Tc 719 Form

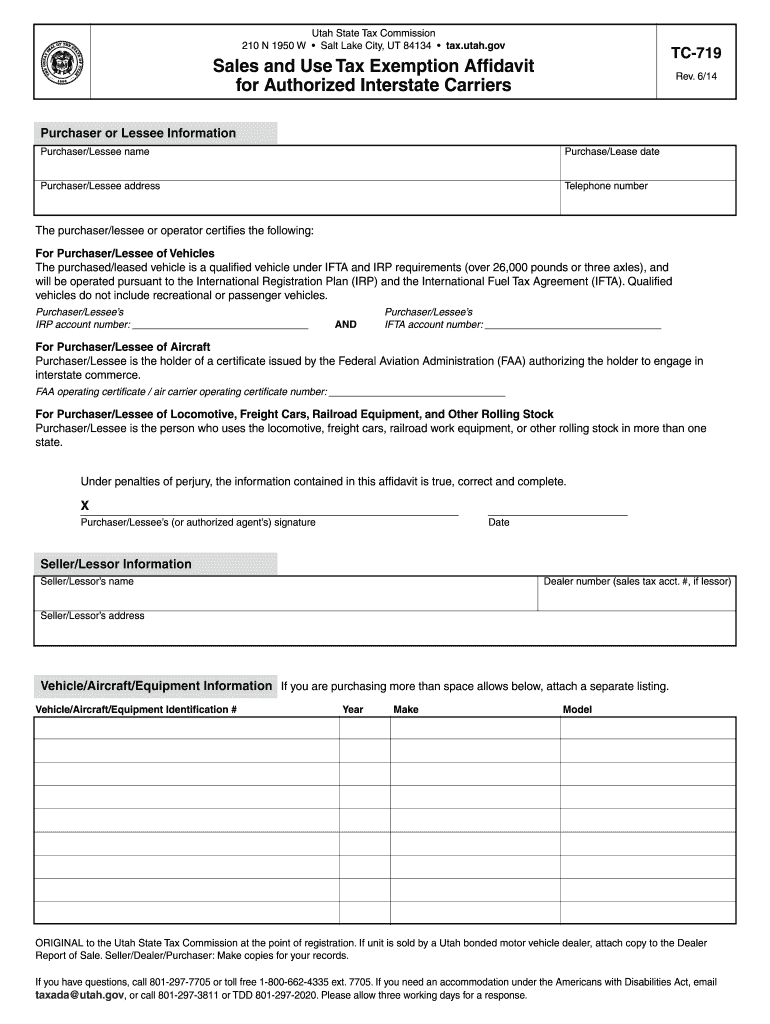

What is the TC 719?

The TC 719, also known as the Utah sales tax exemption form, is a document used by individuals and businesses in Utah to claim exemption from sales tax on certain purchases. This form is essential for entities that qualify for tax exemptions, such as non-profit organizations, government agencies, and certain types of businesses. By submitting the TC 719, taxpayers can ensure they do not pay sales tax on eligible items, thereby reducing their overall costs.

How to Use the TC 719

To use the TC 719 effectively, follow these steps:

- Determine eligibility: Confirm that your organization or business qualifies for a sales tax exemption under Utah law.

- Complete the form: Fill out the TC 719 accurately, providing all required information, including the name of the purchaser, the nature of the exemption, and details about the items being purchased.

- Provide supporting documentation: Attach any necessary documents that support your claim for exemption, such as proof of non-profit status or government identification.

- Present the form: Provide the completed TC 719 to the seller at the time of purchase to ensure the exemption is applied.

Steps to Complete the TC 719

Completing the TC 719 involves several key steps:

- Gather necessary information: Collect details about your organization, including its name, address, and tax identification number.

- Identify the exemption type: Clearly indicate the reason for the exemption, such as educational purposes or non-profit status.

- Fill out the form: Carefully enter all required information, ensuring accuracy to avoid delays or complications.

- Review and sign: Double-check the completed form for errors, then sign and date it to certify its accuracy.

Legal Use of the TC 719

The TC 719 is legally recognized in Utah as a valid means for claiming sales tax exemptions. To ensure its legal use, it must be completed accurately and submitted in accordance with state regulations. The form must be presented to the seller at the time of purchase, and it is crucial to retain a copy for your records. Misuse of the form, such as claiming exemptions for ineligible purchases, can result in penalties and fines.

Eligibility Criteria

Eligibility for using the TC 719 varies based on specific criteria set by Utah law. Generally, the following entities may qualify:

- Non-profit organizations that have been granted tax-exempt status.

- Government agencies purchasing items for official use.

- Businesses that meet specific criteria, such as those engaged in manufacturing or certain types of agriculture.

It is essential to review the specific exemption categories outlined by the Utah State Tax Commission to confirm eligibility.

Form Submission Methods

The TC 719 can be submitted in various ways, depending on the seller's preferences:

- In-person: Present the completed form directly to the seller at the time of purchase.

- Online: Some sellers may accept digital copies of the TC 719 via email or through their online purchasing systems.

- By mail: Although less common, you may be able to send a copy of the form to the seller if prior arrangements are made.

Quick guide on how to complete tc 719

Complete Tc 719 effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It presents an ideal eco-friendly option to conventional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Tc 719 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The best approach to edit and eSign Tc 719 without hassle

- Find Tc 719 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Tc 719 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tc 719 and how does it relate to airSlate SignNow?

TC 719 refers to a specific compliance and documentation standard that airSlate SignNow adheres to. By utilizing airSlate SignNow, businesses can ensure that their eSigning processes align with tc 719 regulations, providing assurance of document integrity and security.

-

What features does airSlate SignNow offer to meet tc 719 requirements?

airSlate SignNow includes features such as secure eSignatures, audit trails, and document verification that align with tc 719. These features ensure that every signed document is legally binding and meets the compliance standards necessary for various industries.

-

Is airSlate SignNow a cost-effective solution for tc 719 documentation needs?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing tc 719 compliant document management. With flexible pricing plans, organizations can choose options that suit their budget while still complying with necessary documentation standards.

-

Can airSlate SignNow integrate with other tools for tc 719 compliance?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that help streamline compliance with tc 719. This ensures that you can manage documents effectively within your existing tech stack, saving time and enhancing productivity.

-

What are the key benefits of using airSlate SignNow for tc 719 documentation?

Using airSlate SignNow for tc 719 documentation provides several benefits, including enhanced security, compliance assurance, and ease of use. These advantages help businesses increase efficiency in their processes while ensuring all documentation meets the tc 719 standards.

-

How does airSlate SignNow ensure the security of tc 719 related documents?

airSlate SignNow utilizes advanced encryption and security protocols to protect tc 719 related documents. By employing these measures, businesses can rest assured that their sensitive information remains confidential and secure during the signing process.

-

What support options are available for airSlate SignNow users focusing on tc 719?

airSlate SignNow provides excellent customer support, including resources specifically for tc 719 compliance assistance. Users can access tutorials, live chat, and email support to navigate any complexities related to compliance and efficient document management.

Get more for Tc 719

Find out other Tc 719

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure