Fatca Declaration Form

What is the Fatca Declaration Form

The Fatca Declaration Form is a crucial document for U.S. taxpayers, designed to comply with the Foreign Account Tax Compliance Act (FATCA). This form is primarily used to report foreign financial accounts and assets, ensuring that U.S. citizens and residents disclose their financial interests held outside the United States. The form helps the IRS collect information on foreign accounts to combat tax evasion and promote transparency in international finance.

How to use the Fatca Declaration Form

Using the Fatca Declaration Form involves several steps to ensure accurate completion and compliance with IRS regulations. First, gather all necessary information about your foreign financial accounts, including bank names, account numbers, and balances. Next, fill out the form with the required details, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific guidelines provided by the IRS.

Steps to complete the Fatca Declaration Form

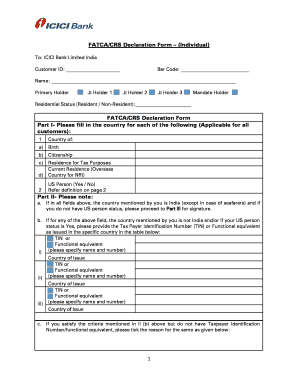

Completing the Fatca Declaration Form requires attention to detail. Start by downloading the form from the IRS website or obtaining it from your financial institution. Follow these steps:

- Provide your personal information, including your name, address, and taxpayer identification number.

- List all foreign financial accounts, including the name of the institution, the account type, and the maximum balance during the tax year.

- Indicate whether you are the owner of the accounts or if you have signature authority.

- Review the form for accuracy before submission.

Legal use of the Fatca Declaration Form

The Fatca Declaration Form is legally binding when completed correctly. It must be filed in accordance with IRS guidelines to avoid penalties. The form serves as a declaration of your foreign financial interests and is essential for compliance with U.S. tax laws. Failure to file accurately can result in significant fines and legal repercussions, emphasizing the importance of understanding its legal implications.

Required Documents

To complete the Fatca Declaration Form, certain documents are necessary. You will need:

- Your personal identification, such as a Social Security number or taxpayer identification number.

- Information about all foreign financial accounts, including statements and account details.

- Any relevant tax documents that may support your declaration.

Form Submission Methods

The Fatca Declaration Form can be submitted through various methods. Taxpayers have the option to file electronically using the IRS e-file system, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate IRS address. It is important to check the IRS guidelines for the correct submission method and ensure that the form is sent before the filing deadline to avoid penalties.

Quick guide on how to complete fatca declaration form

Effortlessly Prepare Fatca Declaration Form on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Fatca Declaration Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Fatca Declaration Form with Ease

- Find Fatca Declaration Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fatca Declaration Form to ensure effective communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a FATCA declaration, and why do I need one?

A FATCA declaration is a document required by the U.S. Internal Revenue Service to identify U.S. taxpayers with foreign financial accounts. It ensures compliance with tax regulations and helps avoid penalties. If you have international investments or accounts, submitting a FATCA declaration is vital.

-

How can airSlate SignNow help with my FATCA declaration?

airSlate SignNow streamlines the process of signing and submitting your FATCA declaration electronically. With features like eSignatures, document templates, and secure storage, it simplifies compliance and reduces paperwork. This makes your FATCA declaration submission quick and efficient.

-

Is airSlate SignNow cost-effective for managing FATCA declarations?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes looking to manage FATCA declarations. By using our platform, you can save costs associated with paper handling and postage. The ease of electronic management further enhances your cost-effectiveness.

-

What features does airSlate SignNow provide for FATCA declarations?

Our platform includes features such as customizable templates, eSigning capabilities, and secure document storage tailored for FATCA declarations. You can also track the status of your documents in real-time, ensuring you remain compliant efficiently. These tools enhance your overall workflow.

-

Can airSlate SignNow integrate with other software for my FATCA declaration needs?

Absolutely! airSlate SignNow can integrate seamlessly with various applications, like CRMs or accounting software, to enhance your FATCA declaration management. This connectivity allows for data synchronization and streamlined processes. Check our integrations page for compatibility details.

-

Is airSlate SignNow secure for hosting my FATCA declaration?

Yes, security is a top priority at airSlate SignNow. Our platform complies with industry standards for data protection, ensuring your FATCA declaration and sensitive information remain secure. We use encryption and secure access protocols to safeguard your documents.

-

What are the benefits of using airSlate SignNow for FATCA declarations?

Using airSlate SignNow for your FATCA declaration offers numerous benefits, including time savings, reduced errors, and increased compliance assurance. The user-friendly interface makes it easy for anyone to navigate. Our platform also provides detailed tracking and audit trails for your declarations.

Get more for Fatca Declaration Form

- Bill of sale without warranty by individual seller rhode island form

- Bill of sale without warranty by corporate seller rhode island form

- Chapter 13 plan and coversheet rhode island form

- Rhode island agreement 497325252 form

- Verification of creditors matrix rhode island form

- Correction statement and agreement rhode island form

- Closing statement rhode island form

- Flood zone statement and authorization rhode island form

Find out other Fatca Declaration Form

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe