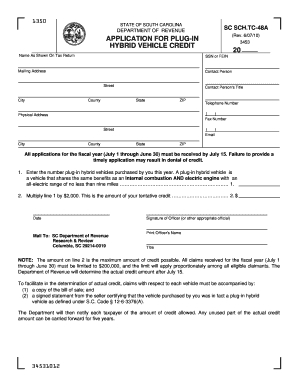

APPLICATION for PLUG in HYBRID VEHICLE CREDIT 20 Sctax Form

What is the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax

The APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax is a tax form used by individuals and businesses in the United States to apply for a federal tax credit for purchasing a plug-in hybrid vehicle. This credit aims to encourage the adoption of environmentally friendly vehicles by providing financial incentives. The form captures essential information about the applicant, the vehicle, and the purchase details, ensuring compliance with IRS regulations.

Steps to complete the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax

Completing the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax involves several key steps:

- Gather necessary documentation, including proof of purchase and vehicle specifications.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about the vehicle, such as make, model, and vehicle identification number (VIN).

- Indicate the amount of credit you are applying for, based on the vehicle's eligibility.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the plug-in hybrid vehicle credit, applicants must meet specific eligibility criteria. The vehicle must be a new plug-in hybrid that meets the IRS requirements for battery capacity and emissions. Additionally, the applicant must be the original purchaser of the vehicle and must not have claimed the credit for the same vehicle in previous tax years. It is essential to verify that the vehicle is listed on the IRS-approved vehicle list to ensure eligibility.

Required Documents

When applying for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax, certain documents are required to substantiate the claim. These include:

- Proof of purchase, such as a sales receipt or invoice.

- Vehicle specifications that confirm battery capacity and emissions ratings.

- Completed form with accurate personal and vehicle information.

Form Submission Methods

The APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax can be submitted through various methods. Applicants can choose to file the form electronically using tax software that supports e-filing, or they can print the completed form and mail it to the designated IRS address. In-person submission is generally not an option for this form, so it is crucial to ensure that all information is accurate before submitting electronically or by mail.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax. These guidelines outline the eligibility requirements, necessary documentation, and the process for claiming the credit. It is essential for applicants to familiarize themselves with these guidelines to ensure compliance and avoid potential issues during the tax filing process.

Quick guide on how to complete application for plug in hybrid vehicle credit 20 sctax

Accomplish APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly without delays. Handle APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax on any device utilizing airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax without hassle

- Find APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

The APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax is a form that eligible taxpayers can use to claim a tax credit for investing in plug-in hybrid vehicles. This credit can signNowly reduce your tax liability, making eco-friendly choices more affordable. It's an incentive from the government to promote cleaner energy vehicles.

-

How do I apply for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

To apply for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax, you must complete the relevant form and submit it along with your federal tax return. Ensure you gather all necessary documents, such as proof of vehicle purchase and compliance. The process can be simplified with digital document solutions like airSlate SignNow.

-

Are there any eligibility requirements for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

Yes, to qualify for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax, your vehicle must meet specific criteria such as being a qualifying plug-in hybrid model and purchased within the eligible timeframe. Additionally, your income level and tax liability may affect your eligibility and the amount of credit you can claim. It's best to check the latest IRS guidelines for exact requirements.

-

What are the benefits of using airSlate SignNow for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

Using airSlate SignNow to handle the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax offers you a smooth and efficient experience for document preparation and eSigning. This easy-to-use platform allows collaboration among stakeholders and ensures that your documents are securely handled. Additionally, it helps in reducing processing time and potential errors.

-

Is there a cost associated with submitting the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

While there is no direct cost to submit the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax, there may be associated costs for preparing your tax return or using platforms like airSlate SignNow for document handling. However, these costs are often minimal compared to the savings from the tax credit itself. It's always a good idea to consult a tax professional for detailed insights on potential expenses.

-

Can I track the status of my APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

Yes, once you've submitted your APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax with your tax return, you can track the status through the IRS website or by contacting a tax representative. Keeping your documentation in order with tools like airSlate SignNow also helps in easily accessing necessary information if queries arise during processing.

-

What integrations does airSlate SignNow support for managing the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax?

airSlate SignNow offers various integrations with popular applications such as Google Drive, Dropbox, and CRM systems, enhancing the efficiency of your document management for the APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax. These integrations make it easy to store, share, and access documents seamlessly. This versatility can signNowly simplify the application process.

Get more for APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax

Find out other APPLICATION FOR PLUG IN HYBRID VEHICLE CREDIT 20 Sctax

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement