Agreement between Lender Borrower Form

Understanding the Agreement Between Lender and Borrower

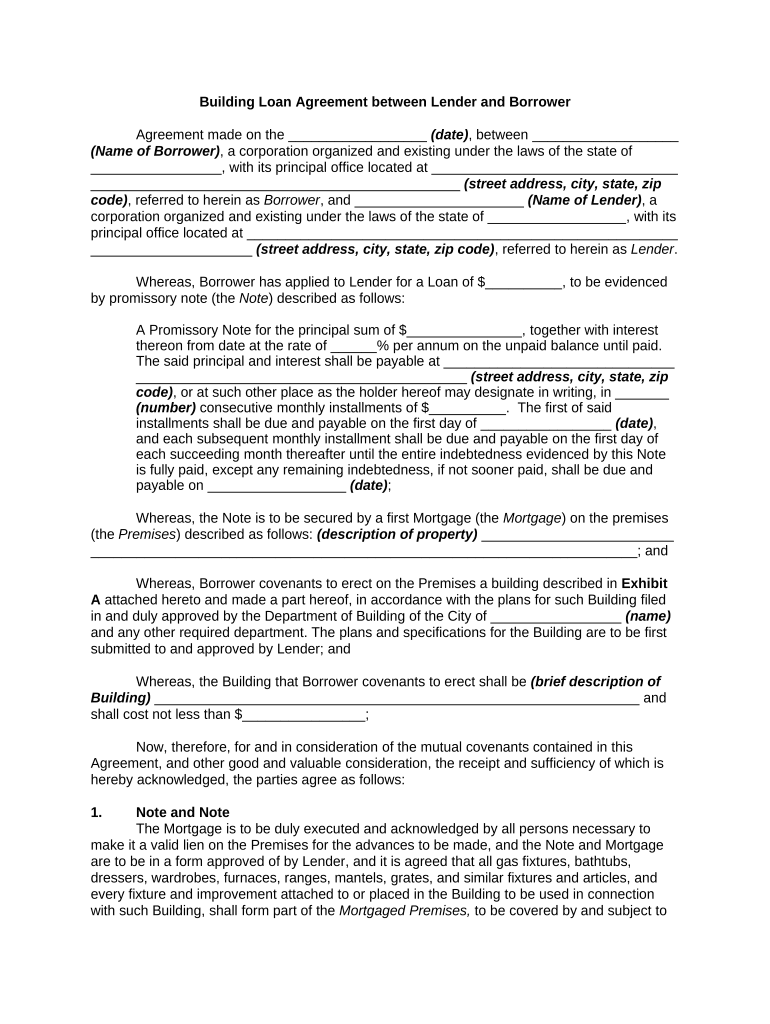

The agreement between lender and borrower is a legally binding document that outlines the terms and conditions of a loan. This agreement serves to protect both parties by clearly defining the responsibilities and expectations involved in the lending process. Key components typically include the loan amount, interest rate, repayment schedule, and any collateral involved. By having a detailed agreement, both the lender and borrower can avoid misunderstandings and legal disputes.

Steps to Complete the Agreement Between Lender and Borrower

Completing the agreement between lender and borrower involves several important steps. First, both parties should agree on the loan terms, including the amount and interest rate. Next, it is essential to draft the agreement, ensuring all key elements are included. Once the document is prepared, both parties should review it thoroughly to confirm accuracy and mutual understanding. After any necessary adjustments, the agreement should be signed by both parties, ideally in the presence of a witness or notary to enhance its legal standing.

Key Elements of the Agreement Between Lender and Borrower

Several key elements must be included in the agreement between lender and borrower to ensure clarity and enforceability. These elements typically consist of:

- Loan amount: The total sum being borrowed.

- Interest rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment schedule: The timeline for repayments, including due dates and amounts.

- Collateral: Any assets pledged by the borrower to secure the loan.

- Default terms: Conditions under which the borrower may default and the lender's rights in such cases.

