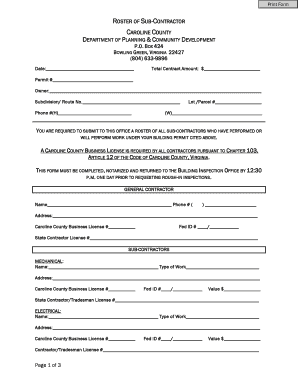

ROSTER of SUB CONTRACTOR Caroline County Form

What is the online tax form?

The online tax form is a digital document used by individuals and businesses to report their income, expenses, and other financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and can vary depending on the taxpayer's situation, such as whether they are self-employed, a corporation, or a partnership. Utilizing an online tax form streamlines the filing process, making it easier to complete and submit from any location.

Steps to complete the online tax form

Completing the online tax form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide to help you through the process:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Choose the appropriate online tax form based on your filing status and income type.

- Fill in your personal information, such as your name, address, and Social Security number.

- Input your income details, including wages, dividends, and any other sources of income.

- Claim deductions and credits you qualify for to reduce your taxable income.

- Review the completed form for accuracy and ensure all required fields are filled.

- Submit the form electronically to the IRS and save a copy for your records.

Filing deadlines for online tax submissions

Filing deadlines for online tax submissions are crucial to avoid penalties and interest charges. Generally, individual taxpayers must file their federal tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to be aware of any specific state deadlines as well, as they can differ from federal timelines.

Required documents for online tax filing

To successfully complete your online tax filing, you will need several key documents. These typically include:

- W-2 forms from employers, detailing your annual earnings and tax withholdings.

- 1099 forms for any freelance or contract work, showing income received.

- Receipts for deductible expenses, such as medical bills, charitable donations, and business expenses.

- Last year's tax return, which can provide a helpful reference for current filings.

IRS guidelines for online tax filing

The IRS provides specific guidelines for online tax filing to ensure compliance and accuracy. Taxpayers are encouraged to use IRS-approved e-filing software, which can help in correctly completing forms and maximizing deductions. Additionally, the IRS emphasizes the importance of keeping personal information secure and recommends using strong passwords and two-factor authentication when filing online.

Penalties for non-compliance with online tax filing

Failing to comply with online tax filing requirements can lead to significant penalties. These may include:

- Failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late.

- Failure-to-pay penalty, which is usually 0.5 percent of the unpaid tax for each month it remains unpaid.

- Interest charges on any unpaid tax, which can accumulate over time.

Quick guide on how to complete roster of sub contractor caroline county

Ease of Preparing ROSTER OF SUB CONTRACTOR Caroline County on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the required forms and store them securely online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Manage ROSTER OF SUB CONTRACTOR Caroline County on any device using airSlate SignNow mobile applications for Android or iOS and simplify your document-driven tasks today.

Effortlessly Modify and Electronically Sign ROSTER OF SUB CONTRACTOR Caroline County

- Obtain ROSTER OF SUB CONTRACTOR Caroline County and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign ROSTER OF SUB CONTRACTOR Caroline County to ensure outstanding communication throughout your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to online tax?

airSlate SignNow is an electronic signature solution that facilitates the sending and signing of documents online. It specifically benefits those handling online tax processes by streamlining document management, ensuring secure signatures, and improving overall efficiency in tax-related tasks.

-

How can airSlate SignNow help with online tax forms?

With airSlate SignNow, completing online tax forms becomes a breeze. Users can easily fill out, sign, and send tax documents electronically, reducing the risk of errors and expediting the submission process to ensure compliance with deadlines.

-

Is airSlate SignNow affordable for small businesses handling online tax?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses managing online tax needs. By providing a range of pricing tiers, it ensures that even businesses on a budget can afford a reliable e-signature solution for their tax documentation.

-

What features does airSlate SignNow offer for online tax processes?

airSlate SignNow provides various features that enhance online tax processes, including document templates, automated workflows, and secure cloud storage. These features help users efficiently manage tax documents while maintaining compliance and ensuring data security.

-

Can airSlate SignNow integrate with my existing accounting software for online tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software. This integration allows users to streamline their online tax preparations by connecting their e-signature workflows directly to their accounting tools.

-

What are the benefits of using airSlate SignNow for online tax submissions?

Using airSlate SignNow for online tax submissions offers numerous benefits, including faster turnaround times, enhanced security through encryption, and a reduced carbon footprint by minimizing paper usage. This not only simplifies the tax submission process but also helps businesses operate more sustainably.

-

Is airSlate SignNow compliant with online tax regulations?

Yes, airSlate SignNow is designed to meet various online tax regulations, ensuring that all electronic signatures are legally binding. This compliance ensures that your signed tax documents are valid and can be used confidently for official submissions.

Get more for ROSTER OF SUB CONTRACTOR Caroline County

- Contract for deed package south carolina form

- Statutory equivalent of living will or declaration for a desire of a natural death statutory south carolina form

- South carolina attorney form

- Revocation of statutory equivalent of living will or declaration south carolina form

- Gift act form

- South carolina process 497325894 form

- South carolina attorney 497325895 form

- Sc anatomical form

Find out other ROSTER OF SUB CONTRACTOR Caroline County

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip