Form 1093 Irs

What is the Form 1093 IRS

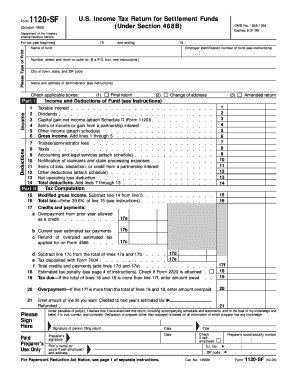

The Form 1093, also known as the 1093 application form, is a document utilized in various contexts, primarily related to tax and legal matters in the United States. This form is often required by the IRS for specific reporting purposes and is vital for ensuring compliance with federal regulations. Understanding what the 1093 form entails is essential for individuals and businesses to avoid penalties and maintain proper documentation.

How to Use the Form 1093 IRS

Using the Form 1093 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and any relevant financial data. Next, fill out the form carefully, ensuring that all sections are completed as required. Once the form is filled out, it can be submitted electronically through a secure platform or mailed directly to the appropriate IRS office. Familiarizing oneself with the specific instructions related to the 1093 form is crucial for effective use.

Steps to Complete the Form 1093 IRS

Completing the Form 1093 requires attention to detail and adherence to specific guidelines. Follow these steps for a successful submission:

- Review the form to understand the required information.

- Collect necessary documents, such as identification and financial records.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check for any errors or omissions before submission.

- Submit the form electronically or by mail, depending on your preference.

Legal Use of the Form 1093 IRS

The legal use of the Form 1093 is governed by specific regulations that ensure its validity. For a form to be legally binding, it must meet certain criteria, including proper signatures and adherence to eSignature laws. Utilizing a trusted eSigning solution can enhance the legal standing of the completed form, ensuring compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1093 are crucial for compliance with IRS regulations. It is essential to be aware of these dates to avoid penalties. Generally, the form must be submitted by the specified due date, which can vary depending on the type of filing and the specific circumstances of the taxpayer. Keeping a calendar of important dates related to the 1093 form can help ensure timely submissions.

Required Documents

To complete the Form 1093, certain documents are typically required. These may include:

- Personal identification, such as a Social Security number or taxpayer identification number.

- Financial statements or records relevant to the information being reported.

- Any previous tax forms that may provide context or necessary data.

Having these documents ready can streamline the completion process and reduce the likelihood of errors.

Quick guide on how to complete form 1093 irs 5499359

Effortlessly Prepare Form 1093 Irs on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed papers, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without holdups. Manage Form 1093 Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Edit and Electronically Sign Form 1093 Irs with Ease

- Obtain Form 1093 Irs and click on Get Form to begin.

- Utilize the tools provided to fill in your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Alter and electronically sign Form 1093 Irs and guarantee excellent communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 1093 and how is it used?

Form 1093 is a tax form used by businesses to report certain financial information to the IRS. It helps streamline the reporting process, ensuring compliance with tax regulations. Using airSlate SignNow to manage Form 1093 allows for secure electronic signatures and easy document tracking.

-

How can airSlate SignNow help me with Form 1093?

airSlate SignNow provides a user-friendly platform to complete and eSign Form 1093 electronically. This eliminates the hassle of printing, signing, and scanning, making the entire process quicker and more efficient. Our solution also offers templates and integrations to simplify your workflow.

-

Is there a cost associated with using airSlate SignNow for Form 1093?

Yes, there are various pricing plans available for airSlate SignNow users, which provide different features and levels of access. These plans are designed to be cost-effective, ensuring you only pay for the tools you need to efficiently manage Form 1093 and other documents. You can explore the pricing options on our website.

-

What features does airSlate SignNow offer for managing Form 1093?

airSlate SignNow offers a range of features for managing Form 1093, including customizable templates, automated workflows, and secure electronic signatures. Additionally, you can track document status in real-time, making it easier to manage submissions and comply with deadlines.

-

Are there integrations available for Form 1093 with airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various third-party applications that can enhance how you handle Form 1093. Users can connect their existing tools, such as CRM and accounting software, to streamline their processes. This integration helps maintain consistency across your workflow.

-

What are the benefits of using airSlate SignNow for Form 1093?

Using airSlate SignNow for Form 1093 provides numerous benefits, including time savings, reduced paperwork, and improved accuracy through automated data entry. Additionally, the platform ensures compliance and security, giving you peace of mind when handling sensitive financial documents.

-

Can I track the status of my Form 1093 with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form 1093 in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay updated on its progress and can take appropriate action if needed.

Get more for Form 1093 Irs

- Warranty deed from two individuals to husband and wife oregon form

- Deed husband wife 497323603 form

- Death deed 497323604 form

- Quitclaim deed from a limited liability company to two individuals oregon form

- Two husband wife 497323606 form

- Quitclaim deed from husband and wife to trust oregon form

- Oregon warranty deed form 497323608

- Quitclaim deed from individual to trust oregon form

Find out other Form 1093 Irs

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online