Legal Use of the Agreement Between Lender and Borrower

The legal use of the agreement between lender and borrower is crucial for ensuring that both parties adhere to the terms set forth. This document must comply with relevant state and federal laws regarding lending practices. Additionally, it is important that the agreement is signed and dated by both parties to establish its validity. In the event of a dispute, having a properly executed agreement can serve as evidence in a court of law, reinforcing the lender’s rights and the borrower’s obligations.

How to Use the Agreement Between Lender and Borrower

Using the agreement between lender and borrower effectively involves a few straightforward steps. Once the agreement is completed and signed, both parties should retain a copy for their records. It is advisable for the lender to monitor repayment according to the agreed schedule, while the borrower should ensure timely payments to maintain a good credit standing. If any issues arise, such as difficulty in making payments, both parties should communicate promptly to discuss potential solutions or modifications to the agreement.

State-Specific Rules for the Agreement Between Lender and Borrower

State-specific rules for the agreement between lender and borrower can significantly impact the terms and enforceability of the document. Each state may have different regulations regarding interest rates, loan terms, and borrower protections. It is essential for both parties to familiarize themselves with their state’s laws to ensure compliance. Consulting with a legal professional can provide valuable insights into any specific requirements that must be addressed in the agreement.

Quick guide on how to complete agreement between lender borrower

Complete Agreement Between Lender Borrower effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow supplies you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Agreement Between Lender Borrower on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Agreement Between Lender Borrower effortlessly

- Obtain Agreement Between Lender Borrower and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Agreement Between Lender Borrower and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a building loan agreement?

A building loan agreement is a contract between a lender and a borrower outlining the terms of a loan specifically for construction purposes. This agreement includes details such as loan amount, repayment schedule, and interest rates, ensuring both parties understand their obligations. Using airSlate SignNow, you can easily create and manage these agreements digitally for added convenience.

-

How does airSlate SignNow help in creating a building loan agreement?

airSlate SignNow offers intuitive tools to create custom building loan agreements with templates that you can easily modify. With features like drag-and-drop functionality and pre-filled fields, you can streamline the document creation process. This not only saves time but also ensures accuracy and compliance with legal standards.

-

What are the key features of airSlate SignNow for building loan agreements?

Key features of airSlate SignNow include eSignature capabilities, document templates, and a secure signing process. You can track the status of your building loan agreement in real time, ensuring that all parties have signed and received the document promptly. Additionally, the platform allows for easy collaboration among stakeholders involved in the loan process.

-

How much does it cost to use airSlate SignNow for building loan agreements?

airSlate SignNow offers a variety of pricing plans to suit different business needs, making it a cost-effective solution for creating building loan agreements. Prices typically start with a free trial, allowing you to explore the features before committing. Monthly and annual subscription options provide further savings, so you can choose what works best for your budget.

-

Can I integrate airSlate SignNow with other tools for processing building loan agreements?

Yes, airSlate SignNow integrates seamlessly with various popular business tools to enhance your workflow for building loan agreements. This includes CRM systems, cloud storage services, and task management software. By utilizing these integrations, you can streamline processes and ensure better collaboration across your organization.

-

What benefits does eSigning a building loan agreement provide?

eSigning a building loan agreement via airSlate SignNow signNowly accelerates the document turnaround time by eliminating the need for physical signatures. This convenience reduces paperwork and enhances efficiency for all parties involved. Additionally, eSignatures are legally binding, ensuring your agreements hold up in court.

-

Is my data secure when using airSlate SignNow for building loan agreements?

Absolutely! airSlate SignNow prioritizes your data security with encryption protocols, compliance with regulations like GDPR, and secure storage practices. This guarantees that your building loan agreements and any sensitive information are well-protected against unauthorized access, giving you peace of mind while conducting business.

Get more for Agreement Between Lender Borrower

- 2013 spf 100 form

- Pass through entity prior year forms wv state tax department

- Form 560 alaska price report 2018

- Tax alaska 6967206 form

- Alaska gas exploration and development tax creditas form

- Saveresetprintalaskafishery resource landing form

- Cigarette and tobacco tax alaska department of revenue tax tax alaska form

- Alaska application deferred basis online form

Find out other Agreement Between Lender Borrower

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement