Wv Commercial Business Property Form

What is the WV Commercial Business Property?

The WV commercial business property refers to real estate used for business purposes in West Virginia. This includes various types of properties such as office buildings, retail spaces, warehouses, and industrial sites. Understanding the classification of commercial property is essential for businesses, as it affects taxation, zoning regulations, and potential investment opportunities. The commercial property is often assessed differently than residential property, which can influence the financial obligations of a business owner.

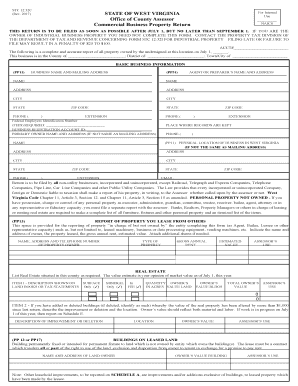

Steps to Complete the WV Commercial Business Property Return

Completing the WV commercial business property return involves several key steps to ensure compliance with state regulations. First, gather all necessary documentation related to the property, including purchase agreements, property tax assessments, and any previous returns. Next, accurately fill out the form, ensuring all required fields are completed, such as property value and business details. After completing the form, review it for accuracy and clarity before submitting it. Finally, keep a copy of the submitted return for your records, as it may be needed for future reference or audits.

Legal Use of the WV Commercial Business Property

The legal use of the WV commercial business property is governed by local zoning laws and state regulations. Businesses must ensure that their operations comply with these laws to avoid penalties or legal issues. Certain properties may have restrictions on the type of business activities allowed, which can impact how a business operates. It is important for business owners to consult local zoning boards or legal advisors to understand the specific legal requirements associated with their commercial property.

Required Documents for the WV Commercial Business Property Return

When filing the WV commercial business property return, specific documents are required to support the information provided on the form. These documents typically include proof of ownership, such as a deed or title, recent property tax assessments, and any relevant financial statements that detail the property's value. Additionally, businesses may need to provide documentation related to any improvements made to the property, as these can affect its assessed value. Ensuring all required documents are included with the return can help facilitate a smoother review process.

Filing Deadlines for the WV Commercial Business Property Return

Filing deadlines for the WV commercial business property return are crucial for compliance. Typically, the return must be submitted by the first day of July each year. It is important for business owners to be aware of these deadlines to avoid late fees or penalties. Additionally, businesses should keep track of any changes in state regulations that may affect filing dates or requirements, as these can vary from year to year.

Penalties for Non-Compliance with the WV Commercial Business Property Return

Failure to comply with the requirements for the WV commercial business property return can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is essential for business owners to understand the importance of timely and accurate submissions to avoid these consequences. Regularly reviewing compliance requirements and maintaining organized records can help mitigate the risk of non-compliance.

Quick guide on how to complete wv commercial business property

Complete Wv Commercial Business Property effortlessly on any device

Digital document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Wv Commercial Business Property on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Wv Commercial Business Property effortlessly

- Obtain Wv Commercial Business Property and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Wv Commercial Business Property and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the wv commercial business property return process?

The wv commercial business property return process involves filing specific documents related to your commercial property for tax assessments. This process ensures you comply with local regulations while maximizing your returns. airSlate SignNow simplifies this with its eSigning features, making it easy to send and sign necessary documents.

-

How can airSlate SignNow help with my wv commercial business property return?

airSlate SignNow provides a seamless platform for preparing and eSigning documents related to your wv commercial business property return. With its user-friendly interface, you can quickly send documents for eSignature and track their status, ensuring your return is submitted efficiently and on time.

-

What are the costs associated with using airSlate SignNow for wv commercial business property return?

The pricing for airSlate SignNow is competitive and varies based on the features you choose. For users needing assistance with the wv commercial business property return, the platform offers cost-effective solutions that can streamline your document management process, ultimately saving you time and money.

-

Are there any integrations available for airSlate SignNow related to wv commercial business property return?

Yes, airSlate SignNow offers various integrations with popular business applications that can help in managing your wv commercial business property return. This includes cloud storage services and CRM tools that allow you to efficiently organize and access your documents all in one place.

-

What features does airSlate SignNow offer for handling wv commercial business property return documents?

airSlate SignNow features robust tools for handling wv commercial business property return documents, including customizable templates and automated workflows. These features help streamline the document creation and signing process, ensuring that all necessary paperwork is handled quickly and accurately.

-

Why is eSigning important for my wv commercial business property return?

eSigning is crucial for your wv commercial business property return as it enhances the speed and security of document transactions. With airSlate SignNow, you can officially sign documents electronically, reducing the time spent on paperwork and ensuring compliance with legal standards.

-

Can I use airSlate SignNow on mobile devices for my wv commercial business property return?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your wv commercial business property return on-the-go. Whether you're in the office or away, you can easily access your documents, send them for signing, and keep track of your submissions right from your smartphone or tablet.

Get more for Wv Commercial Business Property

- Letter notice rent template form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession south carolina form

- Letter from tenant to landlord about illegal entry by landlord south carolina form

- Letter from landlord to tenant about time of intent to enter premises south carolina form

- Tenant notice rent 497325652 form

- Letter from tenant to landlord about sexual harassment south carolina form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children south carolina form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure south form

Find out other Wv Commercial Business Property

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast