Simplified Method Worksheet Form

What is the Simplified Method Worksheet

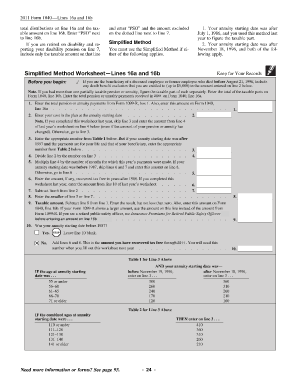

The Simplified Method Worksheet is a tax form used by individuals to calculate the taxable amount of certain distributions from retirement accounts, specifically focusing on the tax implications of these distributions. This worksheet is particularly relevant for those who receive distributions from qualified retirement plans and need to determine the portion that is taxable. It streamlines the process by allowing taxpayers to apply a simplified calculation method, making it easier to report income accurately on their tax returns.

How to use the Simplified Method Worksheet

Using the Simplified Method Worksheet involves several straightforward steps. First, gather all necessary information related to your retirement distributions, including the total amount received and any previously taxed contributions. Next, follow the worksheet's instructions to input your figures accurately. The worksheet will guide you through calculations to determine the taxable amount. It is essential to ensure that all entries are correct to avoid discrepancies in your tax filing.

Steps to complete the Simplified Method Worksheet

Completing the Simplified Method Worksheet requires careful attention to detail. Begin by filling in your personal information at the top of the form. Then, you will need to calculate the total amount of your retirement distributions. Follow the prompts to identify how much of this amount has already been taxed. The worksheet will require you to perform basic calculations to arrive at the taxable portion of your distributions. Finally, review your entries for accuracy before submitting your tax return.

IRS Guidelines

The IRS provides specific guidelines for using the Simplified Method Worksheet, ensuring that taxpayers understand how to apply it correctly. According to IRS instructions, the worksheet is designed for use with distributions from qualified retirement plans, including 401(k)s and IRAs. It is crucial to adhere to these guidelines to ensure compliance with tax regulations and to avoid potential penalties. Taxpayers should also be aware of any updates or changes to IRS policies that may affect their use of the worksheet.

Legal use of the Simplified Method Worksheet

The legal use of the Simplified Method Worksheet hinges on its compliance with IRS regulations. This form is recognized as a legitimate tool for calculating taxable amounts from retirement distributions, provided it is filled out accurately and submitted in accordance with IRS guidelines. Using the worksheet correctly can help taxpayers avoid legal issues related to underreporting income or miscalculating taxes owed.

Eligibility Criteria

To utilize the Simplified Method Worksheet, taxpayers must meet specific eligibility criteria. Generally, it is applicable to individuals who have received distributions from qualified retirement plans and have previously made after-tax contributions to these plans. Understanding these criteria is essential for determining whether the worksheet is the appropriate tool for your tax situation. If you do not meet the eligibility requirements, alternative methods may need to be considered for calculating taxable amounts.

Quick guide on how to complete simplified method worksheet

Manage Simplified Method Worksheet effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Simplified Method Worksheet on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Simplified Method Worksheet with ease

- Find Simplified Method Worksheet and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow designed for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Simplified Method Worksheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a simplified method worksheet?

A simplified method worksheet is a tool designed to streamline the process of managing documents. With airSlate SignNow, this worksheet helps businesses easily track and organize their paperwork, ensuring efficiency and clarity.

-

How does airSlate SignNow enhance the use of a simplified method worksheet?

airSlate SignNow enhances the simplified method worksheet by integrating eSignature capabilities that allow users to send, sign, and manage documents all in one platform. This not only saves time but also increases accuracy and reduces paperwork.

-

What are the pricing options for using a simplified method worksheet with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business sizes, making the simplified method worksheet accessible for everyone. Pricing is based on features, volume of documents, and additional integrations, allowing you to choose the best fit for your needs.

-

Can I integrate the simplified method worksheet with other applications?

Yes, airSlate SignNow allows for seamless integrations with numerous applications, enhancing the functionality of your simplified method worksheet. This means you can easily connect your workflow with tools like Google Drive, Dropbox, and CRMs to improve collaboration.

-

What are the benefits of using a simplified method worksheet in my business?

The primary benefit of using a simplified method worksheet is increased efficiency in document management. Additionally, airSlate SignNow provides features like eSigning and automatic reminders, helping to reduce errors and improve turnaround times in your business processes.

-

Is the simplified method worksheet suitable for small businesses?

Absolutely! The simplified method worksheet is particularly beneficial for small businesses navigating limited resources. airSlate SignNow’s user-friendly interface allows small teams to efficiently manage their documentation without requiring extensive training or technical expertise.

-

Does airSlate SignNow support mobile access for the simplified method worksheet?

Yes, airSlate SignNow supports mobile access, enabling users to manage their simplified method worksheet on-the-go. This feature ensures that you can send, sign, and track documents from anywhere, providing maximum flexibility for your business operations.

Get more for Simplified Method Worksheet

- Filing lien oregon form

- Quitclaim deed from individual to corporation oregon form

- Warranty deed from individual to corporation oregon form

- Transfer on death deed from an individual ownergrantor to four individual beneficiaries oregon form

- Oregon filing form

- Notice completion oregon form

- Oregon quitclaim deed 497323636 form

- Warranty deed from individual to llc oregon form

Find out other Simplified Method Worksheet

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online