Fillable Online Tax Virginia Form OIC Fee Offer in

What is the Fillable Online Tax Virginia Form OIC Fee Offer In

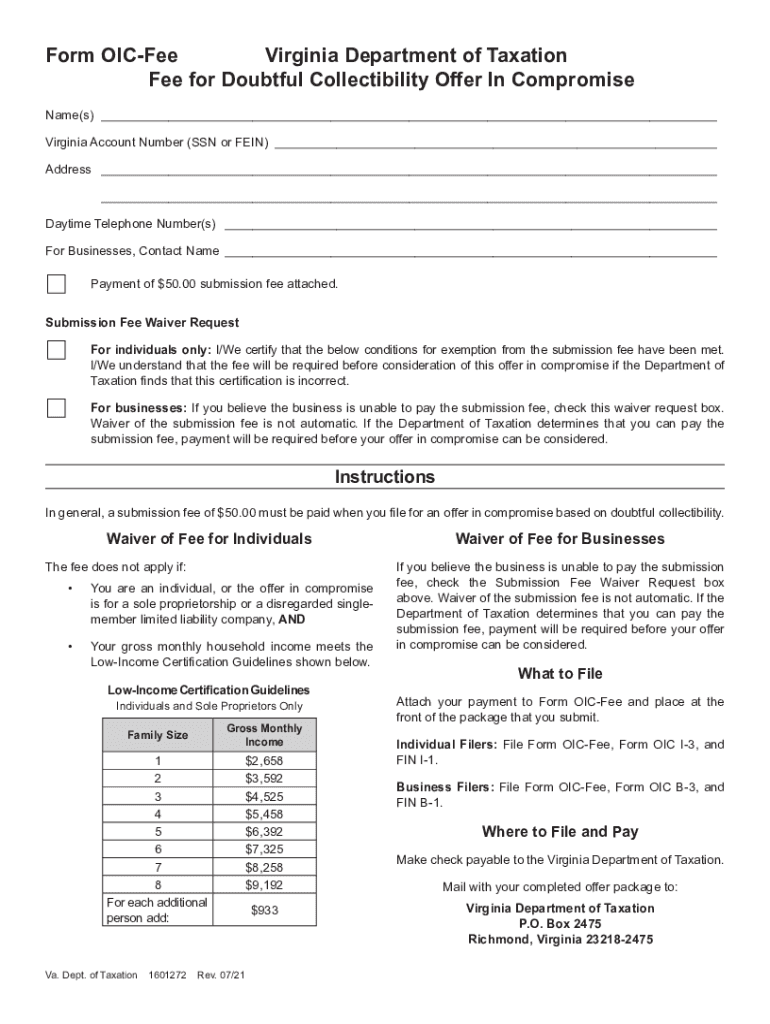

The Fillable Online Tax Virginia Form OIC Fee Offer In is a document that allows taxpayers in Virginia to propose a settlement to the state for outstanding tax liabilities. This form is specifically designed for individuals and businesses seeking to negotiate a reduced payment amount based on their financial situation. By submitting this form, taxpayers can request that the Virginia Department of Taxation consider their offer in compromise, which may lead to a more manageable tax obligation.

How to use the Fillable Online Tax Virginia Form OIC Fee Offer In

Using the Fillable Online Tax Virginia Form OIC Fee Offer In involves several steps to ensure that all necessary information is accurately provided. Taxpayers should begin by gathering relevant financial documents, including income statements, expenses, and any other documentation that supports their request. Once the form is accessed online, users can fill in their personal details, tax identification numbers, and the specifics of their offer. It is important to review the completed form for accuracy before submission to avoid delays in processing.

Steps to complete the Fillable Online Tax Virginia Form OIC Fee Offer In

Completing the Fillable Online Tax Virginia Form OIC Fee Offer In requires careful attention to detail. The following steps outline the process:

- Access the fillable form on the Virginia Department of Taxation website.

- Enter personal information, including name, address, and Social Security number.

- Provide details about your tax liabilities and the amount you are offering to pay.

- Attach supporting documents that demonstrate your financial situation.

- Review the entire form for completeness and accuracy.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Fillable Online Tax Virginia Form OIC Fee Offer In

The legal use of the Fillable Online Tax Virginia Form OIC Fee Offer In is governed by state tax laws and regulations. This form must be completed and submitted in compliance with the Virginia Department of Taxation's guidelines. It is essential that taxpayers provide truthful and accurate information, as any discrepancies may result in penalties or denial of the offer. The form serves as a formal request for the state to review the taxpayer's financial circumstances and negotiate a potential settlement.

Eligibility Criteria

To qualify for submitting the Fillable Online Tax Virginia Form OIC Fee Offer In, taxpayers must meet specific eligibility criteria. Generally, individuals must demonstrate an inability to pay their full tax liability due to financial hardship. This could include factors such as unemployment, medical expenses, or other financial burdens. Additionally, taxpayers must have filed all required tax returns and cannot be currently in bankruptcy proceedings. Meeting these criteria is crucial for the acceptance of the offer in compromise.

Form Submission Methods

The Fillable Online Tax Virginia Form OIC Fee Offer In can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Taxpayers can complete and submit the form electronically via the Virginia Department of Taxation's website.

- Mail: For those who prefer a paper form, the completed document can be printed and mailed to the appropriate address provided by the state.

- In-Person: Taxpayers may also have the option to deliver the form in person at designated tax offices, though this may vary based on location and current regulations.

Required Documents

When submitting the Fillable Online Tax Virginia Form OIC Fee Offer In, certain documents are required to support the offer. These may include:

- Recent pay stubs or income statements.

- Bank statements showing account balances.

- Documentation of monthly expenses, such as rent or mortgage payments, utilities, and medical costs.

- Any other financial records that illustrate the taxpayer's financial situation.

Quick guide on how to complete fillable online tax virginia form oic fee offer in

Effortlessly Prepare Fillable Online Tax Virginia Form OIC Fee Offer In on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Fillable Online Tax Virginia Form OIC Fee Offer In on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Edit and eSign Fillable Online Tax Virginia Form OIC Fee Offer In with Ease

- Find Fillable Online Tax Virginia Form OIC Fee Offer In and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Fillable Online Tax Virginia Form OIC Fee Offer In and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Fillable Online Tax Virginia Form OIC Fee Offer In?

The Fillable Online Tax Virginia Form OIC Fee Offer In is a digital document that allows taxpayers in Virginia to apply for an Offer In Compromise to settle their tax liabilities. This form simplifies the application process, enabling users to fill it out easily online and submit it efficiently.

-

How can I access the Fillable Online Tax Virginia Form OIC Fee Offer In?

You can access the Fillable Online Tax Virginia Form OIC Fee Offer In on the airSlate SignNow platform. Simply navigate to the designated section on our website, where you can fill the form interactively, saving time and ensuring accuracy in your submission.

-

Are there any fees associated with the Fillable Online Tax Virginia Form OIC Fee Offer In?

Yes, there is typically a fee associated with submitting the Fillable Online Tax Virginia Form OIC Fee Offer In. However, using airSlate SignNow's platform helps you save on costs by streamlining the process and reducing the need for extra administrative support.

-

What are the benefits of using airSlate SignNow for the Fillable Online Tax Virginia Form OIC Fee Offer In?

Using airSlate SignNow for the Fillable Online Tax Virginia Form OIC Fee Offer In provides multiple benefits, including an easy-to-use interface, quick document turnaround, and enhanced security. This ensures that your sensitive information is safely transmitted while giving you peace of mind.

-

Can I sign the Fillable Online Tax Virginia Form OIC Fee Offer In electronically?

Yes, with airSlate SignNow, you can electronically sign the Fillable Online Tax Virginia Form OIC Fee Offer In. Our platform allows you to eSign documents securely and conveniently, signNowly speeding up the submission process.

-

What integrations are available with airSlate SignNow for tax forms?

airSlate SignNow offers various integrations with third-party applications, making it easy to manage your documents and streamline your workflow. You can connect it with accounting software and cloud storage services to manage the Fillable Online Tax Virginia Form OIC Fee Offer In seamlessly.

-

Is the Fillable Online Tax Virginia Form OIC Fee Offer In suitable for businesses?

Absolutely! The Fillable Online Tax Virginia Form OIC Fee Offer In is designed to assist both individuals and businesses in managing their tax obligations. Businesses can benefit greatly from the streamlined process and electronic signing features that airSlate SignNow offers.

Get more for Fillable Online Tax Virginia Form OIC Fee Offer In

Find out other Fillable Online Tax Virginia Form OIC Fee Offer In

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement