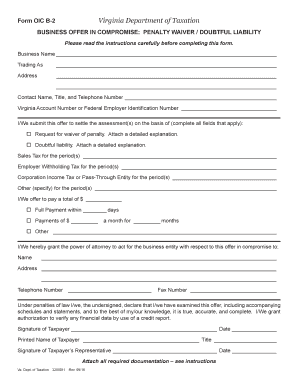

Form OIC B 2 Business Offer in Compromise Form OIC B 2 Business Offer in Compromise

What is the Form OIC B-2 Business Offer In Compromise?

The Form OIC B-2 Business Offer In Compromise is a tax form used by businesses to propose a settlement to the Internal Revenue Service (IRS) for tax liabilities. This form allows businesses facing financial difficulties to negotiate a reduced amount owed to the IRS, providing a pathway to resolve tax debts without the burden of full payment. It is specifically designed for business entities, including corporations and partnerships, to facilitate a compromise based on their unique financial situations.

How to Use the Form OIC B-2 Business Offer In Compromise

Using the Form OIC B-2 involves several steps to ensure that the submission is complete and accurate. First, businesses must assess their financial situation and determine if they qualify for an offer in compromise. After gathering necessary financial documents, businesses can fill out the form, providing detailed information about their income, expenses, and assets. Once completed, the form should be submitted to the IRS along with the required payment for the application fee. It is important to keep a copy of the form and any supporting documents for personal records.

Steps to Complete the Form OIC B-2 Business Offer In Compromise

Completing the Form OIC B-2 requires careful attention to detail. Follow these steps:

- Gather financial documents, including profit and loss statements, balance sheets, and tax returns.

- Fill out the form accurately, ensuring all sections are completed, including business information and financial disclosures.

- Calculate the offer amount based on the business's ability to pay, using IRS guidelines.

- Include the application fee, which is non-refundable, and ensure it is submitted with the form.

- Review the completed form for accuracy before submission.

Legal Use of the Form OIC B-2 Business Offer In Compromise

The Form OIC B-2 is legally binding once submitted to the IRS. It is essential for businesses to understand that submitting this form does not guarantee acceptance of the offer. The IRS will review the financial information provided and determine whether the proposed compromise is acceptable based on the business's financial condition and the IRS's guidelines. Compliance with all legal requirements is crucial to ensure the validity of the offer.

Eligibility Criteria for the Form OIC B-2 Business Offer In Compromise

To qualify for the Form OIC B-2, businesses must meet specific eligibility criteria set by the IRS. These criteria include:

- The business must be current with all required tax filings.

- The business must demonstrate an inability to pay the full tax liability.

- The offer must be reasonable based on the business's financial situation.

- Businesses must not be in an open bankruptcy proceeding.

Form Submission Methods for the OIC B-2

The Form OIC B-2 can be submitted to the IRS through various methods. Businesses may choose to file the form electronically using IRS e-file options, or they can submit a paper form via mail. It is important to follow the specific submission guidelines provided by the IRS to ensure that the form is processed efficiently. Additionally, keeping a record of the submission method and date is advisable for future reference.

Quick guide on how to complete form oic b 2 business offer in compromise form oic b 2 business offer in compromise

Effortlessly Prepare Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise Seamlessly

- Obtain Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise?

The Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise is a specific IRS form that allows businesses to settle tax debts for less than the full amount owed. By submitting this form, businesses can negotiate to reduce tax liabilities while avoiding bankruptcy. Understanding this form is crucial for any business looking to resolve their tax issues efficiently.

-

How can airSlate SignNow help with the Form OIC B 2 Business Offer In Compromise?

airSlate SignNow streamlines the process of filling out the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise, making it easy to eSign and send. Our platform simplifies document management, ensuring that all details are accurately captured and securely submitted. This allows businesses to focus on their operations rather than paperwork.

-

What are the costs associated with using airSlate SignNow for the Form OIC B 2 Business Offer In Compromise?

airSlate SignNow offers competitive pricing plans that cater to various business needs when managing the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise. We provide budget-friendly options that include features like unlimited eSigning and document storage. Our plans allow businesses to choose a solution that fits their financial strategy.

-

What are the key features of airSlate SignNow for handling the Form OIC B 2 Business Offer In Compromise?

airSlate SignNow includes essential features like customizable templates, secure eSigning, and audit trails for the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise. These features not only enhance accuracy but also provide peace of mind by ensuring compliance and security for your documents. Additionally, our user-friendly interface makes the process straightforward for all users.

-

Can I integrate airSlate SignNow with other software for the Form OIC B 2 Business Offer In Compromise?

Yes, airSlate SignNow offers seamless integrations with various platforms, enhancing your ability to manage the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise. You can connect with tools like CRM systems, cloud storage solutions, and productivity applications. This integration capability allows for a more cohesive workflow and data management.

-

What are the benefits of using airSlate SignNow for the Form OIC B 2 Business Offer In Compromise?

Using airSlate SignNow for the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise can signNowly reduce the time and effort needed to complete your tax resolution. Our platform ensures accurate document handling and timely submissions, ultimately leading to faster resolutions. Additionally, the electronic signing process is convenient and legally compliant.

-

Is airSlate SignNow secure for handling the Form OIC B 2 Business Offer In Compromise?

Absolutely! airSlate SignNow prioritizes security by employing advanced encryption protocols when managing the Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise. Our system is compliant with industry standards, ensuring that your sensitive information remains protected throughout the process. You can trust us to safeguard your data.

Get more for Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise

- Merging two firms form

- Law of partner form

- Law partnership agreement between two partners with provisions for eventual retirement of senior partner form

- Agreement events form

- Letter to alleged patent infringer form

- Petition to improve county road form

- Petition for improved road paving form

- Shareholders pdf form

Find out other Form OIC B 2 Business Offer In Compromise Form OIC B 2 Business Offer In Compromise

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online