Truck Driver Expenses Worksheet Form

What is the Truck Driver Expenses Worksheet

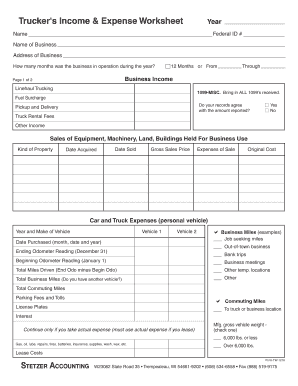

The truck driver expenses worksheet is a vital document designed to help truck drivers and owner-operators track and manage their business-related expenses. This worksheet typically includes categories such as fuel costs, maintenance, insurance, and tolls. By accurately recording these expenses, drivers can identify tax deductions and maintain better financial oversight of their trucking operations. This form is particularly useful during tax season, as it simplifies the process of reporting expenses to the IRS.

How to use the Truck Driver Expenses Worksheet

Using the truck driver expenses worksheet involves several straightforward steps. First, gather all relevant receipts and documentation related to your trucking expenses. Next, categorize each expense in the worksheet, ensuring that you include all necessary details such as date, amount, and purpose. Regularly updating the worksheet will provide a comprehensive overview of your expenses, making it easier to identify potential deductions when filing taxes. Additionally, keeping this worksheet organized can help in case of audits or inquiries from tax authorities.

Steps to complete the Truck Driver Expenses Worksheet

Completing the truck driver expenses worksheet requires careful attention to detail. Follow these steps for effective completion:

- Collect all receipts and invoices related to your trucking expenses.

- Organize expenses into categories such as fuel, repairs, and meals.

- Enter each expense into the worksheet, noting the date and amount.

- Calculate total expenses for each category at the end of the worksheet.

- Review the completed worksheet for accuracy before submitting it with your tax return.

Legal use of the Truck Driver Expenses Worksheet

The truck driver expenses worksheet is legally recognized as a tool for documenting business expenses, which can be crucial for tax purposes. To ensure its legal validity, it is essential to maintain accurate records and receipts to support the entries made in the worksheet. Compliance with IRS guidelines regarding expense documentation will help prevent issues during audits. Using a reliable e-signature platform, like airSlate SignNow, can further enhance the legitimacy of your completed worksheet by providing a secure and legally binding signature.

IRS Guidelines

The IRS provides specific guidelines regarding the documentation of business expenses for truck drivers. According to IRS regulations, it is important to keep detailed records of all expenses, including receipts and invoices. The truck driver expenses worksheet can serve as a comprehensive summary of these expenses, which should align with IRS requirements for deductions. Understanding these guidelines will help ensure that all reported expenses are valid and can withstand scrutiny during tax assessments.

Examples of using the Truck Driver Expenses Worksheet

Examples of using the truck driver expenses worksheet include tracking fuel costs for long-haul trips, recording maintenance expenses for vehicle repairs, and documenting meals during overnight hauls. For instance, if a driver spends $100 on fuel and $50 on a meal while on the road, these expenses should be recorded in their respective categories on the worksheet. This practice not only aids in identifying potential deductions but also provides a clear financial picture of the trucking business.

Quick guide on how to complete truck driver expenses worksheet

Complete Truck Driver Expenses Worksheet with ease on any device

Digital document management has gained traction among companies and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without setbacks. Manage Truck Driver Expenses Worksheet on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest method to modify and eSign Truck Driver Expenses Worksheet effortlessly

- Locate Truck Driver Expenses Worksheet and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Truck Driver Expenses Worksheet and guarantee seamless communication at any point during the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a profit and loss statement for trucking company pdf?

A profit and loss statement for trucking company pdf is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This document is essential for trucking companies to understand their profitability and operational efficiency. By converting it to a PDF, it ensures easy sharing and printing for stakeholders.

-

How can airSlate SignNow help me create a profit and loss statement for trucking company pdf?

airSlate SignNow provides an intuitive platform for creating and managing documents, including a profit and loss statement for trucking company pdf. With our templates and document editor, you can easily input financial data and generate a professional-looking PDF. This streamlines your accounting processes and saves time.

-

Is there a cost associated with generating a profit and loss statement for trucking company pdf using airSlate SignNow?

While airSlate SignNow offers a free trial, there are subscription plans that provide additional features for creating documents like a profit and loss statement for trucking company pdf. Pricing varies based on the features you need and the number of users. Review our pricing page for specific details on plan costs.

-

What features does airSlate SignNow offer for financial documents?

airSlate SignNow offers features like document templates, electronic signatures, and collaboration tools, making it easy to create a profit and loss statement for trucking company pdf. You can track document status, set reminders, and ensure compliance, enhancing the overall document management process. These tools help streamline your business operations.

-

Are there integration options with airSlate SignNow for accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software to facilitate the development of a profit and loss statement for trucking company pdf. This integration allows you to import financial data directly into your documents, reducing the manual data entry effort. Popular integrations include QuickBooks and Xero.

-

Can I customize my profit and loss statement for trucking company pdf with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your profit and loss statement for trucking company pdf to fit your branding and specific needs. You can adjust the layout, colors, fonts, and include your logo to ensure the document represents your company's identity. This level of customization is vital for professional appearances.

-

What are the benefits of using airSlate SignNow for profit and loss statements?

Using airSlate SignNow for your profit and loss statement for trucking company pdf offers numerous benefits, including time efficiency, enhanced accuracy, and secure document handling. The platform ensures that your financial documents are easily accessible and shareable while maintaining compliance with regulations. Additionally, we provide customer support to assist you if needed.

Get more for Truck Driver Expenses Worksheet

- Premarital agreements package new mexico form

- Painting contractor package new mexico form

- Framing contractor package new mexico form

- Foundation contractor package new mexico form

- Plumbing contractor package new mexico form

- Brick mason contractor package new mexico form

- Roofing contractor package new mexico form

- Electrical contractor package new mexico form

Find out other Truck Driver Expenses Worksheet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors