Georgia Cobb County Occupancy Excise Form

What is the Georgia Cobb County Occupancy Excise?

The Georgia Cobb County Occupancy Excise is a tax levied on the rental of rooms in hotels, motels, and similar establishments within Cobb County. This tax is applicable to guests who stay in these accommodations for a short duration. The revenue generated from this excise tax is typically used to support local tourism initiatives and infrastructure development in the county. Understanding this tax is essential for hotel and motel operators, as well as for guests who wish to be informed about additional charges during their stay.

How to Obtain the Georgia Cobb County Occupancy Excise

To obtain the Georgia Cobb County Occupancy Excise, businesses must first register with the Cobb County tax office. This involves filling out the necessary forms and providing required documentation, such as proof of business ownership and identification. Once registered, businesses will receive a license that allows them to collect the occupancy excise tax from guests. It is crucial for operators to keep their registration current and to renew it as required by local regulations.

Steps to Complete the Georgia Cobb County Occupancy Excise

Completing the Georgia Cobb County Occupancy Excise involves several key steps:

- Register your business with the Cobb County tax office.

- Collect the occupancy excise tax from guests at the time of payment.

- Maintain accurate records of all rentals and taxes collected.

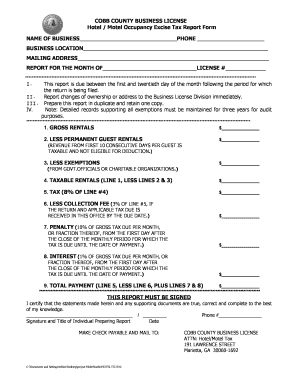

- Complete the occupancy excise report, detailing the total rentals and taxes due.

- Submit the report and remit the collected taxes to the Cobb County tax office by the designated deadlines.

Legal Use of the Georgia Cobb County Occupancy Excise

The legal use of the Georgia Cobb County Occupancy Excise requires compliance with local tax laws and regulations. Businesses must ensure that they are accurately collecting and remitting the excise tax as mandated. Failure to comply can result in penalties, including fines and potential legal action. It is advisable for operators to stay informed about any changes in tax laws that may affect their obligations.

Required Documents for the Georgia Cobb County Occupancy Excise

When applying for the Georgia Cobb County Occupancy Excise, several documents are required to ensure a smooth registration process. These typically include:

- Proof of business ownership, such as a business license.

- Identification documents for the business owner.

- Completed registration forms provided by the Cobb County tax office.

- Any additional documentation requested by the tax office.

Penalties for Non-Compliance

Non-compliance with the Georgia Cobb County Occupancy Excise regulations can lead to significant penalties. Businesses that fail to collect or remit the excise tax may face fines, interest on unpaid taxes, and potential legal consequences. It is essential for operators to understand their responsibilities and ensure timely compliance to avoid these repercussions.

Quick guide on how to complete georgia cobb county occupancy excise

Prepare Georgia Cobb County Occupancy Excise effortlessly on every device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to acquire the right format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any holdups. Handle Georgia Cobb County Occupancy Excise on any device using airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest method to edit and eSign Georgia Cobb County Occupancy Excise effortlessly

- Find Georgia Cobb County Occupancy Excise and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal standing as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or mislocated documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Georgia Cobb County Occupancy Excise and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Cobb license excise tax?

The Cobb license excise tax is a tax applied to businesses operating within Cobb County, Georgia. This tax is based on the gross revenue generated from business operations and must be filed annually to comply with local regulations. Understanding this tax is essential for businesses in the area to avoid penalties.

-

How can airSlate SignNow help with documents related to Cobb license excise tax?

airSlate SignNow streamlines the document management process by allowing businesses to eSign and send documents related to the Cobb license excise tax quickly and efficiently. This ensures that your tax forms are submitted on time and with all necessary signatures. Our platform simplifies the entire workflow, so you can focus on running your business.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of different businesses. Plans are available for individuals, small teams, and larger enterprises, allowing you to choose the one that best suits your needs while ensuring effective management of documents related to the Cobb license excise tax.

-

Are there specific features that assist with tax document management?

Yes, airSlate SignNow includes features such as customizable templates and automated reminders to ensure that all documents related to the Cobb license excise tax are properly managed. These features help reduce errors and make the filing process straightforward. Additionally, our secure cloud storage keeps your sensitive tax documents safe.

-

Is airSlate SignNow compliant with legal standards for tax documents?

Absolutely, airSlate SignNow is designed to comply with all legal standards for document management, including those pertaining to tax documents such as the Cobb license excise tax. Our platform employs advanced security measures and electronic signature laws, ensuring that your documents are valid and secure.

-

Can I integrate airSlate SignNow with other software for better productivity?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, accounting software, and cloud storage services. This allows businesses to enhance productivity and streamline the process of handling documents related to the Cobb license excise tax, all from a single platform.

-

What benefits does using airSlate SignNow offer for managing taxes?

Using airSlate SignNow to manage tax documents offers signNow benefits, including reduced paperwork, increased efficiency, and enhanced security. By simplifying the eSigning process for your Cobb license excise tax documents, you can ensure timely compliance and focus more on growing your business.

Get more for Georgia Cobb County Occupancy Excise

- Contract for deed package rhode island form

- Living will form 497325351

- Power of attorney forms package rhode island

- Revocation of statutory equivalent of living will or declaration rhode island form

- Revised uniform anatomical gift act donation rhode island

- Employment hiring process package rhode island form

- Revocation of anatomical gift donation rhode island form

- Employment or job termination package rhode island form

Find out other Georgia Cobb County Occupancy Excise

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate