efficiency and ensure your documents are always accessible and organized.

-

How do I ensure my tax exempt form is valid?

To ensure your tax exempt form is valid, complete all required fields accurately and review your local state regulations. airSlate SignNow helps verify the authenticity of your forms through electronic signatures and record-keeping, providing peace of mind.

-

Can I send tax exempt forms to multiple recipients at once?

Absolutely! airSlate SignNow allows you to send tax exempt forms to multiple recipients simultaneously, saving time and streamlining the signing process. This feature is especially useful for organizations that require multiple approvals on a single document.

Get more for Tax Exemption Certificates University Of Delaware

- Individual credit application oregon form

- Wage agreement 497323777 form

- Interrogatories to plaintiff for motor vehicle occurrence oregon form

- Interrogatories to defendant for motor vehicle accident oregon form

- Llc notices resolutions and other operations forms package oregon

- Worker request for reconsideration spanish oregon form

- Worker request for reconsideration oregon form

- Insurer request for reconsideration oregon form

Find out other Tax Exemption Certificates University Of Delaware

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document