Form LLF 4

What is the Form LLF 4

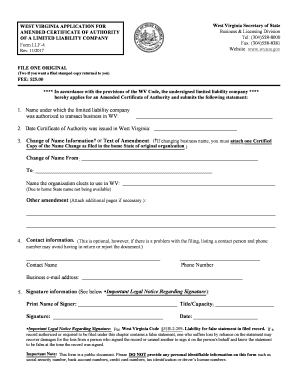

The Form LLF 4 is a specific document used in various legal and administrative processes in the United States. It serves as a formal declaration or application related to specific regulatory requirements. Understanding its purpose is crucial for individuals and businesses that need to comply with relevant laws and regulations. This form may be associated with financial disclosures, business registrations, or other formal requests that require official documentation.

How to use the Form LLF 4

Using the Form LLF 4 involves several steps to ensure that it is completed correctly and submitted in accordance with the relevant guidelines. First, gather all necessary information and supporting documents required to fill out the form accurately. Next, carefully complete each section of the form, ensuring that all details are correct and clearly written. After completing the form, review it thoroughly for any errors or omissions before submission. Depending on the requirements, you may need to submit the form online, by mail, or in person.

Steps to complete the Form LLF 4

Completing the Form LLF 4 requires attention to detail and adherence to specific guidelines. Follow these steps for a smooth process:

- Gather necessary information, including personal details and any required documentation.

- Access the form through the appropriate channels, ensuring you have the latest version.

- Fill out each section of the form, providing accurate and complete information.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Form LLF 4

The legal use of the Form LLF 4 is essential for ensuring compliance with applicable laws and regulations. When filled out correctly, the form can serve as a legally binding document. It is crucial to follow all legal requirements associated with the form, including obtaining necessary signatures and providing accurate information. Failure to comply with these legal standards may result in penalties or rejection of the form.

Key elements of the Form LLF 4

Understanding the key elements of the Form LLF 4 is vital for its proper completion and submission. Key elements typically include:

- Personal or business identification information.

- Specific details related to the purpose of the form.

- Signature lines for necessary parties.

- Instructions for submission and any required attachments.

Form Submission Methods

The Form LLF 4 can be submitted through various methods, depending on the specific requirements set forth by the issuing authority. Common submission methods include:

- Online submission through designated portals.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form LLF 4 can lead to significant penalties. These may include fines, delays in processing, or rejection of the form. It is essential to understand the consequences of failing to submit the form correctly or on time to avoid potential legal issues and ensure compliance with all relevant regulations.

Quick guide on how to complete form llf 4

Effortlessly Prepare Form LLF 4 on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form LLF 4 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Form LLF 4 with Ease

- Locate Form LLF 4 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form LLF 4 to guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form LLF 4, and how is it used?

Form LLF 4 is a specific document used for [insert relevant purpose]. With airSlate SignNow, you can easily create, send, and eSign Form LLF 4, streamlining your document management process. Our platform helps you manage and store your forms securely.

-

How much does it cost to use airSlate SignNow for Form LLF 4?

The pricing for using airSlate SignNow to manage Form LLF 4 varies depending on your needs. We offer various subscription plans that are cost-effective and tailored for businesses of all sizes. Check our pricing page for detailed information about each plan.

-

What features does airSlate SignNow offer for Form LLF 4?

airSlate SignNow offers several features for managing Form LLF 4, including customizable templates, document tracking, and secure eSigning. You can also collaborate with team members in real-time and access your documents from anywhere. These features enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other software for Form LLF 4?

Yes! airSlate SignNow supports integrations with a variety of software solutions, making it easy to incorporate Form LLF 4 into your existing workflows. Popular integrations include CRM systems, cloud storage, and workflow automation tools, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Form LLF 4?

Using airSlate SignNow for Form LLF 4 provides signNow benefits such as improved turnaround times, reduced printing costs, and enhanced security. Our platform ensures that you can manage your forms electronically, minimizing errors and streamlining operations. This leads to better document management overall.

-

Is airSlate SignNow easy to use for beginners managing Form LLF 4?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for beginners to manage Form LLF 4. The intuitive interface and step-by-step guides help users navigate the platform without needing extensive training. Start sending and signing documents effortlessly!

-

How secure is the use of airSlate SignNow for Form LLF 4?

Security is a top priority for airSlate SignNow when managing Form LLF 4. We utilize advanced encryption protocols and comply with industry standards to protect your sensitive information. Your documents are safe with us, ensuring peace of mind for your business.

Get more for Form LLF 4

- South carolina property 497325560 form

- Quitclaim deed from husband and wife to an individual south carolina form

- Deed wife to 497325562 form

- South carolina liability form

- Notice of furnishing by corporation or llc south carolina form

- Sc notice commencement form

- Quitclaim deed from individual to individual south carolina form

- Sc deed form

Find out other Form LLF 4

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple