Sale of Assets of Corporation with No Necessity to Comply with Form

Understanding the Sale of Assets of Corporation With No Necessity to Comply With

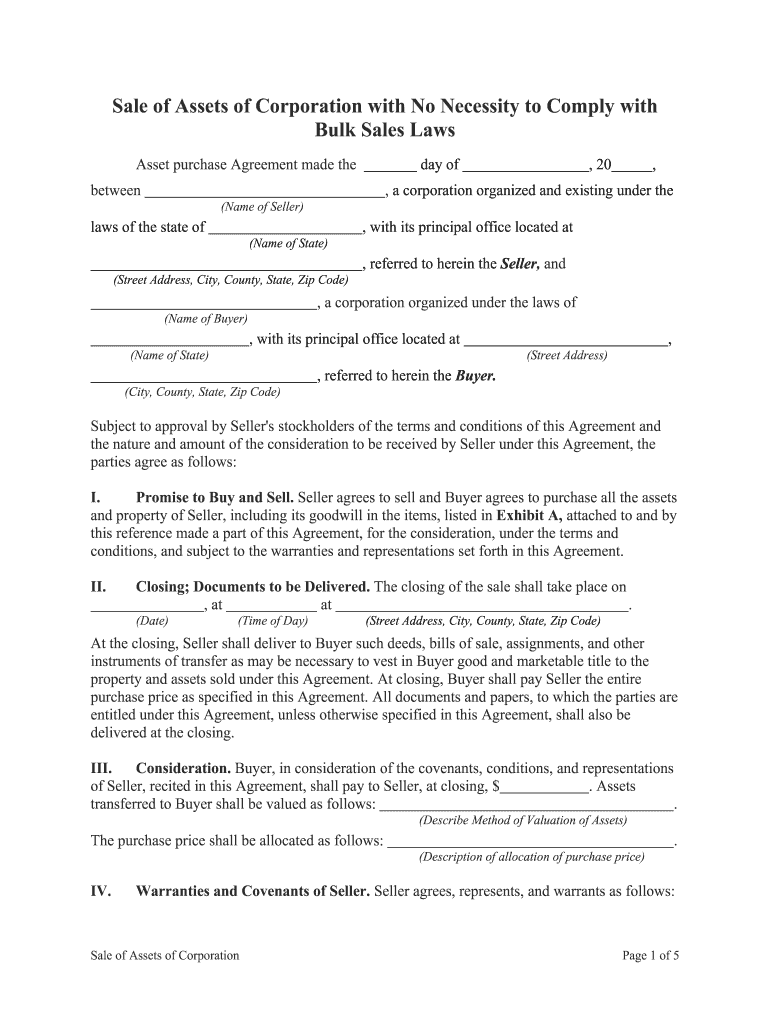

The sale of assets of a corporation with no necessity to comply with specific regulations refers to transactions where a corporation can sell its assets without adhering to certain compliance requirements. This can simplify the process for businesses looking to liquidate or restructure. Understanding the legal framework surrounding these sales is essential for ensuring that the transaction is valid and recognized by relevant authorities.

Steps to Complete the Sale of Assets of Corporation With No Necessity to Comply With

Completing the sale of assets involves several key steps:

- Identify the assets to be sold, ensuring they are clearly documented.

- Assess the fair market value of the assets to determine a suitable sale price.

- Prepare a sales agreement outlining the terms of the sale, including payment details and any warranties.

- Execute the agreement, ensuring all parties sign it, preferably using a reliable eSignature platform for legal validity.

- Transfer ownership of the assets, which may involve updating any necessary registrations or titles.

Legal Use of the Sale of Assets of Corporation With No Necessity to Comply With

Legally, the sale of assets can be executed without the need to follow specific compliance measures, provided that the transaction adheres to general business laws. This includes ensuring that the sale does not violate any contractual obligations or fiduciary duties. It is crucial to maintain transparency and document the sale appropriately to avoid potential disputes.

Key Elements of the Sale of Assets of Corporation With No Necessity to Comply With

Several key elements define the sale of assets in this context:

- Asset Identification: Clearly identifying which assets are being sold is vital.

- Valuation: Understanding the market value of the assets ensures fair pricing.

- Sales Agreement: A well-drafted agreement protects all parties involved.

- Execution: Proper execution of the agreement is necessary for legal recognition.

Examples of Using the Sale of Assets of Corporation With No Necessity to Comply With

Practical examples of this type of sale can include:

- A corporation selling off outdated equipment to streamline operations.

- A business liquidating its inventory to raise capital without complex regulatory hurdles.

- A company restructuring its assets to focus on core operations, selling non-essential properties.

Required Documents for the Sale of Assets of Corporation With No Necessity to Comply With

When executing a sale of assets, certain documents are typically required:

- Sales agreement detailing the transaction.

- Asset valuation reports to support the sale price.

- Transfer documents, if applicable, to change ownership of physical assets.

- Board resolutions or approvals, if required by corporate governance.

Quick guide on how to complete sale of assets of corporation with no necessity to comply with

Complete Sale Of Assets Of Corporation With No Necessity To Comply With effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Sale Of Assets Of Corporation With No Necessity To Comply With on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Sale Of Assets Of Corporation With No Necessity To Comply With with ease

- Obtain Sale Of Assets Of Corporation With No Necessity To Comply With and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or hide sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Sale Of Assets Of Corporation With No Necessity To Comply With and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sale of assets of corporation with no necessity to comply with

How to create an electronic signature for the Sale Of Assets Of Corporation With No Necessity To Comply With in the online mode

How to generate an eSignature for your Sale Of Assets Of Corporation With No Necessity To Comply With in Google Chrome

How to generate an electronic signature for signing the Sale Of Assets Of Corporation With No Necessity To Comply With in Gmail

How to create an electronic signature for the Sale Of Assets Of Corporation With No Necessity To Comply With from your smartphone

How to generate an eSignature for the Sale Of Assets Of Corporation With No Necessity To Comply With on iOS

How to generate an electronic signature for the Sale Of Assets Of Corporation With No Necessity To Comply With on Android

People also ask

-

What is the Sale Of Assets Of Corporation With No Necessity To Comply With?

The Sale Of Assets Of Corporation With No Necessity To Comply With refers to a streamlined process that allows businesses to sell their assets without the typical regulatory burdens. This approach simplifies transactions, enabling corporations to operate more efficiently. With airSlate SignNow, you can facilitate these transactions securely and easily.

-

How does airSlate SignNow support the Sale Of Assets Of Corporation With No Necessity To Comply With?

airSlate SignNow enables businesses to prepare, send, and eSign documents related to the Sale Of Assets Of Corporation With No Necessity To Comply With effortlessly. Our user-friendly platform ensures that all necessary documents are handled securely, reducing administrative overhead. With template features, you can easily manage and execute these sales without hassle.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing tailored to meet various business needs. Whether you're a small startup or a large corporation, we have plans that support the Sale Of Assets Of Corporation With No Necessity To Comply With. Choose an option that best fits your budget and unlock various features to enhance your document workflow.

-

Are there any features that enhance the Sale Of Assets Of Corporation With No Necessity To Comply With?

Yes, airSlate SignNow offers features like customizable templates, automated workflows, and real-time notifications that enhance the process of the Sale Of Assets Of Corporation With No Necessity To Comply With. These tools not only save time but also improve accuracy and compliance in your transactions. Simplified document management ensures you can focus on your core business activities.

-

What benefits does eSigning provide for the Sale Of Assets Of Corporation With No Necessity To Comply With?

eSigning enhances the Sale Of Assets Of Corporation With No Necessity To Comply With by expediting the signing process, reducing turnaround time signNowly. With secure electronic signatures, you ensure legal validity while maintaining a clear audit trail. This boosts transparency and reliability in all your asset transactions.

-

Can airSlate SignNow integrate with other software for managing asset sales?

Absolutely! airSlate SignNow offers seamless integrations with various business software, making it easier to manage the Sale Of Assets Of Corporation With No Necessity To Comply With efficiently. Integrate with tools like CRM systems, document management software, and more, to create a comprehensive solution for your asset management needs.

-

Is airSlate SignNow suitable for businesses of all sizes involved in asset sales?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, whether you are a solo entrepreneur or part of a large corporation involved in the Sale Of Assets Of Corporation With No Necessity To Comply With. Our platform scales with your needs, providing essential tools to facilitate efficient document handling, no matter the size of your transactions.

Get more for Sale Of Assets Of Corporation With No Necessity To Comply With

- Plaid pantries inc employment application plaid pantry form

- 90 day form human resources cornell university

- Bapplicationb for bemploymentb solicitud de empleo form

- Big lots careers 2012 2019 form

- Httpswwwtxcaorgimagesconferencescc14powerpoints6pdf form

- Employee status change form roman catholic diocese of tucson diocesetucson

- Sta application for employment form

- Form b307 2015 2018

Find out other Sale Of Assets Of Corporation With No Necessity To Comply With

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later