Complying with Employment Record Requirements SHRM Form

What is the Complying With Employment Record Requirements SHRM

The Complying With Employment Record Requirements SHRM form is essential for organizations to ensure they meet the legal standards for maintaining employee records. This form serves as a guideline for employers in the United States, outlining the necessary documentation and practices needed to comply with federal and state regulations regarding employment records. By adhering to these requirements, businesses can protect themselves from potential legal issues and ensure that they are providing a fair and transparent work environment.

Steps to complete the Complying With Employment Record Requirements SHRM

Completing the Complying With Employment Record Requirements SHRM form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary employee information, including personal details, employment history, and any relevant documentation. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the completed form for any errors or omissions before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on your organization's procedures.

Legal use of the Complying With Employment Record Requirements SHRM

The legal use of the Complying With Employment Record Requirements SHRM form is crucial for maintaining compliance with employment laws. This form must be completed in accordance with regulations set forth by the Equal Employment Opportunity Commission (EEOC) and the Fair Labor Standards Act (FLSA). Employers must ensure that the information collected is accurate and kept confidential, as misuse of employee records can lead to legal repercussions. Adopting a secure method for storing and managing these records is also essential to comply with privacy laws.

Key elements of the Complying With Employment Record Requirements SHRM

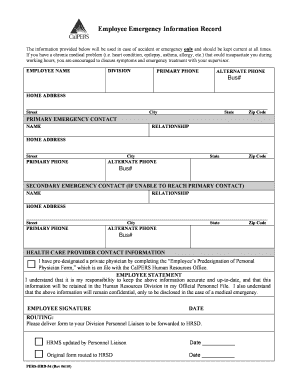

Key elements of the Complying With Employment Record Requirements SHRM form include the collection of essential employee data, such as full name, Social Security number, job title, and employment dates. Additionally, it requires documentation of any disciplinary actions, performance reviews, and training records. Employers must also ensure that they maintain records related to wages, hours worked, and benefits provided. These elements are vital for demonstrating compliance with legal requirements and for supporting any potential employment-related claims.

State-specific rules for the Complying With Employment Record Requirements SHRM

State-specific rules regarding the Complying With Employment Record Requirements SHRM form can vary significantly. Each state may have its own regulations concerning the retention and management of employment records. Employers should familiarize themselves with these state-specific requirements to ensure compliance. For instance, some states may mandate longer retention periods for certain records or have additional documentation requirements. Consulting with legal counsel or HR professionals can help clarify these state-specific rules.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the Complying With Employment Record Requirements SHRM form can result in significant penalties for employers. Non-compliance may lead to fines, legal action, or other sanctions imposed by regulatory agencies. Additionally, employers may face challenges in defending themselves against wrongful termination or discrimination claims if proper records are not maintained. It is crucial for businesses to prioritize compliance to avoid these potential consequences.

Quick guide on how to complete complying with employment record requirements shrm

Complete Complying With Employment Record Requirements SHRM effortlessly on any gadget

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing users to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without interruptions. Handle Complying With Employment Record Requirements SHRM on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign Complying With Employment Record Requirements SHRM with ease

- Obtain Complying With Employment Record Requirements SHRM and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Complying With Employment Record Requirements SHRM to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help with complying with employment record requirements SHRM?

airSlate SignNow is a robust eSignature and document management solution that simplifies the process of sending and signing documents. By automating the documentation process, it ensures that your business remains compliant with employment record requirements SHRM, reducing the risk of errors and omissions.

-

How does airSlate SignNow ensure compliance with employment record requirements SHRM?

airSlate SignNow ensures compliance with employment record requirements SHRM through secure electronic signatures and comprehensive audit trails. This feature guarantees that all signed documents are legally binding and easily retrievable, helping organizations maintain proper employment records.

-

What features does airSlate SignNow offer to assist in complying with employment record requirements SHRM?

Key features of airSlate SignNow include customizable templates, automated workflows, and real-time tracking. These tools make it easier for HR departments to create, send, and manage documents that comply with employment record requirements SHRM efficiently.

-

Is airSlate SignNow a cost-effective solution for businesses meeting employment record requirements SHRM?

Yes, airSlate SignNow is a cost-effective solution designed for businesses of all sizes. With transparent pricing plans and no hidden fees, it provides organizations with the necessary tools to comply with employment record requirements SHRM without breaking the bank.

-

What integrations does airSlate SignNow offer for complying with employment record requirements SHRM?

airSlate SignNow offers seamless integrations with popular HR tools, CRM systems, and cloud storage services. These integrations enhance workflow efficiency, ensuring that businesses can manage their employment records while complying with requirements SHRM effortlessly.

-

How can airSlate SignNow improve my company's efficiency in meeting employment record requirements SHRM?

airSlate SignNow streamlines document management and signing processes, signNowly reducing the time spent on paperwork. By automating repetitive tasks, businesses can focus on core HR functions while ensuring they comply with employment record requirements SHRM.

-

Can airSlate SignNow adapt to various industries while complying with employment record requirements SHRM?

Absolutely! airSlate SignNow is versatile and can be tailored to fit the specific needs of various industries, including healthcare, finance, and education. This adaptability allows organizations in all sectors to comply with employment record requirements SHRM effectively.

Get more for Complying With Employment Record Requirements SHRM

Find out other Complying With Employment Record Requirements SHRM

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple